The Easing Frenzy Provides Fuel For REITs by Michael A. Gayed

Summary

- One of investors’ darlings, the real estate sector, seems poised to continue outperforming the overall market.

- Central banks continue to ease around the world.

- As Jesse Livermore put it, buying cheap is not the only game in town. Buying at the right time is as valuable.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

It isn't as important to buy as cheap as possible as it is to buy at the right time. - Jesse Livermore

One of investors' darlings, the real estate sector, seems poised to continue outperforming the overall market. For instance, since its inception, Real Estate Select Sector SPDR Fund (NYSEARCA:XLRE) knew only one thing: to push for new highs.

Central banks continue to ease around the world. The Fed already did it twice this year, and most recently the RBA in Australia lowered the cash rate to a historic low: 0.75%.

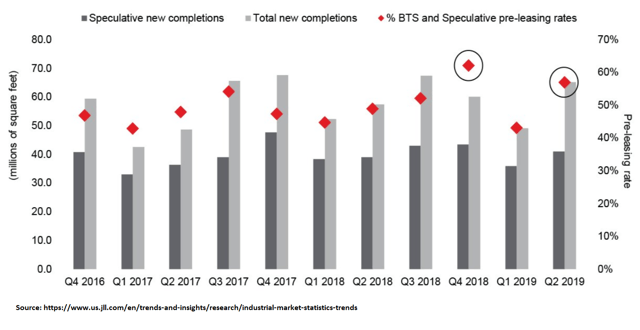

As I mentioned in the last Lead-Lag Report, such conditions make real-estate yields look especially attractive, with industrial and rental REITs looking strong. According to a JLL Research paper, in Q2 2019, the US industrial vacancy rate remains steady at 5% while rents continued to climb in the second quarter. The pre-leasing rates trend looks steady too.

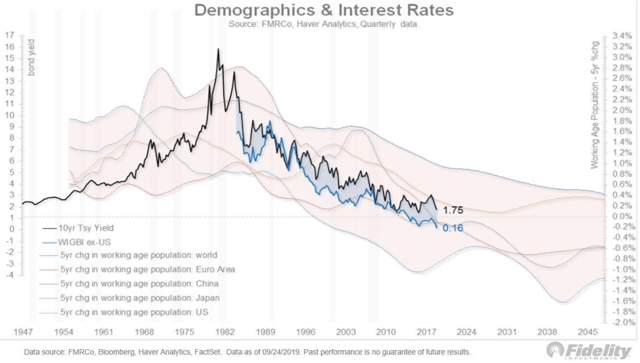

Have you ever thought about demographics and interest rates? A recent study shows that demographics help to predict interest rates. If it predicts low interest rates into 2040, as the chart below implies, the obvious thing to do is to continue investing in real estate as banks will partner up with their capital at low fixed costs. On top of that, rents most likely will continue to grow.

As Jesse Livermore put it, buying cheap is not the only game in town. Buying at the right time is as valuable.

Beware of running corrections. The waves theory tells us that the market sums up all investors' expectations, and it moves in waves based on greed, fear, human nature stuff.

A textbook running correction looks like the blue lines on the right side of the chart below. The market advances, pause a bit, then explodes higher. Next, it consolidates in a triangular pattern. Then boom! An extension follows as traders try to pick a top in overbought areas. Not wise!

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Thank you for posting from the https://steemleo.com interface 🦁