How To Sell Cryptos Short On Kraken...And Why You Should Be Doing It!

Whats up everyone, today I'm going to be talking to you about something I'm really passionate about. We're going to be talking about going short in crypto!

If you’ve been in the space for a while, then obviously you hear it all the time, HODL, HODL, HODL, HODL. Everyone seems to think this is an investment strategy, in my opinion it’s really not. If you want to just throw some money at crypto, and hope to make some money down the line, then sure go for it. But if you want to be trading and actually making money on crypto by playing the market, you have to play both sides. I mean really, you can’t just go long forever!

My Opinion On Going Short

Okay, so I know I'm probably going to have some crypto purists that have their pitchforks out chasing me after this one....But seriously, I got into crypto because I was really into the technology, I got in through mining. And it should be said that i didn’t start out as a trader, but it is part of what i do to sustain myself while working in the crypto space. I see it so often nowadays, everyone just says HODL, HODL, HODL. This really just...this isn't trading. And even more importantly, its just not an effective way to make money.

Dont get me wrong, I know that there are people out there that got in early enough that this might work for you but the reality is, if you’re sitting there and you’re just “hodling” everything, you’re essentially just opening a long position...forever.

Say Ethereum goes up by fifty dollars. And you’re already holding Ethereum, great it went up by fifty bucks! Now if it turns and it comes back down fifty dollars...well if you''re a "HODLer" your fifty bucks is now gone. If you’d just gone short, you could’ve just made fifty dollars and you could’ve reinvested it into Ethereum! And that’s something that i really think people don’t understand. And it is a very important concept to get about going short!

You can go short and still support the coin you're shorting!!! I hold a bit of Ethereum on the Kraken account I'm using for this tutorial specifically so that I can short it and build up the position! People seem to have this idea that if you’re going short you're going against the coin. Don’t think of it as selling, its not! You can bolster your own portfolio and build it up with the profit you make from these short positions.

What Is Short Selling?

Okay so hopefully we’ve got you a little bit convinced that going short isn’t completely evil... But really, what is going short?

So for starters: going long. This is what everyone knows. When you buy or you “HODL”, you’re going long. You’re opening up a position and saying i believe that this coin is going to go up, so I’m going to buy it and when the price goes up I’m going to sell that and realize my profits.

Going short is essentially just taking the other side of that trade. A simplified explanation of the process is that you’re going to have a margin account, which is basically collateral. Some exchanges provide a service that basically says, alright if you want to go short, we have these people that hold their coins and it’s going to be in their portfolio, they’re not going to be trading it and we have access to those coins. So you pay a small rollover fee which is minimal on Kraken every four hours. Essentially you’re just going to pay a little bit to borrow shares from someone else and you’re going to sell them, expecting the price to go down. You’re collateral is going to cover that, so if it goes against you it will eventually liquidate that. Were not going to talk about margin calls and all of that today, there’s much more to it; but we will be covering the nitty-gritty of margin trades in a follow up!

Anywho, the biggest thing to take away, is that when those prices go down and you’ve already sold, all you have to do to exit is go back in and buy back those same shares that you sold at the top for a lower price. All of the hairy borrowing process is of course handled back end by the exchange and you simply walk away with profit in your base currency.

Really, going short is really just taking the other side of a long trade. There’s nothing wrong with this, there’s nothing evil about going short!

Just Show Us How Already!

Alright, so you've listened to me ramble about what going short is and why you should do it, now lets dive in and see how to actually do it! It should be mentioned that I'm using Kraken. You can do this on Bitfinex, Poloniex, and there's a number of platforms that do offer the ability to go short now, but the options are more limited. Personally I'm just comfortable with Kraken. I have a little side account here we’ll show you how to execute the trade with. You can do order entry through the old school form, but I find the chart style order entry more my style.

We're going to be taking a look at doing this on Monero, and I actually did open the position up and ride it out for a bit. Anywho, it's really a very simple process.

Entry

- Select Sell Order

- Select Limit Order

- Select 2x Leverage (necessary to go short)

- Current price: $153.67

- Select Number of Shares (3 for this example)

- Set Sell Price of $153.65 (this is to ensure the order is filled)

- Review Your Order

- Double Check it again!

- Confirm

And there you go! We have officially borrowed three shares of Monero, sold them on the market and now we're waiting for the market to go down so that we can buy those shares back and take our profit's!

As I mentioned before, selling short is really just the other side of a long position; so exiting is just as simple!

Exit

- Select Buy Order

- Select Limit Order

- Select 2x Leverage (on Kraken setting any leverage will exit a margin trade no matter the value)

- Select Number of Shares (3 again)

- Set Buy Price of $145 (arbitrary value for example)

- Review Your Order

- Double Check it again!

- Confirm

And there you have it, you're exit is set! Once that price gets down to $145, it will buy those shares back and exit.

Final Thoughts

See, going short really isn't that scary or complicated! I think that a lot of new traders stray away from it....and I can understand, there's something that even feels a little bit wrong as you get excited watching the market plummet. But In my opinion a market where you can sell short actually improves accountability. In a market where everything is strictly long positions it’s very hard to interpret what the general consensus on the market is. You have to have two sides to a trade to truly get a sense of things. I know that a lot of people say, well you know you should just hold, its good for crypto's, it's good for the community. But I actually have to disagree. If a crypto is not doing well, people should be selling it and shorting it. Markets are supposed to be indicative of how that project is doing. And of course, going short is an essential tool for any trader, go short people!!

Hopefully you found this useful, and maybe there's even somebody out there that has finally decided going short isn't evil and is about to open up their first short position!

But anywho, we’d love to hear from you! What else would you like to hear about going short? Is there something you don't quite get that we could help you out with? Let us know in the comments, well get back to you! We're always looking for what our followers want to see in trading and cryptos!

▶️ DTube

▶️ IPFS

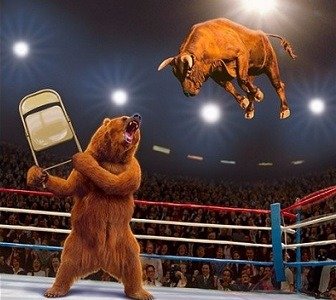

Thanks for the guide on trading @cryptoplayhouse, really love the last image!!

We have something in the works that might help you get yourself more exposure. We are looking for some who can teach many, and thought you might be interested.

Learn more about us here: Introduction and Leverage TIMM for profit. and let me know if you'd like to get a free trial. You can also chat with us: Discord

Cheers!

Wonderful tutorial, Well explained. People do not understand that HODL-ING forever does not really yield the maximum profit.

I believe this can also be done on Binance too

I was unaware binance had added short positions, I'll have to look into that. If they really are offering that capability I may very well revisit their platform, thanks for the heads up!

I'm absolutely agree with you, but how do you know when it's time to sell and when buy?

That requires the application of a strategy based on technical analysis or other quantitative conditions. No one has a crystal ball. It's not about that. It's about tilting the odds in your favor.

Interesting, does it work like this only on kraken, or also other exchanges like?

There are other exchanges that allow you to sell short as well, like Bitmex.

🙏

Insightful article, thanks for sharing. My only issue is with short trading is it is time consuming and I do not have the time of day to consistently search crypto and the prices while working.

It's really as time consuming as taking a long position. What you're describing is not having enough time to actively trade in general, not just shorting.

Gracias por compartir esta informaciòn saludos.

De nada, saludos.