Airdrop Taxation - Is the Bitcoin-Cash Fork / Bitcoin Unchained Airdrop A Taxable Event? What About Byteball?

The IRS expects you to pay taxes on just about everything, even down to a paperclip you find in the street. Technically, you should file that as a taxable gain at the value of the paperclip on the day you acquired it, and you'll be taxed at a rate similar to your income (ie, fairly high). For anyone aware that the IRS taxes gambling and lottery winnings, despite both being -EV (expected value) activities, this should come as no surprise. (Remember - you're more likely to die in a car accident going to buy a lottery ticket, than you are to win the actual lottery once you have the ticket.)

This presents a dangerous conundrum for holders of Bitcoin. As the scaling debate in Bitcoin winds toward a not-entirely-certain outcome, numerous new versions of Bitcoin are cropping up. Two notables ones include Bitcoin Cash (BCC), and @stan 's own Bitcoin Unchained (BTC-U). Bitcoin Cash is already being valued at between $250-$800 on Via-BTC despite being pre-market. Bitcoin Unchained is also pre-market, and both will be distributed via air-drop.

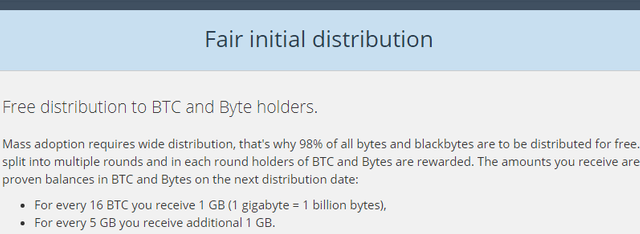

Air-drop is a form of cryptocurrency distribution where the coins or shares are simply given out for free, often to a specific subset of (future) owners based on variable criteria. Byteball, another cryptocurrency, also distibutes based on who holds BTC and Byteball.

In the case of both BCC and BTC-U, these will be given out to anyone holding Bitcoin in a private wallet or at an enabled exchange. Some, but not all exchanges, will likely claim the bitcoins of their customers funds without much comment. This might lead to a situation where large amounts of these new coins are dumped immediately into the market, or simply left dormant and ignored.

However, for those that are claimed, these would likely be considered a taxable gain of property, given the IRS has declared Bitcoin and other "virtual currency" to be property. Are each of these new items technically Bitcoin? It probably doesn't matter, as it is likely the IRS will tax them this way should either of them persist and retain value. Technically, they could impose tax liability on all holders at the time of the fork as a property gain. I wrote a post here on why this would be ridiculous, detailing the thin order book.

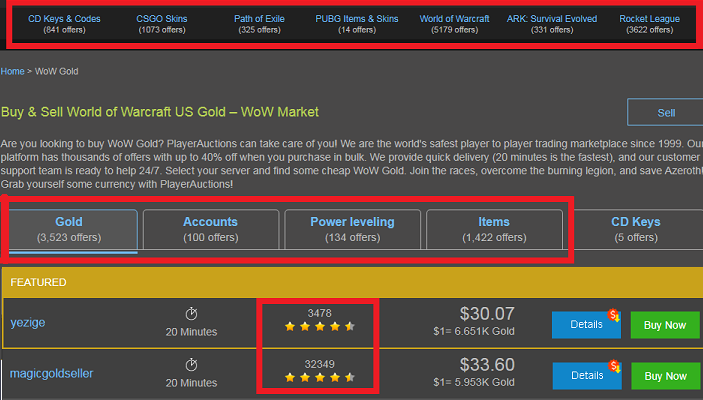

The "logical" conclusion is these new off-shoots of Bitcoin, BCC and BTC-U, would probably immediately be considered property under the IRS claim that "virtual currency" is property. This becomes a serious problem if you have no interest in these coins, as it is feasible you could be expected to claim a taxable property gain on a coin you don't want. The idea that you could execute an orderly exit from these coins at the current quoted price on ultra-thin volume exchanges in China is outright silly.

If any, or several, of these coins go to zero, all holders will have had a realized taxable gain when they acquired the coin and nothing to show for it (except maybe a capital loss deduction at a lower tax rate at your initial "found property" cost basis). Users, whether they claimed their coins or not, could end up with nothing and big tax bills on their initial property "gains".

The only suggestion I have for holders is to move any forked assets into the coin of their choice and continue holding it for more than 1 year as a capital asset. That allows you to legally minimize your potential tax liability without worrying about things such as like-for-like exchanges.

Note - I am not currently a practicing lawyer or accountant. This is not investment, legal, or tax advice. Do your own due diligence. Don't go to jail listening to a guy posting South Park memes.

Read more about Bitcoin Cash here.

Read more about Bitcoin Unchained here.

Check out my Steem-Taxation series by clicking here. Part 4 coming soon!

Copyright: Family Guy, South Park

And so, I managed to find a mention of Byteball in your blog.

Is there another?

You got a 7.69% upvote from @adriatik courtesy of @stimialiti!

You got a 50.00% upvote from @greengrowth thanks to @stimialiti! You too can use @GreenGrowth by sending your post URL in the memo field to the bot. Minimum bid is 0.01.

If you feel this post is spammy or not worthy of @Greengrowth you can contact a moderator in our Discord Channel https://discord.gg/6DhnVTQ.

Great post! You've earned a 16.67% upvote from @dolphinbot

You got a 16.63% upvote from @luckyvotes courtesy of @stimialiti!

You got a 38.34% upvote from @oceanwhale courtesy of @stimialiti! Delegate us Steem Power & get 100%daily rewards Payout!20 SP, 50, 75, 100, 150, 200, 300, 500,1000 or Fill in any amount of SP. Click For details | Discord server

hahahahahaha.... as you get creative in your earnings, the IRS is getting creative with its collection of taxes... the money is now online, expect the taxes to head in that direction

I think the best we can hope for in this regard is that the IRS remains someone behind the times on these issues.

Because, I suspect any modernization on their end will be to our detriment.

You are correct, very correct... the funny thing, the volatility in this market and the marketcap of crypto is to big to ignore... the transparency of some of the blockchain makes their jobs very easy... I suspect when they ramp up their efforts to collect their dues, the privacy and anonymous coins would skyrocket in the market... once you see that trend developing, then you know where to place your trades, easy money... so its still possible to profit if they modernize their game

Agreed, but I think, it's still going to take them some time to catch up.

I have a feeling they are closer to "internet is a series of tubs" than actually understanding the various cryptos.

They are unable to impse any taxes on your holdings, that is until you transfer them to your fiat account. Just transfer the wealth to a paper wallet and some day in the future, leave the US. and reap the crypto rewards.

Technically, they can impose them whenever and however they like. You are guilty until proven innocent.

no taxation without representation

DOWN WITH THE IRS

DOWN WITH THE CENTRAL BANKS

IRS is behaving like the dictator here, some day it will be in great trouble.

Your post nice topic I like it .......................

https://steemit.com/cryptocurrency/@xervantes/earn-free-coins

what do you think about it? You know about it? Know about the owners? Does it remind you anything similar in the past?

How to participate in Airdrops - https://blog.coinswitch.co/airdrops-everything-you-need-to-know-84b2fa0d005d