Technical Outlook EUR/USD and GBP/USD Post NFP

The dollar under pressure at the weekend (Friday 06/04) following a US employment report that released mixed results as wage data rose as expected, but the NFP and unemployment numbers missed expectations.

The dollar index, which measures the greenback's performance against several other major currencies, slipped 0.33% to 89.82. While EUR / USD and GBP / USD each rose 0.33% and 0.61%.

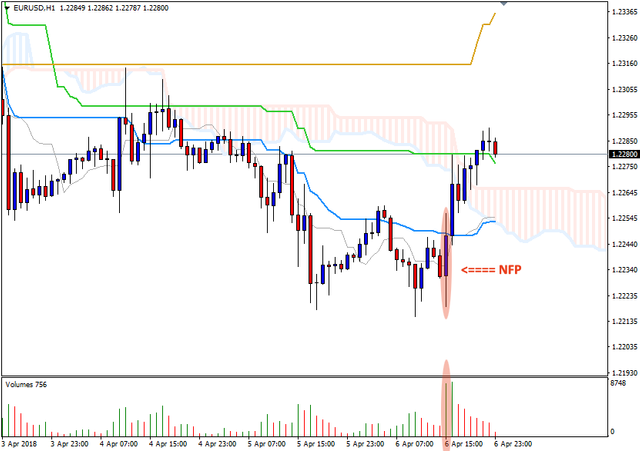

EUR/USD

Successfully climbed through Kijun-sen H1 and then touched Kijun-sen H4, the pair is changing the bias to be positive in short-term trading. But what is probably important enough to note is that the current Euro upside is still limited by Kijun-sen Daily (now at 1.2336).

The bullish outlook in the next few sessions is maintained as long as the price is trading above 1.2253 (Kijun-sen H1) and above 1.2266 (Senkou-span B), facing resistance at 1.2314 and 1.2336.

On the downside, below 1.2253 risks chasing back 1.2238 and 1.2215. Only break or closing price (Daily candle) below 1.2215 can accelerate bearish to catch lower price, faced with support at 1.2154 (Low 01/03) and 1.2087 (High 04/01).

On the other hand, this area (1.2154 - 1.2087) can be an opportunity to start looking for buy positions in the medium to long term portfolio.

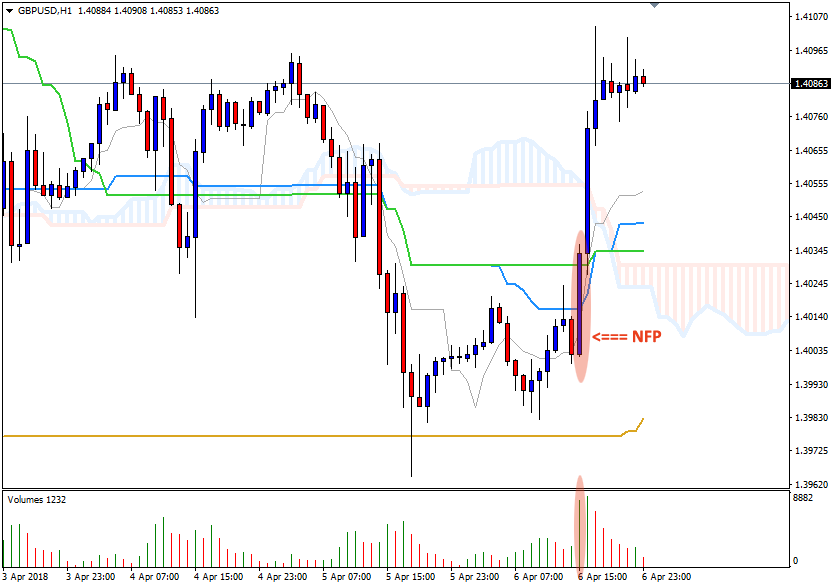

GBP/USD

Unlike the Euro, Sterling's positive bias against the Greenback feels more convincing, given the price that remains trading above the equilibrium level of Kijun-sen Daily (now at 1.3983). Coupled with Bullish Engulfing candle post NFP is more "confident" than the Euro.

Smaller correction or sellers response in the range of 1.4087 / 95 will probably still occur considering the bullish Sterling still can not close the price above that range. But this condition can also be an opportunity to find a buy position when the pullback price towards 1.4043 (Kijun-sen H1) and 1.4034 (Kijun-sen H4) with the SL tight.

The bullish potential in the next few sessions is maintained as long as the price moves above 1.4043 / 34, to deal with short term resistance located at 1.4143 / 50 and 1.4191 / 1.4200.

On the downside, closing the price (Daily candle) below 1.4014 (Low 04/04) may risk extending the decline towards 1.3983 and 1.3965 (Low 05/04). Break or closing price below this level could potentially turn the outlook to negative to print a lower price.

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly & Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness