Get Ready for the Crypto Super Bowl, Feds Seize $3.6 Billion in Stolen Crypto, Binance Invests $200 Million in Forbes

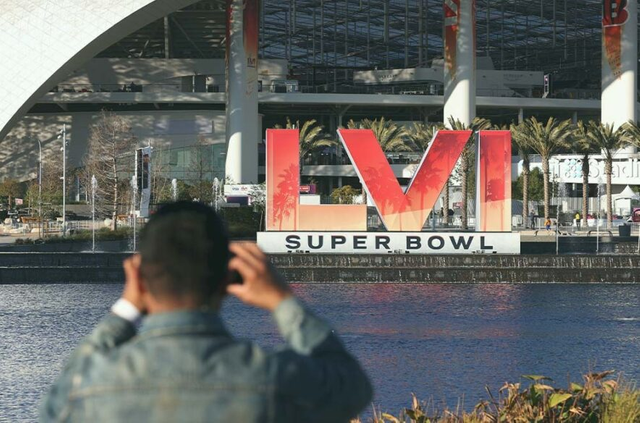

Get ready for the “Crypto Bowl” this weekend. Ads for crypto companies are expected to be all over the commercial breaks for the first time ever during the biggest sporting event of the year.

Several crypto exchanges — eToro, FTX, and Crypto.com — are confirmed to have ads running during the Super Bowl. Coinbase, perhaps the most well-known exchange there is, is rumored to have an ad on deck, though the company has not confirmed it. When NextAdvisor reached out to Coinbase for confirmation, a spokesperson stated the company has “nothing to announce at this time.”

While the Super Bowl is sure to bring prominent crypto brands in front of new audiences, crypto’s growing presence in the mainstream market has been building even before this weekend’s Super Bowl ads.

Crypto.com recently spent $700 million for naming rights to L.A.’s Staples Center, and FTX inked $135 million and $17.5 million deals for naming rights to the Miami Heat’s arena and the field at California Memorial Stadium. Many other crypto firms have also partnered with professional athletes and sports leagues in sponsorship deals. Celebrities are getting involved, as well: Canadian rapper Drake shared his Super Bowl bets on Instagram, including over $400,000 worth of Bitcoin on the Los Angeles Rams beating the Cincinnati Bengals.

Meanwhile, federal law enforcement officers seized more than $3.6 billion in cryptocurrency linked to a 2016 hack of virtual crypto exchange Bitfinex, the Justice Department said in a release. BlackRock may begin offering a cryptocurrency trading service to its investor clients. And crypto exchange Binance invested $200 million in Forbes.

Here’s more on the latest crypto news investors should know about:

Ilya Lichtenstein, 34, and his wife Heather Morgan, 31, were arrested and charged earlier this week related to an alleged conspiracy to launder cryptocurrency stolen during the 2016 hack of crypto exchange Bitfinex. The stolen crypto is currently valued at approximately $3.6 billion, the Justice Department’s largest financial seizure ever. According to the DOJ, the couple “employed numerous sophisticated laundering techniques,” but the couple was not charged in the Bitfinex hack, which resulted in the theft of almost 120,000 Bitcoin that’s now worth more than $4.5 billion. Deputy Attorney General Lisa O. Monaco said these arrests demonstrate that “cryptocurrency is not a safe haven for criminals,” and that they will take a “firm” stand against anyone involved in illegal crypto activity.

BlackRock, the world’s largest asset manager, may be gearing up to offer crypto trading services to investor clients. According to sources with knowledge of the plans, CoinDesk reported the firm will allow its clients to trade crypto on portfolio management system Aladdin, and also plans to enable investors to borrow using crypto collateral. The New York-based company currently has $10 trillion in assets for institutions.

Forbes announced a $200 million investment from crypto exchange Binance earlier this week. According to the announcement, the investment will help Forbes execute on its plan to merge with a publicly traded special purpose acquisition company, or SPAC, in the first quarter of 2022. It will make Binance one of the top two largest owners of the publication, which will be listed on the New York Stock Exchange under the ticker symbol “FRBS.” Two Binance execs will also join the Forbes board as a result of the investment.

Bitcoin is the largest cryptocurrency by market cap, and a good indicator of the crypto market in general, since other coins like Ethereum (and smaller altcoins) tend to follow its trends. Even though Bitcoin recently set another new all-time high, it was a pretty normal uptick for the crypto, which is notorious for its volatility. That’s not to say investors should take swings in either direction lightly, and this is also why investing experts recommend not making any major investment changes based on these normal fluctuations.

Cryptocurrency is still very new, and everything from innovation to regulation can have outsize impact for investors. Here’s how you can invest smartly, regardless of what’s making news or Bitcoin’s price swings.

Cryptocurrency volatility is nothing new, and you should be comfortable with this if you decide to invest.

Volatility can be attributed to an “immature market,” says Ollie Leech, learn editor at Coindesk, a cryptocurrency news outlet. Anything from a celebrity tweet to new federal regulation can send prices spiraling.

“If Elon Musk puts hashtag Bitcoin in his Twitter bio, it sends Bitcoin up 10%,” says Leech.

This unpredictability is part of the reason why investing experts warn against investing huge amounts of your portfolio into a risky asset like crypto. Many recommend keeping your crypto holdings to less than 5% of your total portfolio.

For new investors, day-to-day swings can seem frightening. But if you’ve invested with a buy-and-hold strategy, dips are nothing to panic about, says Humphrey Yang the personal finance expert behind Humphrey Talks. Yang recommends a simple solution: don’t look at your investment.

“Don’t check on it. That’s the best thing you can do. If you let your emotions get too much into it then you might sell at the wrong time, make the wrong decision,” says Yang.

This is the traditional “set it and forget it” advice that many traditional long-term investors follow. If you can’t get on board, and the extreme dips continue to cause you worry, then you might have too much riding on your cryptocurrency investments.

“The most important thing any investor can do, whether they are investing in Bitcoin or stocks, is not just to have a plan in place, but to also have a plan they can stick with,” says Douglas Boneparth, a CFP and the president of Bone Fide Wealth. “While buying the dip might be attractive, especially with an asset that you really like, it might not always be the best idea at the moment.”