Proof JPMorgan & Big Banks Have Been Manipulating Precious Metals And Currency Markets

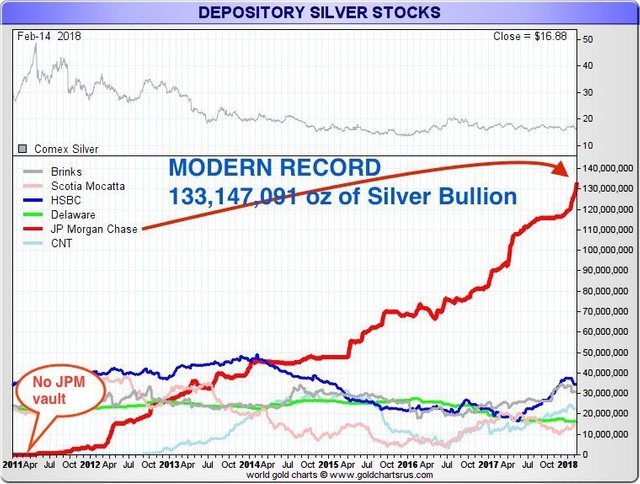

A few months ago I was warned by Professor @trigabyte that precious metals prices have been suppressed by a large group of currency traders. Over the past couple of months, several respected commentators and (of course) the mainstream media have been reporting that JPMorgan has supposedly amassed a gigantic hoard of “physical silver”, roughly twice as large as what was amassed by the Hunt Brothers (and their cartel) back in 1980, when the Hunt Brothers were formally charged and convicted of “cornering the silver market”.

This report was previously greeted with extreme skepticism in a previous commentary, for a multitude of reasons. When the Hunt Brothers were charged/convicted of cornering the market; their hoard accounted for less than 20% of total global inventories, yet this “squeeze” on the market resulted in the price of silver soaring by a factor of ten (i.e. 1,000%).

The JPMorgan “silver hoard” is supposed to be twice as large as that of the Hunt Brothers; yet it comes at a time where global silver inventories are at best one quarter as large as back in 1980. In other words, the JPMorgan silver hoard (if it existed) would represent a market concentration of at least eight times as extreme as that of the Hunt Brothers. Yet while JPMorgan has been accumulating this supposed hoard; the price of silver has been falling.

Let me repeat this point, to ensure that it is clearly grasped by readers. We have a supposed market concentration today in the silver market by JPMorgan which is eight times as extreme as that of the Hunt Brothers (when the price of silver increased by 1,000%); yet, today, the price of silver has been falling, not spiking higher.

How is this possible? It’s not. There is no rational/legitimate market (or universe) where a market concentration of this supposed magnitude could not result in a dramatic, upward spike in price. Period. Certainly if this much silver was ever dumped onto the market (rather than supposedly withdrawn from the market), we know what would happen to the price of silver: it would plummet lower.

Obviously “markets”, by definition, move in two directions. If dumping massive amounts of silver (and even paper-called-silver) onto the market causes the price to crash, always, then withdrawing massive quantities of physical silver from the market must cause the price to soar. Always.

This brings us to the explanation of JPMorgan’s latest gigantic silver-fraud, and the purpose behind that fraud. Further enlightenment comes via the interesting observations of Bill Holter (from June 26th):

First, we have an insane situation brewing in Comex silver. The open interest finally exceeded 200,000 contracts (1 billion ounces). I believe the only other time this much open interest existed was back in 1980 or ’81. This makes no sense whatsoever, the price is again plumbing 4 year lows yet open interest has moved to record highs…?

In other words; we have Mr. Holter reporting a market-insanity precisely parallel to what was just noted before this, where JPMorgan has purportedly accumulated an extreme, long position in the silver market (larger and more extreme than in 1980), yet the price has gone down rather than up. Holter continues:

The fact open interest has expanded while price has declined is proof positive the “initiation” of this expanded open interest has been by “shorts” but absorbed by “someone” on the other side of the trade. Total global production of silver is only 800 million ounces or thereabouts so Comex shorts have contracted to deliver 25% more silver than will even be produced globally over the next 12 months. Silver available for Comex delivery only totals 57 million ounces so they sit on a naked short time bomb of more than 950 million ounces! [emphasis mine]

Enter JPMorgan. Obviously one does not have to be Sherlock Holmes to deduce who is the “someone” on the “other side of the trade.” They are the facilitator for the construction of this gigantic, illegal short position. In an ironic example of role-reversal; we have JPMorgan playing the part of the patsy-long, absorbing all of the bets of “the other side” in this serial shorting – by other Big Bank tentacles of the One Bank (such as Scotia Maccotta and HSBC).

Simultaneously; we have JPMorgan claiming to have accumulated a massive hoard of “physical silver”, when the market tells us that this could not possibly have occurred. Hence we know that the JPMorgan silver hoard is imaginary silver. But this begs an obvious question: why would the most-notorious silver short in the history of the silver market pretend to accumulate a massive long position – while still holding a large short position, itself?

To say that this makes absolutely no sense is the greatest of understatement. Obviously there had to be an ulterior motive to this sham, as JPM would certainly never engage in any behavior to deliberately drive-up the price of silver, which is precisely what it seemed to be doing here. Now, via Bill Holter, we see this “ulterior motive”, plain as day:

…they [i.e. the One Bank] sit on a naked short time bomb of more than 950 million ounces!

How do you defuse an absurdly gigantic, naked-short, time bomb in the silver market? With an absurdly gigantic “hoard” of physical silver, conveniently delivered to the market, as needed, to prevent implosion of this time bomb. And in our criminalized system, if you don’t have a hoard of real silver available for this defusing; imaginary silver will be a perfectly good substitute.

Let me refer back to the commentary which first scoffed at reports of JPM’s imaginary silver hoard:

…The purpose of JPMorgan pretending to hold “a massive long position”?

That’s an easy one. If JPMorgan pretends to be holding a 350-million ounce hoard of silver and its criminal accomplices who operate and (supposedly) police these markets go along with this massive sham; that is 350 million “ounces of silver” which this fraud-factory could claim to dump onto the market – as part of some future operation to crash the price of silver.

This is exactly what we seem to be seeing now, except with one, different wrinkle. Instead of JPM’s imaginary silver hoard being used to drive-down the price of silver still further (from already extremely depressed levels); this imaginary silver hoard will be dumped onto the market to “cover the shorts” – to prevent an explosive rise in the price of silver when these naked shorts would (otherwise) implode.

All that remains is to put this latest “operation” in the silver market into the overall context of the looming economic catastrophe which approaches, the Next Crash, scheduled for this year, 2018 (perhaps the end of this year). What happens in sane, legitimate markets when some economic disaster and/or panic occurs? People seek shelter in humanity’s most time-tested “safe havens”, gold and silver.

What happens when populations collectively move into these safe havens? The price for these precious metals explodes higher. However, as we have seen for most of the last 40 years, and all of the last 25 years; this is the one thing which the One Bank seeks to prevent, with literally all of its criminal might.

When you are planning to crash global markets (in order to profit from your foreknowledge of that scheduled crash); you know that doing so will put tremendous upward pressure on both gold and silver prices, and gold and silver demand, in markets already (criminally) stretched to the breaking-point. How do you blunt such a price-spiral, and hopefully the explosion in demand which would/should accompany it? By scheduling a price-crashing operation in the silver market simultaneous with, or slightly after your other, larger “operation”.

If Niccolo Machiavelli were alive today, he would be carefully taking notes, as he observed the schemes and crimes of the One Bank.

Now comes the kicker....

Here is the official report and details of the

An ex-J.P. Morgan Chase trader has admitted to manipulating the U.S. markets of an array of precious metals for about seven years -- and he has implicated his supervisors at the bank.John Edmonds, 36, pleaded guilty to one count of commodities fraud and one count each of conspiracy to commit wire fraud, price manipulation and spoofing, according to a Tuesday release from the U.S. Department of Justice. Edmonds spent 13 years at New York-based J.P. Morgan until leaving last year, according to his LinkedIn account.

As part of his plea, Edmonds said that from 2009 through 2015 he conspired with other J.P. Morgan traders to manipulate the prices of gold, silver, platinum and palladium futures contracts on exchanges run by the CME Group. He and others routinely placed orders that were quickly cancelled before the trades were executed, a price-distorting practice known as spoofing.

"For years, John Edmonds engaged in a sophisticated scheme to manipulate the market for precious metals futures contracts for his own gain by placing orders that were never intended to be executed," Assistant Attorney General Brian Benczkowski said in the release.

Of note for J.P. Morgan, the world's biggest investment bank by revenue: Edmonds, a relatively junior employee with the title of vice president, said that he learned this practice from more senior traders and that his supervisors at the firm knew of his actions.

Further, Edmond's case stemmed from an "ongoing investigation" run by the FBI's New York field office, the Justice Department said.

Edmonds pleaded guilty under a charging document known as an "information." Prosecutors routinely use them to charge defendants who have agreed to cooperate with an ongoing investigation of other people or entities.

His sentencing is scheduled for Dec. 19. Edmonds faces up to 30 years in prison but is likely to receive less time than that. The guilty plea was entered under seal Oct. 9 and unsealed on Tuesday.

New York-based J.P. Morgan declined to comment on the case through a spokesman. It was reported earlier by the Financial Times.

J.P. Morgan learned about this case only recently, according to a person with knowledge of the matter. A recent regulatory filing from the bank didn't make any mention of the issue.

The source of this news is CNBC

Heya tbs, i enjoyed your article a lot. This type of in depth analysis of the Ag market interests me greatly. But i think JPM might actually have the phyzz. I can’t cite it, but inread an article about JPM inheriting all the Ag shorts from Lehman bros. And that they have never lost money on a trade with these securities — what? Never? Yep, that’s what it said. But anyways, what i think “could” be happening is this:

JP profits from closing ALL of the shorts they have on the books as they dump ever more paper-silver (futures) into the market with one tentacle. And with another tentacle they spend perfectly good CASH (or whatever) on buying up, and taking delivery of massive amounts of real deal, hard asset silver. This while the whole thing is grinding down everybody and causing institutional hatred for our beloved asset class — namely: silver.

So it is outright FRAUD! They are selling false silver into the market to make it cheaper for them to buy the real stuff.

When the gross majority of silver shorts on the JPM balance sheet finally closes, i predict they will just sit back with some popcorn, make an immediate policy reversal, and start buying longs, which of course will signal that the silver rocket has lift-off — or something like that...

⚡️✨☝️🤩✨⚡️

I think in one way or another that is about what will happen.... there are many of these tentacles you speak of and they are vast.... This is just another method for using an asset class as a storage of value and then controlling it to manipulate...

This is an old school 51% attack!

Best allusion yet!!!