The Best Personal Finance Summaries (for Malaysians) - 24 March 2020

The Best Personal Finance Summaries - 24 March 2020

We are 7 days into our #RMO (Restricted Movement Order).

We hope that you are healthy, staying sane, and have the money to cover your basic needs.

As mentioned last week, we are trying to help by going live each day on our Youtube channel and Facebook page with interviews with financial experts.

We hope that through watching these videos, you will be able to take advantage of all the financial opportunities that will exist after this crisis.

And of course, our RM500 giveaway is still happening.

The first winner will be announced in:

Get started here. (or go to the bottom of this newsletter).

From Us

[VIDEO] Book Summary: Rich Dad Poor Dad

With everything happening in the world, there are many things that are going on sale. The question is, are you buying long term assets or liabilities?

[VIDEO] What you need before you invest

[VIDEO] Demystifing Medical Insurance

Money in Daily Life

5 Steps On How Women Can Achieve Financial Stability

Achieving financial stability sounds like a lot of work. But, with proper planning and the right mindset, you are set to go!

Researches have shown that only 20% of women take independent financial decision, 42% have set clear investment goals and 20% have only EPF contributions for their retirement. These stats are worrying because financial planning is an integral part of achieving our financial goals. Thus, listed below are 5 steps on how women can make financial stability.

- Educate yourself about complex financial decisions. Learn about financial planning by understanding your personal and family financial standing. Check out and categorize your monthly cash flow. Make sure to segregate the figures to personal and family finances, respectively.

- Having a MUST contingency reserve of six months expenses. Have a liquid fund of at least six months of living expenses for any unexpected financial bump (so that the bump will not become any unnecessary debt). Having a sufficient emergency fund can allow you to have a better grip on your financial outflow.

- Believe in your unique characteristics. Women are more compassionate, thoughtful, and open-minded. We should leverage this as our advantages in making financial decisions.

- Figure out your end goal. Know what your financial life goals are. Then, invest as early as you can – because compounding will work the magic for you. Be more aggressive and open to discuss finances with your spouse and family regularly.

- Start the financial planning journey with the help of an advisor. A right financial planner or advisor can shape you a financial plan by considering your goals, passions and concerns. However, make sure to get a licensed one who is qualified and certified by Bank Negara Malaysia (BNM) and Securities Commission (SC).

Want To Have Your Money Accelerate Your Goals?

Sign up for our free program and get ready to have your money fuel your aspirations.

Grow Your Wealth

Dollar Cost Averaging: Is It a Practical Strategy to Invest in the Stock Market?

Hi, I’m Cindy Ng. I have RM 12,000 to invest in the stock market. My question is: ‘Should I invest the sum in full or use the Dollar Cost Averaging (DCA) method to spread out my investments to around RM 1,000 per month or RM 3,000 per quarter?

One reader of the KCLau’s blog recently wrote in to ask about the Dollar Cost Averaging (DCA) strategy. Below are the responses answered by Ian Tai, a long-standing author at the personal finance blog.

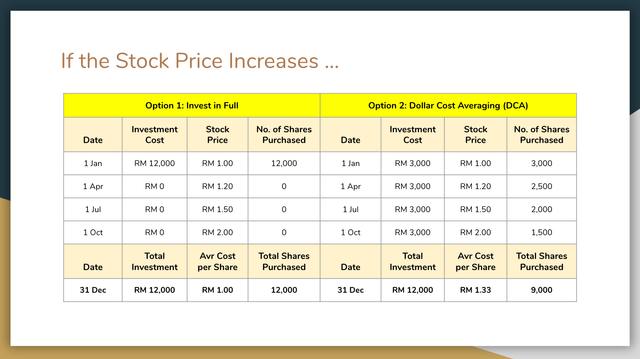

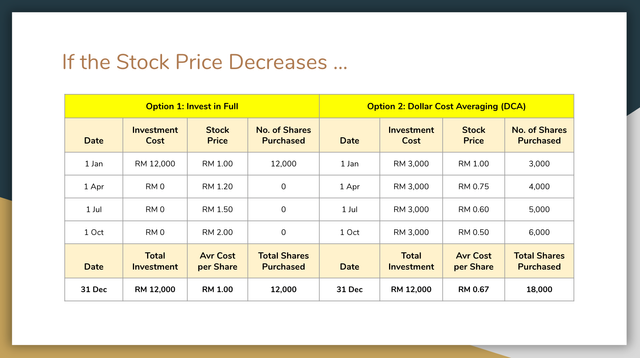

First and foremost, DCA is a popular investment method used by retail investors to invest in liquid-able assets for the long term. Different allocation strategies will generate different investment results. The tables below summarised the effect of DCA under unusual stock price movement.

If the stock price increases:

If the stock price crashes:

The Effectiveness of Dollar Cost Averaging (DCA)

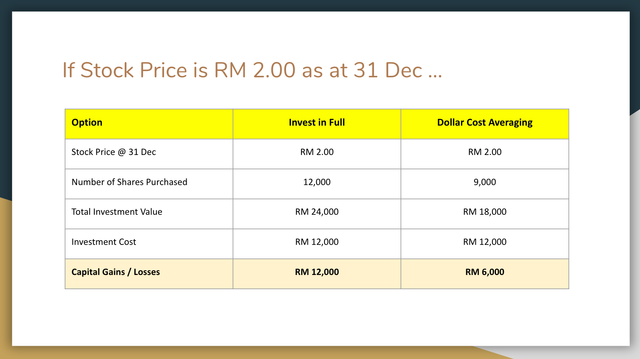

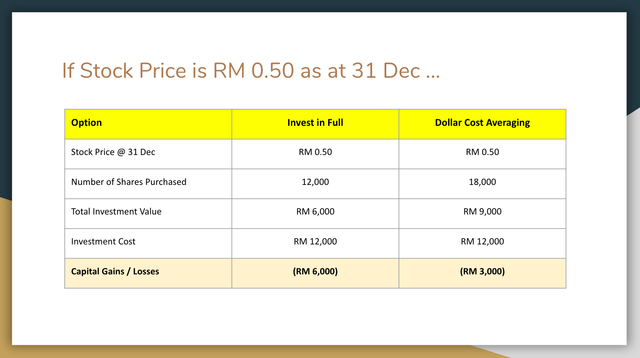

It is obvious to note that DCA lowers investment profits in a rising market, but it reduces losses if the stock price declines. Essentially, DCA is about promoting long-term investing among the investors as it advocates the habit to invest consistently.

Do I Use Dollar Cost Averaging (DCA) when Investing?

For the author, DCA is workable if the investment of your choice is fundamentally substantial (from the perspective of value investor). One should do his/ her due diligence to assess the business before investing. The author, however, prefers DCA as the method encourages investors to treat stock investing as a long-term activity of accumulation of shares of great businesses regularly.

Back to Cindy: To Invest in Full or Use DCA?

There is no straightforward answer to this question. However, Cindy shall evaluate her options by asking herself the following questions:

- How Much is Your Monthly Savings per Month? In short, if her monthly savings are significant (>RM5,000), she could consider investing the RM12,000 in full because the amount would not be a substantial amount to her.

- Which Stock Market Would You Like to Invest Into? Different markets charge different transaction fees (RM12 for Malaysia-, SGD32 for Singapore- and USD30 for US-listed stocks). The high transaction fees might take up a majority portion of the investment and lower the cost-efficiency.

- How Do You Rate Your Investment Skills and Confidence? If Cindy is just still learning about stock investments, she should start small, and DCA is a good strategy for her.

Conclusion

All in all, DCA is intended to promote long-term investing by fixing your amount of investment sum periodically. As such, it is the right way for anyone with a monthly income and limited capital to start investing. However, it is still essential for investors to evaluate the quality of an investment vehicle before committing to it.

What to Do During a Bear Market in Malaysia?

Wouldn’t it be better to sell off my stocks now and buy when the market bottoms out?

What is a Bear Market?

In general, bear markets are markets in which the prices of securities fall by more than 20% amid widespread negative investor sentiment and fear. It can last from weeks to decades.

Things You Should Do During a Bear Market

- Always Stay Invested. In the long term, you’re always better off staying invested. One would never know when a market ‘bottoms’ out. Instead of chasing that bottom, averaging down stock positions is a sound strategy.

- Remember the Fundamentals. Don’t panic. Don’t sell it. Don’t panic sell. Fundamentals of a company will not have changed during a bear market.

It is the Best Time to Start Investing

If you’re ever on the fence and wondering if you should start investing, the time is now. Open a brokerage account and start trading now (go for Rakuten Trade, or StashAway if you prefer a robo-advisor).

End

Keep a calm mind and purchase more stocks if you can. Do not go over your risk threshold. Always stay invested.

4 Ways to Invest in Yourself (and Your Financial Future)

Wealth is an accumulation of the right decisions and not only financial ones. Here are 4 simple steps to investing in yourself for a brighter future.

#1 - First, reduce your debt

Just because debt is typical, doesn’t mean it’s acceptable to have it. Clear your debt – especially those with high interests. Start by creating a suitable budget for yourself to allocate a portion of your income for clearing debts consistently.

#2 – Invest time in enhancing your skills or knowledge

To increase your savings capacity, you could (1) decrease your expenditures or (2) increase your monthly income. To achieve (2), it is crucial to increase your earning potential – skills, experience and knowledge. Also, it is noteworthy to mention that this does not apply to young professionals only – no matter your seniority, you should seek ways to improve yourself. Don’t merely upgrade your lifestyle with your raises. Instead, if you earn more, you save more.

#3 - Invest time in your health

By taking care of yourself now, you can reduce the risk of disrupting your income or dipping into your emergency fund. Take time to find ways to work a healthy lifestyle into your daily routine. Prepare yourself against the unexpected by getting insurances or medical cards.

#4 - Invest your savings in your future

Make sure you have a financial plan in place that includes not just saving but also investing. Remember, wealth is a result of consistent, disciplined saving and investing. You will have the time advantage if you start earlier – however, it’s never too late to begin investing. Most importantly, you should start now!

An Unexpected Pandemic Presents Investment Opportunities)

An unexpected snowfall permits a joyful moment of snow play. Similarly, a sudden pandemic presents investment opportunities.

The author of the popular personal finance blog, KC Lau from KCLau.com shared a story-telling post detailing his reaction and thought towards the unforeseen widespread COVID-19.

He started by mentioning that the outbreak has inflicted massive fear in the financial market. In real life, President Trump has announced the national emergency in the US amidst winter.

During the same winter, KC Lau mentioned that his family was greeted by an unexpected snowfall as well. Undoubtedly, the snowing was unanticipated – this did not deter him from seizing the moment and appreciating the beauty of life with his beloved ones.

The author then referred this incident to the current global financial situation. One should find opportunities to achieve self-improvements and be well-prepared during times like this. Lastly, KC Lau also quoted a saying by Buffett: “when others are fearful, be greedy.” Great wealth is transferred during the period of fear.

How Much Money Do Youtubers Make?)

YouTube is arguably the most appealing platform for making money. There are YouTubers out there earning tens of millions of dollars by uploading videos without leaving their house.

How Youtubers Make Money?

Under the YouTube Partner Program(YPP), a YouTuber can earn money via:

- Ad Revenue. Get paid for allowing Google to display ads on your content. Advertising formats include display ads, overlay ads, non-skippable video ads, bumper ads, and sponsored cards.

- Channel Memberships. Charge a monthly fee to your subscribers. Paid channel subscribers will get access to perks like emojis, badges, and other offerings.

- Merchandise Shelf. Allows you to showcase branded merchandise on your video content via a third-party eCommerce platform.

- Super Chat & Super Stickers. Your fans can pay for Super Chat and Super Stickers when you’re broadcasting a live video. These features make their name and messages stand out in the chat feed during a broadcast.

- YouTube Premium. YouTube offers a monthly subscription to users who want an ad-free experience, offline viewing, and YouTube Music. Creators can get a share of this revenue.

Apart from the YPP, YouTube channel can be monetized using affiliate program, influencer marketing and content licensing through third parties.

Requirements for Making Money on YouTube

Minimum requirements to be eligible for the YPP are:

- 1,000+ subscribers.

- 4,000+ public watch hours in the past 12 months.

- A valid and linked Google AdSense account (this is how you get paid).

- You must live in a region or country where YPP is available.

- Follow all YouTube monetization guidelines and policies.

Each monetization feature also has its unique requirements:

| Features | Requirements |

|---|---|

| Ad Revenue | Must be 18+ (or have a legal guardian), contents should be advertiser-friendly. |

| Channel Memberships | 18+, minimum 30,000 subscribers. |

| Merchandise Shelf | 18+, minimum 10,000 subscribers. |

| Super Chat & Super Stickers | 18+, must be living in a country/ region where Super Chat is available. |

| YouTube Premium | Must create content that’s being watched by YouTube Premium subscribers. |

| Sponsored Content (Third-party) | Need to disclose your brand relationships when you upload content. |

How 10 Youtubers Make Money?

Below is a list of 10 highest-grossing YouTube channels in 2019:

| Channel | Earnings ($ mil) | Content |

|---|---|---|

| Ryan Kaji | 26 | Unboxes and reviews kid toys. Conducts fun science experiments. Owns a line of clothes and toys. |

| Dude Perfect | 20 | Sports and comedy. |

| Anastasia Radzinskaya | 18 | The channel centred on Anastasia’s lifestyle. |

| Good Mythical Morning | 17.5 | Talk show. Does strange things with a comedic twist. |

| Jeffree Star | 17 | Makeup, cosmetics and fashion. |

| Preston Arsement | 14 | Video games with commentary. |

| PewDiePie | 13 | Video games with commentary. |

| Mark Fischbach | 13 | Video games with commentary. Comedy sketches. |

| Daniel Middleton | 12 | Video games with commentary. |

| Evan Fong | 11.5 | Video games with commentary. |

Ways to Qualify for the Giveaway

Here are some ways you can qualify for our giveaway happening in

Here's the full list of the ways you can qualify for the giveaway.

Compare the different car insurance providers from one site

Is your car insurance coming up for renewal soon? If so, make sure you check if there are better deals that other car insurance providers are willing to give you by comparing them all at once.

The best part is you can customize what it is you want and have your quotes in real time.

Oh and your No Claim Discount will carry over to the new provider as well.

Check it out today and start saving!

A way for females to get free insurance

We were talking to our super humble financial advisor friend one day and she started talking about some insurance product for females that provides coverage for all these female related illnesses. But more importantly, the contract also states that all the premiums will be returned at the end of the contract.

Seriously something for all females to consider!

Learn how you can be paying 50% less for medical insurance

We had to interview an expert insurance agent who told us ways that we could be reducing our premiums by 50%+ by following these few tricks. Take a watch and qualify for the giveaway after answering a few questions to prove that you had watched the interview.

Figure out investing in 30 minutes and never deal with it again

Truly investing on autopilot. By signing up for Stashaway, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with any amount as there are no deposit or withdrawal fees!

Plus get the fees even lower by signing up for Stashaway through us*!

Figure out investing in 30 minutes and never deal with it again (halal version)

Truly investing on autopilot (halal version). By signing up for Wahed Invest, you will literally be able to have it automate your investing. Plus with the super low fees, your path to success just got a lot easier.

You can start with as little as RM100 and there are no deposit or withdrawal fees.

Plus get RM40 from Wahed Invest for signing up through us and funding your account by RM100.