EARN USD $58,400 WITHOUT “BURNING” YOUR RETIREMENT PLAN!!

Hey, bear with me for a couple minutes to learn about cryptocurrency and how normal guy me can easily earn some money. You will be surprise that the opportunity may never come again.

“This article may just set you on the path to be financially independent”

“People want to see then believe” - MrBe Dif

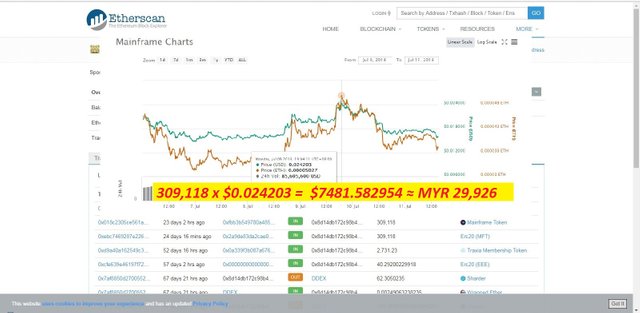

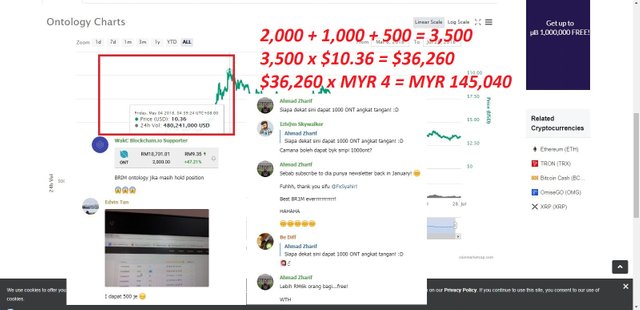

You may no need to come up with any money to participate in cryptocurrency. My friend participated in the Mainframe token Proof of Love campaign and won USD $7,400 worth of token. I subscribe to the Ontology email newsletter and was awarded USD $15,000 worth of tokens. All this did not require any upfront cost but only require participation and faith in the cryptocurrency.

“Won Mainframe tokens worth USD $7,400 (MYR29,926) when token value, $0.024 (ATH) with no capital investment

My friend obtain 3,500 Ontology token worth USD $36,000 (MYR145, 000) without capital investment, by only SUBSCRIBING to their email newsletter! USD $53,000 is the combine value of the losses in opportunity cost if we didn’t participate in the two activity above.

Here’s the “secret” gems – bitcoin a.k.a cryptocurrency

The root problem with conventional currencies is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” - Satoshi Nakamoto

In Malaysian 2017, a survey about cryptocurrency was conducted to around 56 person in Johor Bahru and Kuala Lumpur. Almost 35% have no idea what crypto is, 12% response as ICO (initial coin offering) and the other 47% said that cryptocurrency is bitcoin

47% said that cryptocurrency is bitcoin

Bitcoin is a product that emerged from human’s evolution from barter trading to cowry shells, from shells to coins, from coins to paper money and from paper money to electronic currency. Under the Bretton Woods Agreement in 1944 currencies were pegged to the price of gold, and the U.S. dollar was seen as a reserve currency linked to the price of gold. U.S. President Richard Nixon called for a suspension of the Bretton Woods Agreement in 1971 when it collapsed. The agreement was dissolved between 1968 and 1973. In 1973, the agreement officially ended. Thus central bank around the world is free to print as much money as they required.

Inflation is the worst enemy for fiat currency. USD$1000 in 1997 will be worth only $630 in 2018 with an inflation rate of around 2.5%. Countries under economic embargo like Zimbabwe and Venezuela have hyper inflation rate. Their citizen needs to carry sacks of money just to buy groceries

Is Fiat currency a good storage of value?

The value of the fiat currency is from the trust by the investors and it’s citizen that the government will honour the value. The fiat currency is not pegged to any gold or other commodity. If the investors do not believe the government can manage the economy, they can sell the government bond and the value of the fiat currency will drop.

“Price is what you pay. Value is what you get” – Warren Buffett

With this quote by billionaire Warren Buffett, it shows that nothing is wrong with the ancient barter system plus it’s more transparent without anyone controlling the value. That means fiat currency value is actually depending on the government (or because parties engaging in exchange agree on its value) to maintaining the value. The main problem with the barter system is that the volume is low; risk of non-delivery and hard to get standard of quality product while fiat money is based solely on the faith and credit of the economy.

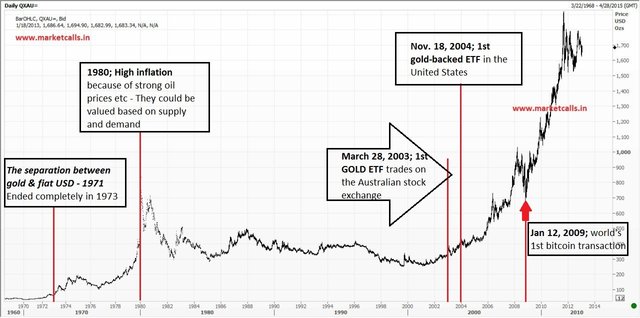

.jpg) Gold vs USD - 50 years chart

Gold vs USD - 50 years chartThe history of bartering dates all the way back to 6000 BC and it’s sustained until the revolution on the currency changing to use dinar’s back in 696AD. Because of the “cunning individual” see the chances for themselves, fiat paper was created, back in 1000 AD. The first recorded use of paper currency is in China. From then, fiat money continue to evolve until the use of gold as the standard., The U.S. currency backed by the federal gold reserve, ended in 1973 when the United States also stop swapping gold to foreign governments in exchange for U.S. currency notes.

“BARTER SYSTEM” in New Morern Era – Cryptocurrency

If you ask me where did I know much about this digital Assets, my answer will be from huobi.com campaign titled “Huobi story second session – Do you know cryptocurrency?”

☺ hihihi.. i come to make you happy, lets continue..

The big difference between barter and fiat currency systems is that the fiat currency system uses an agreed-upon form of paper or coin money as an exchange system rather than directly trading goods and services through bartering. Cryptocurrency uses cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency. Essentially, cryptocurrencies have limited supplies; it’s recorded in a ledger that no one can change unless specific conditions are fulfilled.

To improvise those problems on the medium of exchange from barter trade until electronic money, the mysterious person using the name Satoshi Nakamoto invented Bitcoin back in late 2008 and released as open-source software in 2009. The source code is free for anyone to use and analyse. Other notable cryptocurrencies include bitcoin, ethereum and litecoin.

Bitcoin are designed to work as a decentralized digital currency without any central bank or single administrator, though in practice many aspects of its use are centralized. Bitcoins can be sent on the peer-to-peer bitcoin network directly, without the need for intermediaries, though intermediaries are widely used. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain.

Transactions are recorded in decentralized ledgers, so no central authority controls the cryptocurrency or can alter the transactions recorded. The supply of bitcoin is capped at 21 Million and the supply cannot be simply increase unlike fiat currency like dollars, pounds or euros, which are issued by a central bank.

NO INTERNET – NO BITCOIN – Don’t think too much

In fact, people in the world know that paper money a.k.a fiat currency was facing problem with inflations since its depegged from gold standard since 1971 until today but again, they are still “alive” in this world for the pass over 47 years old. The 1st Internet was born in November 1969, making the Internet 49 years old and the modern internet was born in January 1983 and becomes around 35 years old. According to the howoldistheinter.net, internet was born in March 12, 1989. Yet internet still here and “what have you done today to make it better?”

It’s the future. Cryptocurrencies are being hailed by many as a revolution in the monetary system: a way of transferring borderless digital money in a secure manner, where every transaction can be traced on the blockchain. Plus, since no single party controls cryptocurrencies (though this could change as central banks and investment banks consider developing their own cryptocurrency– it’s big in Japan), the bitcoin network can keep on working even if part of the network is down.

Cryptocurrencies come with significant risks, for one, prices have been extremely volatile. This has partly to do with them being a nascent phenomenon; questions remain over how people will use them, and how regulators will treat them. And, since anyone with access to a person’s private key can spend it, it’s possible for hackers to steal cryptocurrencies. Again you’re advice not to publish/expose/share your private key; it’s like your putting the code to the safe deposit box outside the safe.

THIS IS THE OPPORTUNITY – GET IN EARLY BEFORE THE BOOM OF THE VOLATILE MARKET. Like the proverb ‘Early birds get more worms’

You may have heard about dot com bubble back in 1997-2001 after about 8 years after the internet was born. During that time you’re probably doing nothing to pickup good but battered stocks like amazon or google. In fact, bitcoin started back in 2009 and one year later Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida for 10,000 BTC which is now known as the bitcoin pizza day.

"Financial market are FRACTAL, and Patterns tend to REPEAT itself"

Have we learnt from the PAST?

If you’re comparing the bubble dot com history and relate it into blockchain development, personally it was the usage of the internet and not about cryptocurrency that is going to burst. That should be our perfect time looking for the project stand or build on top of blockchain like most of initial coin offering (ICO).

During the dotcom bubble, many weak internet companies were closed down and the good and strong company thrive after the bubble. Similarly it wills the same for the blockchain environment; the crypto winter we are going through now will filter out the strong blockchain company from the weak. . This should be the perfect time to look out for ICO project that stands out

Cryptocurrency is not the only application of blockchain. Let’s have a look at

- Applications of blockchain technology – smartcontract

- Sharing economy

- Crowdfunding

- Governance ie; election proses

- File Storage ie decentralised storage

- Copyrights of intellectual properties

There are tons of blockchain applications, the above are just a few examples.

Cryptocurrency still in bullish?

I had the unique opportunity to attend the Vietnam Blockchain Festival at the GEM Center in Ho Chi Minh City, Vietnam in May! I learned about many new projects addressing existing problems with blockchain, supply chains, making health records available while maintaining privacy, and securing digital assets. I also met with friendly people and made new contacts. This event is hosted by Huobi Global - top 3 crypto exchange in the cryptocurrency space (register your self here ).

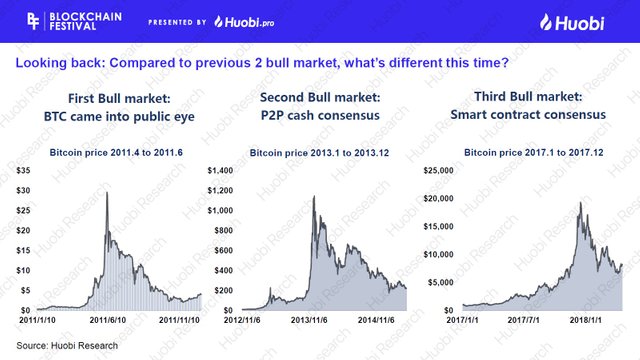

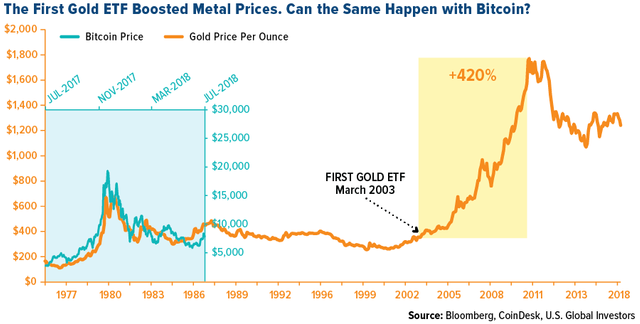

As you can see on the GOLD vs USD chart in the beginning on this post, there is already have some “clue” on the price reaction of the bitcoin price when something new is introduced. Here’s something that I learned from the blockchain festival – reported by huobi research team.

As we can see, the 1st big wave propels BTC into the public – buying pizza for about 10,000 btc. Then came the 2nd wave peer to peer (P2P) cash consensus where users find ways to bring fiat into crypto space. These innovation have changed the course of history to create technological advancements that have made future technological advancement easier. Ethereum introduced the way for trustless contract implementation by creating smartcontract – “ lawyers of blockchain space”. And now ethereum become the 2nd largest coin with an estimated market cap of USD $43.97 B

New trend is emerging!! - Bitcoin ETF

We have missed the first 3 wave in cryptocurrency, I believe the next wave will come when Bitcoin ETF gets approve. The bitcoin graph is similar to gold price when gold ETF was introduce in 2004

“late February is the most likely target for a decision - Jake Chervinsky

According to the Jake Chervinsky (Lawyer - Government enforcement defence & securities litigation) – Bitcoin ETF will probably be delayed, because of how SEC works, they can call for three major extension to approve or deny an ETF by maximum 240 days (45 + 45 + 90 + 60).

There is no more room to make excuses!!

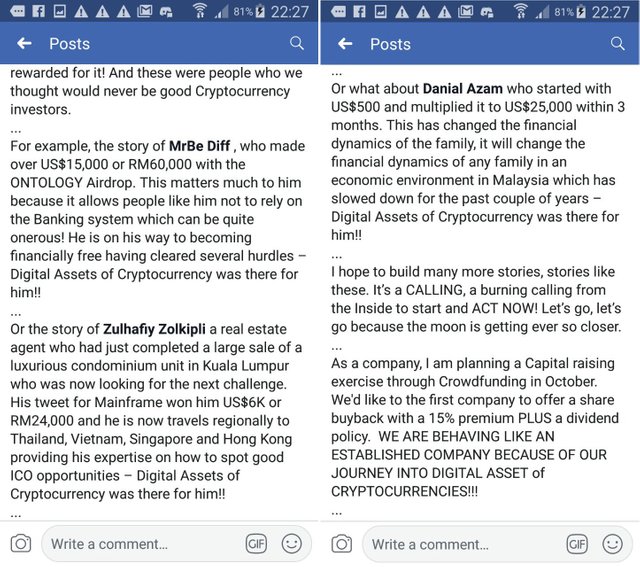

Read my mentor talking about me in his facebook post that may I hope will inspiring you to at least start learning about cryptocurrency.

Yes, it’s true that I’m still struggling financially. Sold my house and my car. After I join his community as head of ICO’s research, I’ve learn a lot about blockchain and the business behind the technology, I also grab opportunity in the cryptocurrency market to continue my journey to be financially independent.

In fact, the crypto start-up space has been booming in the past year. In the first half of 2018 alone there was more money invested in cryptocurrency start-ups compare to the entire 2017. So if you want to invest using your capital into an ICO, why don’t you consider getting free tokens via airdrop and bounty? Your records may even surpass me and may get mention in my mentor’s next article.

Share this on your social media to help people in your network understand this technology. Sharing will motivate me to produce more content like this