Be Your Own Bank Using Bitcoin

The flowering of Bitcoin and other cryptocurrencies has called into question the need for the citizens of the world to depend on banking institutions to exchange value. The emergence of these tools has allowed users to consider more decentralized possibilities to relate economically and even, be their own bank , but is it possible?

ADVANTAGES: NEW VALUE EXCHANGE, WITHOUT INTERMEDIARIES

The cryptocurrencies pose a new value relationship. Thus, the global financial framework supported by the central banks, the money created by them and their management through private banking and commercial exchange, -with its own logic, requirements and requirements-, Bitcoin opposes a decentralized network , where Each one decides the reasons and the way to send money to other users without more demands than having a portfolio with funds, Internet connection and a destination portfolio, regardless of the borders and the time of day.

Bitcoin and cryptocurrencies are generally available 24 hours a day, seven days a week. In addition, there are no limits with respect to the amounts and you can even complete very high transactions for very small commissions.

Think of it this way: anyone can own and transfer the amount of BTC they want to and from anywhere in the world , in a few minutes (or instantaneously in the case of Lightning Network) without limitations, or under the threat of freezing funds . Although in some countries there may be legal obstacles, especially for the exchange of bitcoins for fiat currencies, this problem has to do exclusively with banks ; the network and the use of Bitcoin remains independent.

At this point it should be noted that, although the extent of cryptocurrencies for the transfer of value could be exploited for illicit purposes, it is not inherent in the nature of these tools , it is the user who decides for what and under what Sense uses your funds.

In the case of Bitcoin, there are only 21 million BTC, a figure that can not be modified under any circumstances. However, the value that circulates through the fiduciary currencies can be constantly divided and devalued with the printing of more notes. Inorganic money, which depreciates and detracts from the citizens' economy, does not exist in this scheme . Countries of high inflation and economic measures of this nature show that, despite its volatility, Bitcoin can be a real solution , allowing users to safeguard the value of their assets despite the economic environment.

On the other hand, while when a bank takes care and safeguards the funds, the money does not really belong to the users, in the case of cryptocurrencies, the amount of satoshis stored in a portfolio is exactly the same as that registered in the blockchain and only those who own the private keys can access these funds.

The simplest way to build your own bank is to keep this private key, however, it is not an easy task nor can it be taken lightly.

A RECURRING IDEA IN THE COMMUNITY

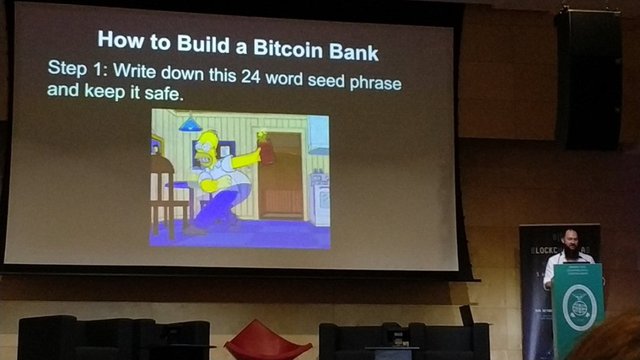

Within the bitcoiner community this is a widespread idea and even the developer Jameson Lopp has offered his opinion on the subject . For him, it is possible, although not without effort. During his participation in a recent event with the Bitcoin technical community, he explained this possibility.

For him, a user can exercise as his own bank, leaving behind the dependency relationship with these institutions. One of the fundamental points of his proposal has to do with the security and responsibility that users must have with the management of their own finances: there is no longer a third party to watch, the responsibility falls exclusively on the users .

The very functioning of Bitcoin enables this new role of users as the main managers of their finances, in return, the requirement is to preserve the words provided by the portfolio for its recovery. Although it seems very simple, it is a complicated process, especially because users are educated and accustomed to trust in third-party custody and because they are not security specialists.

" How would you build a bitcoin bank? All you have to do is write that initial 24 word phrase and keep it safe. This probably seems normal for most of us ... but for a stranger, it's crazy. Outside this room, there are very few security experts who know how to manage this type of systems, "he argued during his presentation in Lisbon.

¿ AND THE RISKS?

However, the risk of this information falling into inadequate hands rises by eliminating the institutional halo of banking as a custodian. Safes filled with security cameras of banks are not an option and the user who decides to be their own bank must manage the care of this information by itself.

This is a problem, not only for the advent of this model of decentralized and personal banking, but also for widespread adoption. Users, accustomed to bequeath this type of responsibility to third parties, could hesitate when choosing a value exchange system where they are required to protect their own security.

Assuming that a user conscientiously decides to take care of their own private keys , the funds could be at risk. Physical attacks, social engineering, phishing, are some of the options. The risk is real.

Even with a high level of redundancy and cryptographic protection , there may be a point of failure, but part of being our own bank is to truly know all the risks to minimize its possible influence, and it is possible.

Great article! I found it very interesting.

Talking about ICOs, after doing your own research, also finding good ICO projects can be profitable.

I want to share with you guys this new exciting project: RAWG.

Check out this new article where RAWG is mentioned as the "IMDB of gaming" on FORBES, one of the leading global media company, focused on business, investing, technology, entrepreneurship, and leadership.

https://www.forbes.com/sites/andrewrossow/2018/07/16/3-reasons-the-video-game-industry-is-bound-for-blockchain/#69da81c87810

The ICO will start in a short period, and they are at the moment in pre-ICO phase. This is the site: https://token.rawg.io/. It's a video game discovery platform that converts your skills into goods and services (the site is already working, with more than 57,000 games in the database).

Have a look and get some information while doing your own research :)

Another interesting point: RAWG has already secured $5m USD, halfway to hard cap of $10m!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by ad1 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Pretty interesting point. Great post https://9blz.com/lbank-review/