The Dow Jones Industrial Average and its 50 Day Moving Average & Interest Rates

In a rising interest rate environment, this might finally be the prick that breaks the "Everything Bubble". We have the Dow down over 400 points today and its sitting right at its 50-Day Moving Average. If we get a close below there and the down trend continues through Friday, batten down the hatches mateys, 'cause there's some rough seas ahead. My guess is that there will be a "mystery buyer" (Financial Stabilization Dark Money) come in a prop up the markets again, but we will see.

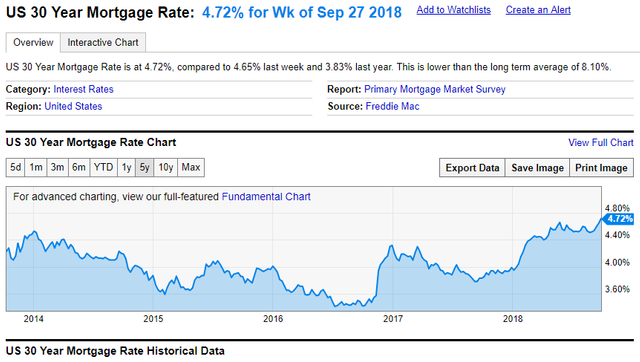

All eyes should be on interest rates as well. Housing is already getting hit by rising borrowing rates and they are still way below the historical average of around 8%. If we continue to see rates move higher, housing worldwide is toast. We will see 2008 all over again only this time it will unfortunately be worse.

The US 30 Year Mortgage Rate is at 4.72%, compared to 4.65% last week and 3.83% last year. This is lower than the long term average of 8.10%.

Housing is starting to be affected by rates that are still around half the historical average! What happens if we move to just the average? It won't be good.

To invest in Mene24k Gold Jewerly click Here

To open your own BitShares account, click Here

To open your own Binance account, click Here

We’re deffo in for a wild ride on this tippy-top, and i can only imagine how bizarre, freakish and unpredictable the News cycle is going to get...

I’m stacking as hard as i can and trying not to be too cynical. As well, enjoying the assurredness i feel by holding sound money — as well as some crazy-ass crypto...

Winter is coming It is known — bah ha ha

Make that -509 at 2:11 EDT, let's go for -1000 today, double the fun.

Its interesting to watch...

People have forgotten what a 2% drop feels like in one day. Volatility is here now. VIX near 20.

I've been investing in the markets since 1994 and watching for longer than that and its been way too quiet the last few years...over half of today's money managers have never been through a complete credit cycle...get your popcorn ready

Lots of people we not around in 1987, I remember pulling over to the side of the road as the market dropped over 20% that day. Just listening to the business news channel, quite a shock. Your right, most traders only start trading at the end of a up cycle, mo mo trading.

As a precious metals fan, I hope the Dow goes down and this bubble explodes...

I don't want to live in a world where Gold is $10,000 USD per oz but its coming.

I don't know how I wasn't following your account already. That's an oversight on my part. Apologies.

I'm watching the market fairly closely. The rising interest rates are likely partly to drive the prices of precious metals down. Unfortunately for the powers that be, it also makes it harder to maintain an upward trajectory on the stock market when bonds start yielding more. And the stocks are already very inflated, so it's going to be a very interesting next few months.

Welcome aboard Pirate...the timing is suspect with the midterms coming up...we shall see.

Thanks, glad to be here!

Yes, it is suspicious being that The Fed probably doesn't want Trump to keep Republican control. What better way to hurt their chances of winning than to raise interest rates which will hurt the economy so the pundits can say that things aren't going well because of DT? I'm really tired of politics.

Thank you for your continued support of SteemSilverGold

Excellent!..and thanks for your support...following!