Know Your Exchange Traded Funds (ETFs)

Several days ago, I wrote about the performance of the world financial markets in the 1st half of 2018.

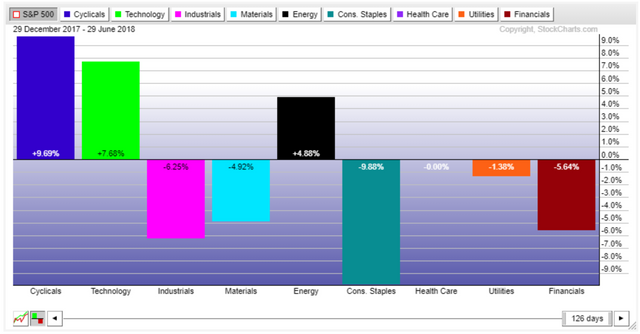

When it came to the US Markets, I talked about that it wasn’t a surprise the NASDAQ was leading the way, the FANG stocks have been on a tear and how Netflix had gain over 100% in just 6 months. Within the US Markets, the consumer discretionary and technology sector are leading the way, while the rise in interest rates and trade wars are hurting the industrial and materials sector.

Sector rotation is the action of shifting investment assets from one sector of the economy to another. Sector rotation strategies have provided investors with superior returns and seek to capitalize on the fact that not all sectors of the economy perform well at the same time. Sector rotation strategies following economic market cycles often seek to identify bullish sector opportunities in expanding markets and mitigate losses through sector rotation to safe havens in recessionary markets

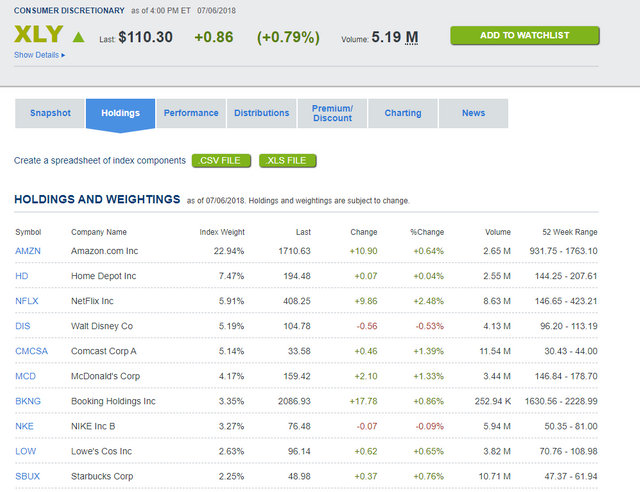

But why would the consumer discretionary sector be slightly leading the technology sector. This is where you have to know your ETFs (include the fees they charge, but that is another post).

The top 3 holding of the SPDR Consumer Discretionary ETF, XLY is Amazon, Home Depot and Netflix. Amazon single handedly has been responsible for 35% of the gains in the S&P 500 through the 1st half of 2018 and makes up 20% of this ETF....WOW. Netflix has increased over 100% in the 1st half of 2018.

That’s tough to beat, lets dissect the SPDR Technology ETF, XLK.

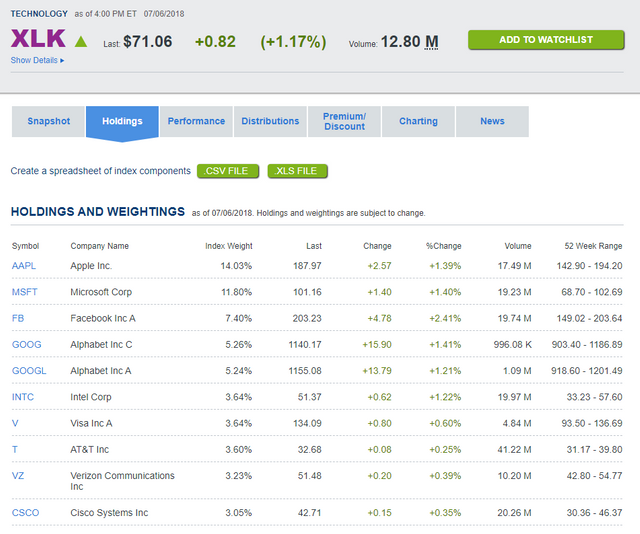

The holdings in XLK is much more evenly distributed. Although there are a lot of great companies in the 10 top, none of them include Amazon or Netflix. When I scrolled through all 75 holdings, Amazon and Netflix weren’t even on the list. Isn’t Amazon and Netflix a tech stock?

When I went down the rabbit hole even further I found out the XLK holds stocks in companies that covering products developed by internet software and service companies, IT consulting services, semiconductor equipment and products, computers and peripherals, diversified telecommunication services and wireless telecommunication services and XLY holds stocks in companies in industries such as automobiles and components, consumer durables, apparel, hotels, restaurants, leisure, media, and retailing.

What’s the moral of the post, Know Your ETFs and more importantly, know what you are investing in?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

Very well written. I would've though NFLX was considered a tech stock.

Thanks @workin2005