A Trade War Deal Will Be A Great Time To Short Industrials

I know the title doesn’t make any sense, let me explain.

The trade war hasn’t been very friendly to the large US industrial based companies who have large overseas markets and huge supply chains. The ongoing uncertainty threatens to slow corporate spending and drive up costs, which could weigh heavily on the industrial sector.

So if a trade war agreement between the US and China is reached, expect the Markets to move up and quick fast. So why I’m saying a deal will be a great opportunity to short, lets go to the charts to find out.

Some associated the down move in the industrial sector to concerns that global economic growth has peaked. Some even say we will be in a recession in 2019 or 2020. My thesis is earnings have peaked and will decelerate in 2019 due to interest rates continuing to increase.

For example, 3M cut its full-year earnings forecast and Caterpillar pointed to rising costs due to increased material and freight costs, which have been largely associated with increased tariffs and steel prices. In additional, the XLI has me concerned as well. On the monthly chart, XLI made a double top, but RSI made a lower high.

The only thing that going to push price back up to the monthly supply is a trade war deal. However, with interest rates steadily increasing, earnings are about to decelerate in 2019, putting pressure on corporate earnings and the stock market.

I have been following Caterpillar for years because it's one of the easiest stocks to follow the boom and bust of the economy. Think about it, Caterpillar makes industrial machines, excavators, tractors and other construction equipment used to build oil wells, factories and subdivisions, etc.that require huge capital investments. All economies grow by capital investments (even service based economies). However, capital investments are usually funded by debt, but if the cost of debt continues the rise, eventually the capital investment spigot will shutoff. This ultimately leads to economies shrink, hurting company profits, including Caterpillar.

So what’s the trade set-up, lets go to the charts?

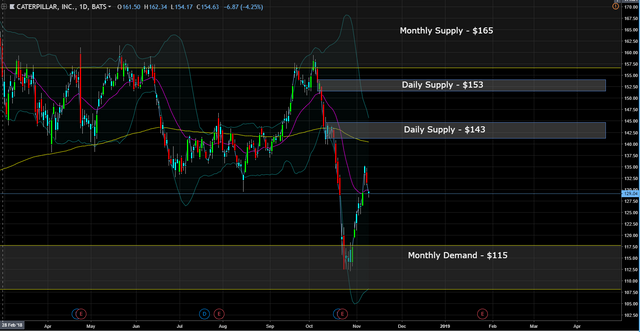

As you can see, the monthly demand zone at $136 held for many months, but was recently breached.

Price also penetrated the next monthly demand at $115 before pulling back.

The chart suggest if price pulls back to the daily supply of $143 or the daily supply of $153, to short price to at least the monthly zone at $115.

My 2-3 year target on Caterpillar is $60.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

Nice analysis Rolland.

Thanks @workin2005.