Stocks in the news: RVNL, Dish television, Wipro, STFC, Vedanta and Wockhardt

NEW DELHI: Clever fates on the Singapore Trade were exchanging 25.50 focuses, or 0.22 percent, higher at 11,677.50, demonstrating a positive begin for the Nifty50. Here are a couple of stocks which may buzz the most in the present exchange:

Dish television:

Singapore Media communications, Bharti Airtel and Warburg Pincus are in converses with at first purchase the close to 61 percent stake of Zee originator Subhash Chandra's family in

Wipro: Largecap IT firm Wipro will think about buyback of significant worth offers on April 16. The revelation was made by the association post promote hours on Wednesday.

) RVNL: State-claimed Rail Vikas Nigam will list on the stock trade today. The Rs 480 crore Initial public offering, which was sold between Walk 29 to April 3, was bought in 1.83 occasions

) RVNL: State-claimed Rail Vikas Nigam will list on the stock trade today. The Rs 480 crore Initial public offering, which was sold between Walk 29 to April 3, was bought in 1.83 occasions

STFC, SCUF: Reports of a conceivable merger of Shriram Capital (SCUF) with Shriram Transport Money (STFC) were welcomed with some distrust, with experts saying the move could influence the close term execution of the stocks.

Wockhardt: Pharma major Wockhardt said it has gotten endorsement from the US wellbeing controller for its 50 mg infusion of Decitabine which is utilized to treat certain types of malignant growth.

NMDC: Walk all out iron metal creation came in at 4.04 million ton against 4.26 million in the year-prior month. Walk deals 3.59 million ton against 4.15 million ton around the same time a year ago.

Fly Aviation routes: Five organizations are said to have submitted articulations of enthusiasm for getting stakes in Fly Aviation routes. Nonetheless, the moneylenders have expanded the Wednesday due date by two days, with the expectation that Etihad Aviation routes, which hasn't presented an EoI, will indicate premium.

Vedanta: The organization has moved the Incomparable Court looking for access to its currently close copper plant at Tuticorin in Tamil Nadu to fix and look after it, refering to the high court's over the top deferral in hearing the case notwithstanding rehashed demands by the firm.

JSW Steel: India's greatest producer of the composite has finished raising $500 million by selling dollar bonds, denoting a recovery in worldwide obligation issues by expansive neighborhood organizations.

Bharti Airtel: The telecom major has fixed April 24 as the record date for deciding investors qualified to apply for its up and coming Rs 25,000-crore rights issue.

TCS: India's biggest programming administrations firm Goodbye Consultancy Administrations (TCS) said it has teamed up with tech mammoth Google to construct industry-explicit cloud arrangements.

Board meetings

Analyst calls

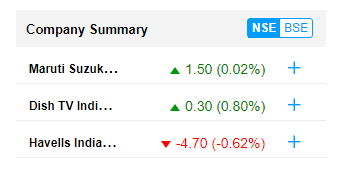

Credit Suisse has held unbiased rating on Maruti SuzukiNSE 0.02 % with an objective cost of ₹6,100. Maruti's piece of the overall industry, which remained at 52% in first 50% of FY19, has slipped to half in second 50% of FY19 with a 150 bps piece of the overall industry misfortune going ahead record of lower offers of the smaller car section, said Credit Suisse.

Antique Stock Broking has kept up purchase rating on State Bank of India with an objective cost of ₹385. The financier anticipates that SBI's profit should bounce back to ₹370 billion by FY21 versus ₹27 billion in FY19. The sharp swing in profit is to a great extent the impact of hazard balanced NIMs returning towards its intend to 2.1%, said Collectible.

Jefferies has held fail to meet expectations rating on ICICI Prudential Extra security Organization with an objective cost of ₹285. Indeed, even with capital markets recuperating, the loss of HNI client base in the previous year to be an obstacle to business development, topping further improvement in persistency and slower fixedcost amortization, said Jefferies. This may go about as a delay VNB edge, with any improvement leaving a higher assurance blend, it said.

CLSA has downsized Century Plyboards to sell from purchase and slice target cost to ₹174 from ₹195. The business sees restricted upside in Century Plyboards imparts to headwinds crosswise over item sections, especially in the MDF and pressed wood portion.

Nomura has minimized Havells IndiaNSE - 0.62 % to nonpartisan from purchase and expanded target cost to ₹750 from ₹636. Havells is a convincing story in the electricals and shopper durables space and the attitude toward key fragments additionally stays enthusiastic, said Nomura. Be that as it may, with a solid keep running over past year, valuations are never again undemanding, the firm said.

Insider Buys:

Gulshan Polyols Constrained: Gulshan Polyols Restricted Workers Welfare Trust has purchased 19,516 offers through Market Buy on Apr 8, 2019.

Meghmani Organics Constrained: Ashishbhai Natwarlal Soparkar Natwarlal has purchased 1,25,000 offers through Market Buy on Apr 8, 2019.

Shalimar Paints Restricted: Rear Vital Ventures has purchased 6,58,872 offers through Special Idea on Apr 8, 2019.

Insider Sells:

Bharti Airtel Constrained: Moti Gyamlani has sold 39,921 offers through Market Deal on Blemish 18, 2019.

Jayshree Tea and Ventures Constrained: Manav Speculation and Exchanging Co. Ltd. has sold 35,065 offers through Market Deal on Apr 2, 2019.

#Note: Disclosure made under Reg 13(4), 13(4a) of SEBI (IT) regulations 1992.