U.S. Capital Market Review 12/22/17

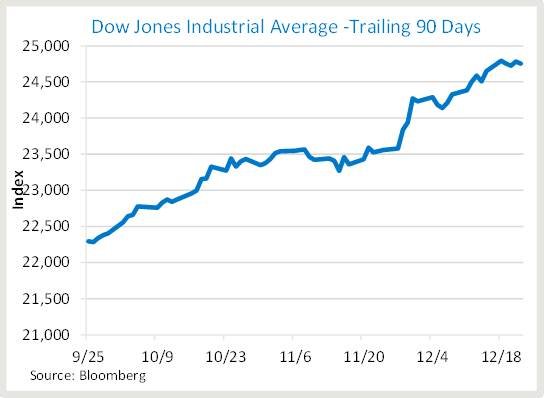

The US capital markets had another strong week, broadly speaking. The gains were mostly attributable to news out of Washington, and the Dow Jones Industrial Average neared 25,000 milestone for the first time.

Congress passed President Trump's much talked about tax cuts, which were signed into law on Friday. Highlights of the legislation include the elimination of the Obamacare requirement that everyone must have health insurance or face penalties, significant tax cut to corporate tax rates and an increase in the standard deduction, which is expected to help middle class families and allow for further economic growth though higher net wages. The lowering of the corporate tax rate is also expected to spur economic growth, which is the backbone to funding the new legislation, otherwise, the national debt is expected to climb. Wall Street expects higher earnings and more growth to propel the economy higher, which was the driver of this weeks gains.

Consumer confidence remains high, and as the holiday season comes to an end, we should start seeing numbers from both online and traditional retailers, which are expected to be very strong given the state of the economy, low unemployment, high consumer confidence, and great early indicators from the retailers ever since Thanksgiving.

With 4 trading days left, the year looks to be a successful one for US stock market investors, and 2018 appears to be positioned well.

Best of luck out there my friends,

Brian

the year looks to be a successful one for US stock market investors.... yes that is true

Market had priced in cuts, we r in the final stages, look for equities to drop 20% by February

We certainly have fewer events ahead to propel stocks further but I also do not see many stumbling blocks to cause a correction... what do you believe the catalyst downward will be? I was actually worried when they were talking about delaying the corporate tax rate cut until 2019 as it would have meant companies would be trying to minimize taxes in 2018 so lower EPS which would have been a hit to the markets in 2018, but they ended up getting the tax rate cut in for 1/1/18 so EPS should be expanding compared to prior quarters and years even on flat revenue, which is the main catalyst I see in 2018. Appreciate the feedback and discussion!

I have no idea really, just that the expansion and piles of debt surrounding it have to cave in at some point.

u got new fan here, keep it up

gppd

Market had priced in cuts, we r in the final stages, look for equities to drop 20% by February

Certainly I think that 2018 will be a good year, especially for crypto money @brian.rrr

Congratulations @brian.rrr, this post is the sixth most rewarded post (based on pending payouts) in the last 12 hours written by a Superuser account holder (accounts that hold between 1 and 10 Mega Vests). The total number of posts by Superuser account holders during this period was 1120 and the total pending payments to posts in this category was $8687.17. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Wish I had a president like yours. He's presence alone is affecting communities in a positive manner.