PiggyBank Mobile App is the best saving App in Nigeria

Piggybank mobile app is a saving platform that helps its customers save. Economist believes that Savings equals investment. If people save their will be enough money to invest. For instance, if you can save a million Naira, that is enough to begin a business that will break even. Aside this, when you save, you can have money for various expenditures. Including unforeseen events and important items like buying a car, organizing your marriage or building a house. Piggybank is providing this opportunity for Nigerians as well as Africans to achieve their dreams by saving their hard earn money until it is needed.

The word Piggybank.ng, if it is looked at in the Nigeria context, is a container (kolo) which is used to save money for a time until it is needed. As a Nigeria, personally, I have used this kind of stuff to save money to buy stuffs during my secondary school days and so is many other Nigerians. This kind of service is what this financial technology company, Piggybank.ng is doing in Nigeria and it is the first of its kinds in Nigeria. PiggyBank.ng App can be downloaded on Play Stores. The App is free to download and free to sign up. You can also sign up via their website.

How does Piggybank.ng works?

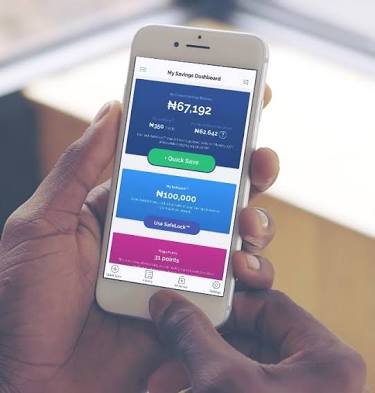

After signing up on Piggybank.ng, you will need to fill in certain amount of money you want to save. You can save on a daily, weekly or monthly basis. The money will be automatically deducted from your bank account as you have requested. You have the option of saving manually with the quick save option. You can save any amount you want in this section. Further, you can lock up certain amount of cash on “savelock” option. If you do this for 1000 days, you will receive 34 percent interest rate upfront. That means, the interest will be added to your “savelock” cash immediately, and not until the completion of the 1000 days. The 34 percent interest rate amount to 12.41 percent per year.

PiggyBank.ng encourages discipline. So, you’re not expected to withdraw your money except on the date you choose or any of PiggyBank.ng four default withdrawer days in a year. If you need to withdraw cash urgently before the due dates then you must pay five percent breaking fees.