Introducing — eFin DEX and EFIN coin

Our ecosystem is constantly evolving to meet the demands of merchants and consumers who choose to participate in utilizing our product & service offerings. As such, eFin will be an integral part of every aspect of the ecosystem.

What is eFin:

eFin is a secure, decentralize, private, unhackable, non-custodial exchange hub of the TokenPay ecosystem. It will provide means necessary to handle large scale, real-time crypto-to-fiat conversions for our merchant services platform and several other platforms such as, WEG AG Bank and TokenSuisse. eFin will also support quick and painless TPAY, XVG, and LTC conversions to mBTC to be used on TokenGaming, CryptoBet, and Esports.io in the future.

eFin DEX

The problem: Centralized Exchanges

When you transfer your coins to a centralized exchange, such as CoinBase, you’re trusting that their security measures are going to be enough to protect your coins. Unfortunately, the numerous hacks that have left users of various centralized exchanges with zero balances tells us that the security measures that are in place are neither effective nor being taken seriously because these hacks constantly occur.

The solution: eFin DEX powered by the Infinitesimal Protocol

With eFin, your coins are always in your control, you are responsible for your private keys, and your digital assets are stored on-chain. Efin never has custody of your coins. This means that your digital asserts are always safe so long as you, the user, are taking appropriate measures to ensure that your private keys are stored safely away from the eyes of malicious individuals. It is easier to hack 1 centralize exchange than it is to hack 1,000,000 individual decentralized wallets.

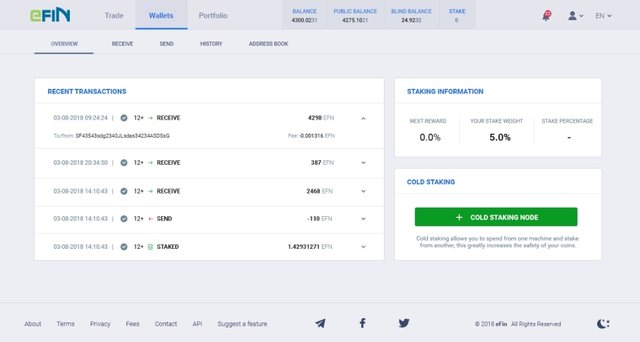

This is an example of what the wallet view might look like.

eFin Technology Deep Dive:

Infinitesimal Protocol

To start, let’s talk about the core protocol behind eFin — Infinitesimal Protocol. This protocol is a highly-scalable decentralized network of multiple off-chain bi-directional micropayment channels that uses RSK-powered smart contracts, Tokenpay’s Multi-signature transaction engine (MTE), and cross-channel atomic swaps to allow near instant transaction confirmations with extremely low fees.

It is a well-known fact that one of the issues plaguing the modern-day bitcoin network is scalability. Scalability refers to the amount of transactions the network can process. Currently, Bitcoin supports less than 7 transactions per second (tps) with a 1 megabyte block size limitation. To rectify this, the Infinitesimal Protocol introduces a network of off-chain bi-directional payment channels where only the participants of the transactions are involved.

What this means is rather than each transaction being broadcast to the entire world, payment channels are established between two participating parties and upon confirmation of transaction via multi-signature consensus, the transaction is then broadcast on-chain which opens the payment channel between the two participants.

This bi-directional payment channel network enables transactions to be made independently without trusting intermediate nodes. To simplify, picture bi-directional payment channels as being similar to what you would see on an IP based network: as long as the data gets to the destination, the communicating end nodes do not worry about the route. That being said, this network operates without custody of third party funds which is enforced by time-locked transactions and cryptographic nuances.

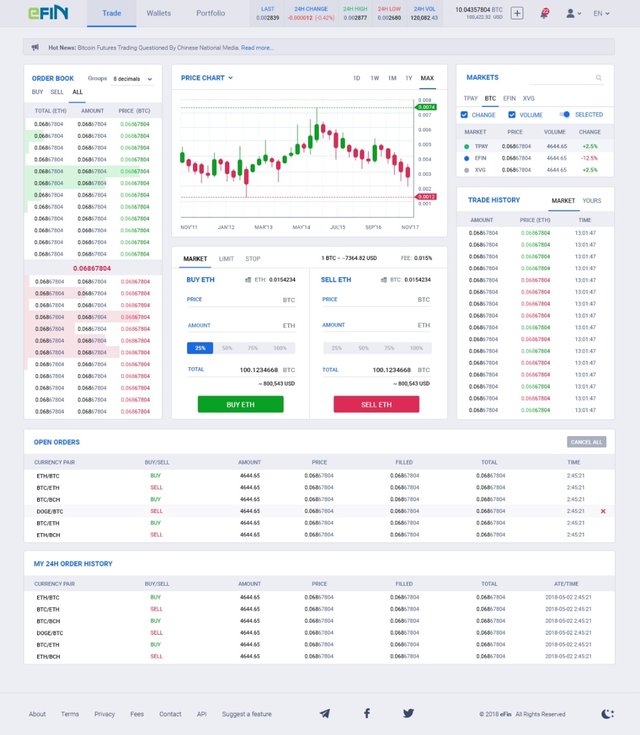

This is an example of what the trading view might look like.

RSK-Powered Smart Contracts

Another integral layer in the Infinitesimal Protocol are RSK-powered Smart Contracts. RSK Smart Contracts are an open-source smart contract platform that was originally created to work as a side-chain product to bitcoin.

A smart contract refers to a piece of code on the blockchain that is designed to take a specific action when certain preset criteria are fulfilled. While these contracts are not “legal” contracts, they are binding in the sense that all criteria must be met for the predetermined action to take place. Since these contracts reside on the blockchain, there is no need for third parties to be involved in the programming of the contract. For example, if Anthony decides to send Billy 10 BTC, once Anthony’s wallet reaches 10 BTC, this action can be automatically achieved through a smart contract with no need for a centralized exchange.

The Infinitesimal Protocol benefits from RSK smart contracts through their obvious decentralized automation capabilities as well as their inherent transactions per second rate of 100 TPS which is roughly the same as PayPal.

It is worth noting that in the future, the RSK team plans on increasing the tps rate to upwards of 2,000 via the Lumino Protocol, at which time the infinitesimal protocol will be upgraded to house the same capabilities.

Multi-Signature Transaction Engine:

Alongside RSK-powered smart contracts and off-chain bi-directional payment channels, the Infinitesimal Protocol operates on top of TokenPay’s Multi-Signature Transaction Engine (MTE). This technology ensures that the eFin network can function in a decentralized capacity without counterparty risk.

By enabling the power of mulit-sig via MTE, this allows for trustless escrow, trustless margin, and robust security. MTE is an advanced protocol that protects the user by requiring the signatures of multiple participating parties to approve a transaction before the corresponding data is published on the blockchain. Unlike traditional payment services, there is no centralized handling of user funds at any point in time.

It is often said that the core values of many modern day cryptocurrencies can be based around decentralization and trustless operation. However, most modern-day exchanges operate in an opposing fashion by being centralized. This is one of the primary flaws with today’s exchanges as they expose themselves to potential hacking and fraud. This increases your coins’ security risk of being stolen or compromised. Unfortunately, many users of various exchanges have experienced this first hand.

To rectify this, eFin’s Infinitesimal Protocol also encompasses the capabilities for cross-chain atomic swaps. This technology allows for the interoperability of different cryptocurrencies on different blockchains without putting either party participating in a swap at risk.

For example:

If Anthony owned 10 BTC but instead wanted 200 LTC, he would have to go through an exchange, i.e, a third-party. However, with atomic swaps, if Billy owned 200 LTC and instead wanted 10 BTC, then Billy and Anthony could make a trade. To prevent, for example, Anthony accepting Billy’s 200 LTC, and then failing to send over his 10 BTC in return, atomic swaps utilizes what is known as hash time-locked contracts (HTLCs).

Hash Time-Locked Contracts (HTLC):

A hash time-locked contract is a type of payment in which two people agree to a financial arrangement where one party will pay the other party a pre-determined amount of crypto. These contracts are “time-locked” which basically means that the receiving party has a certain amount of time to accept the payment, otherwise, the money is returned to the sender.

These styles of payments can help to eliminate the need for third party contracts via contracts that are established between two parties. Third parties that are often involved in contracts are lawyers, banks, etc. Lawyers are often required to draw up contracts, and banks are often required to help store money that is then transferred to the receiving party as stated in the contract.

With HTLC’s, two parties can setup contracts and transfer money without the need for third party involvement.

To summarize the benefits of eFins’ Infinitesimal Protocol:

Benefits:

· Tamper-proof consolidated audit trail

· Near-zero transaction cost

· Increased transactional velocity

· Trust-less Economy

Note: The initial launch of the eFin platform is currently scheduled for Q3 2018. Below is a brief overview of roadmap for eFin.

· Phase 1 is a version of Lightning network — Q1 2019

· Phase 2 is Atomic swaps — Q2 2019

· Phase 3 is RSK smart contracts Q3 2019

EFIN Coin

The EFIN coin is what enables near-instant transaction confirmations at exceptionally low fees. By using TokenPay’s proprietary Infinitesimal protocol, with security maintained by smart contracts, it creates a true trust-less economy, where no third-parties hold custody of your digital assets. It is a product of its own blockchain (not a TPAY fork) with a modern code base that was developed specifically for facilitating financial transactions and will be used on the eFin decentralized asset exchange platform to:

· Ensure a tight buy/sell spread

· Provide near-instant transaction times

· Pay trading fees

· Purchase traditional and crypto-based financial products from TokenSuisse

Furthermore, users will have the ability to exchange EFIN Coins for TokenSuisse financial products on the blockchain. The idea is to tokenize traditional Swiss financial assets and make them available to everybody on the blockchain.

Everyday consumers will have access to previously unobtainable Swiss assets without having to deal with the time consuming and strict requirements associated with obtaining them in the past.

How to get EFIN coins:

Our approach is to reward TokenPay holders as well as non Token-Pay holders to join our decentralized exchange. An incentive of eFin coins will not only power the decentralized network of eFin but will also improve liquidity for eFin.

eFin is going to distribute 70% of the coins to TokenPay holders and users of our exchange, of which is 20% to TPAY holders, 20% PoSv3 rewards, and 30% trading incentive. No decentralized exchange has ever provided such an incentive, and we are making history by being first exchange in the world to do so.

Please show your support!

Be sure to up-vote this article.