Feb. 4-8, 2019 Weekly Trading Update PMs, S&P500, BTC

We complete the weekly wrap-up taking a look at some of the major news of the week and how it effected the various markets.

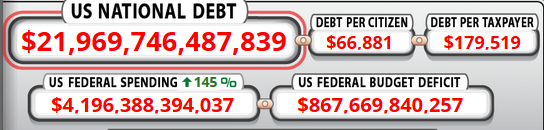

We had Trump finally give his SOTU speech in front of both chambers of Kongress. It shows the vast difference the coming USSA has fallen. Not one word about the massive debt there and in the world.

Europe started the market rollover to the downside, the US markets also starting to reverse, China was closed all week for The Year of the Pig, so they have some catching up to do. Weather is cold,

All our charts will be in the weekly candlestick mode.

Precious metals were about flat all week with usually rise on a Friday, which traditionally goes down so not to excite the traders over the week-end. Gold held the 1300 level, silver showing more downside. USD closed at 96.417 with an impressive 8 day rise, which I think has peaked, based on price and volume assessment. A rise of 0.95 over two weeks.

PMs have performed quite well, given the rise of the USD these past weeks.

Stocks are rolling over, high volume on down days, low volume on positive days, a weak scenario for extended gains going forward. Impressive drive to the top since the day after Christmas.

Crypto caught a surprise bid on Friday afternoon and is sustained up to this morning. Total marketcap up 10 billion in one day, a total of 2062 tokens being tracked, a rise of 45 over two weeks. Even with the up day, the weekly chart still shows a decending wedge pattern, so I call a fake break out, still looking at BTC numbers below 3000. IMHO.

Keep stacking. Go get you some.

Thanks for following @RollingThunder