“Silver Cycles" Strategy of Buying, Selling and Holding Silver– 04FE19 – ‘How it works’

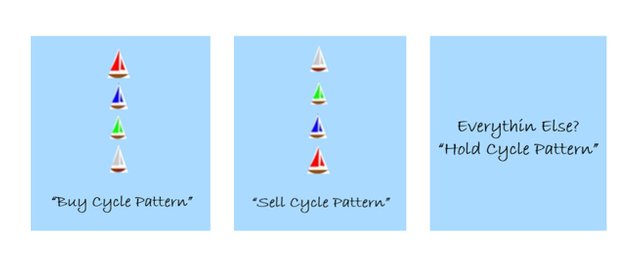

Silver is a tricky investment! It can confound, confuse and frustrate even the most experienced precious metals enthusiast. If you’re like me, and nearly all other silver stackers out there, then you’ve been burned a time or two! So what have I learned over the many years of stacking silver that I want to share with any who wish to learn? Cycles! That’s right! Silver moves in Cycles! How many Cycles? Three…only three; the “Buy Cycle”, the “Sell Cycle” and the “Hold Cycle”. That’s it, there are no others.

With just three Cycles to watch for, we now only have to devise a method to identify these Cycles. Through long trial and error, I have devised such a method by using the 200 day running average (RA), the 50 day RA and the 10 day RA. Why these averages? Timing. It’s all about timing. Change these averages to other time periods and you either trail too far behind the spot price action of silver or you jump too far ahead of it. So over time, I discovered that the 200, the 50 and the 10 day RA’s tend to follow the spot price of silver at just about the right speed.

So now what do we have? We have the “Silver Cycles” strategy. Gone is the “Danger of Emotion!” Gone is the “Struggle of Decision!” and gone is the “Worry of Timing the Market!” The RA lines literally guide us effortlessly through the silver market by establishing easily recognizable patterns which constitute the three cycles of silver – the Buy Cycle, the Sell Cycle and the Hold Cycle. Remember, there are no others. Simple? Yes, it is!

The last thing I had to learn is “How to Buy?” Do we “back-up the truck” at the first appearance of the Buy Cycle pattern? Do we buy just once in a Buy Cycle? These are good questions. But I have learned that the answer is “No” to both. Here is what I have found is best…

When the Buy Cycle pattern appears, I buy small amounts, often. See how the minnows eat: ”Nibble! Nibble! Nibble!” This is how I buy. It's also how I sell during a Sell Cycle. Whether buying or selling, the method is the same.

How much is a nibble? Well that my friend is for you to decide, based on your financial means and personal obligations. For some it may be a $100 a pop, or even $500! For others, it may be the purchase or sale of only an ounce or two at a time. Everyone must decide for themselves what a “nibble” is.

When a Buy Cycle pattern appears, I usually buy each day that the price goes down, never when it goes up, and...only when it is lower than all of the other buys in the cycle. The inverse of this applies to the Sell Cycle. This takes almost all of the guess work out of the “Game”. Oh yes, it is a game! But this strategy is for the “Long Game”, not for the day trader.

Lastly, because I am a lover of the sea and all things nautical, I have set the Silver Cycles strategy to the theme of a fleet of ships, red is the 200 day RA, blue is the 50 day, green is the 10 day and silver is of course the spot price of silver.

Although I give no guarantees and no promises, I will say that this strategy of following the cycles of silver has worked well for me, most of the time. With all that said, I hope you will “Come Aboard!” and sail the ever shifting seas of silver by following the "Silver Cycles"! I've got to run now maties, I see's a bloody pirate climbin' up me portside rail! "Arrrrr!"

Happy sailin'!

Captain Joshua Slane

"Confused? Ascared? Seasick? Need a private chat with th' Captain?" - [email protected]

Reference: Pictures frae www.freeimages.com, www.pexels.com, pixabay.com, steemit.com an’ www.google.com/maps

hello Joshua, so the current silver market rise is in direct opposite of a buy pattern from your 5,50,200 day moving average reasoning. these days are quite different from other times like in 2011, all the way to end of 2019. what are you doing now? are you still holding fast to your buy/hold/sell patterns?

"Hello mucker! Whuar hav ye been?!" 😉 -Keptin