Stock Market Alternatives: Where To Invest Aside From The Stock Market (100% Original Post)

“If I don’t know or if I’m not yet ready to invest in the stock market, where can I put my money instead?”

Below, we’ll discuss a handful of stock market alternatives that you can invest in.

After each one, I’ll briefly state why it’s a good replacement, and the reason why you should consider it.

I hope this will help you in making better investing decisions.

Let’s start.

Equity Funds

Equity funds are managed investments that mainly invest in the stock market.

They are available in commercial banks under Unit Investment Trust Funds (UITF), or through Mutual Fund companies.

Because Equity Funds primarily invest in the stock market, it will move in tandem with it. This means if the stock market goes up, then Equity Funds go up as well. But if stocks go down, so do equity funds.

Why invest here?

If you’re still studying how the stock market works (or don’t have the time yet to learn), then Equity Funds is a simpler alternative. Just give the bank or the mutual fund company your money, and let the fund manager do all the stock market investing decisions for you.

Bonds

Bonds are long-term debts and as an investor, you’re simply lending your money to the government (as treasury bonds) or to a company (as corporate bonds). Your profit comes in the form of interest payments from them (because they borrowed money from you).

Long-time investors consider bonds as the classic alternative to the stock market. When stock prices go down, many investors take their money towards bonds for safety and diversification.

Why invest here?

If you’re looking for a relatively safer, medium to long-term investment, then bonds are a good alternative. Just go to your bank and ask about treasury bonds, T-bills, Long-Term Commercial Papers (corporate bonds) or their Bond UITFs. You can alternatively go to a mutual fund company and ask about their Bond Funds.

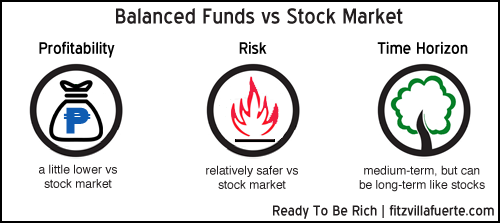

Balanced Funds

An investment fund that primarily puts money in both the stock market and in bonds is called a Balanced Fund. Just like bonds, this is a relatively safer, medium to long-term investment.

Balanced funds have a strong correlation with the stock market. If stock prices go up, so do the gains of a balanced fund – although not as much. While that may seem to be a disadvantage, it’s actually not because if stock prices go down, then balanced fund prices will go down as well, but the losses will not be as much as the stock market.

Why invest here?

For the same reason why you’ll invest in bonds – to have a relatively safer, medium to long-term investment. And just like equity funds, you simply invest through a bank or a mutual fund company and let the fund manager do the investing decisions for you.

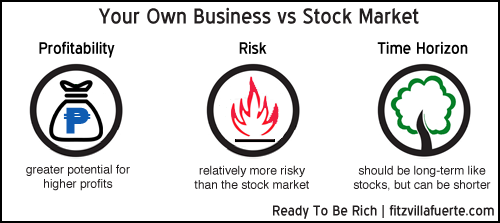

Your Own Business

When you invest in the stock market, you’re simply buying shares of a company and becoming part-owner of that corporation. Under this perspective, putting up your own business gives you the same end result – so why not just start your own company instead, right?

Starting your own business is riskier, more difficult and requires more time – but the potential profit is so much higher than investing in the stock market. And who knows, maybe someday your own company will be able to list itself in the stock market, imagine how great that would feel – people actually buying shares of your company.

Why invest here?

Having your own business is the only alternative I can think of that can outperform the profits you’ll get from the stock market. Plus, it doesn’t just provide capital growth, but constant cashflow as well.

You can also see this blog on my website: https://fitzvillafuerte.com/stock-market-alternatives-where-to-invest-aside-from-the-stock-market.html?utm_content=bufferd2843&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer.

Entrepreneur. Blogger. Dreamer. My Websites:

Facebook

ReadyToBeRich

THANKS FOR READING! :-)

ReadyToBeRich

THANKS FOR READING! :-)

This post was promoted with @monitorcap traffic bot & STEEM promotion service.

Send MIN. $1 SBD to @monitorcap bot with your link in MEMO field

and recieve upvotes & resteems for your posts. @monitorcap - where 'seen' matters !