JPM Market Watch 10/10/18

JPM has earnings coming on the 12th. The stock stock is certainly showing indecision in the direction it wants to move. With all the news around stocks and bonds this month, I think adding earning to this already uncertain market certainly makes this stock one that is likely to move quite dramatically upon earnings.

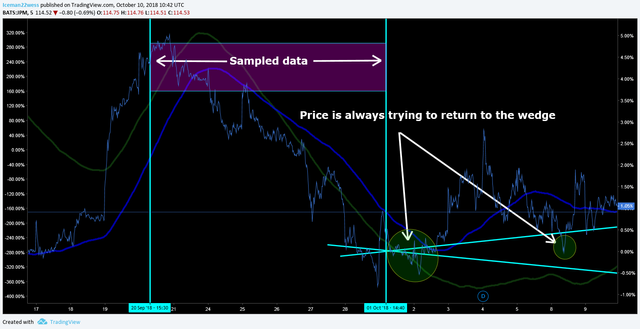

Higher lows, lower highs....tightening up and ready to move soon.

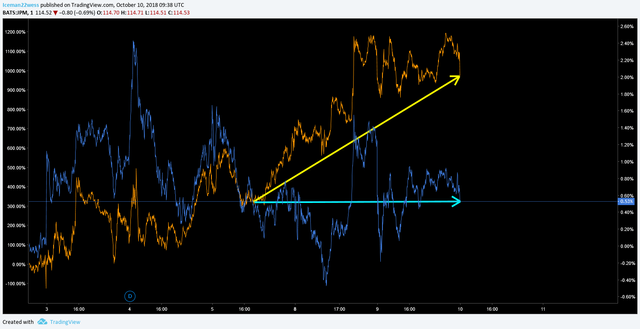

Take a look at this:

The OBV (yellow) A volume indicator is showing a clear uptrend against the price (blue) moving rather flat. A silent accumulation is occurring in the background.

Unfortunately, this isn't enough to trade off of alone. However, taking risk defined position on both sides is a very possible trade here.

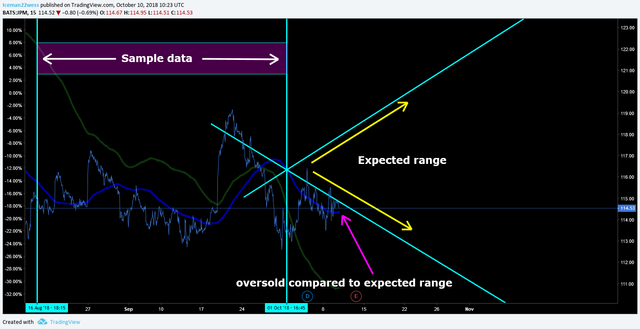

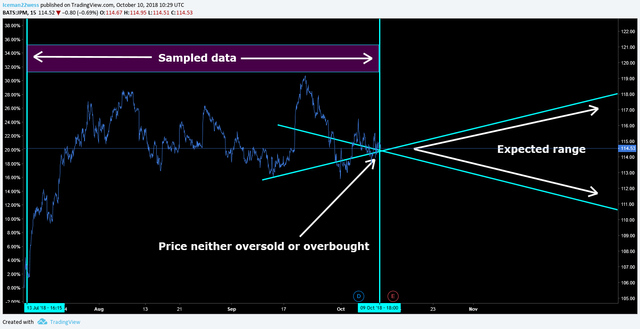

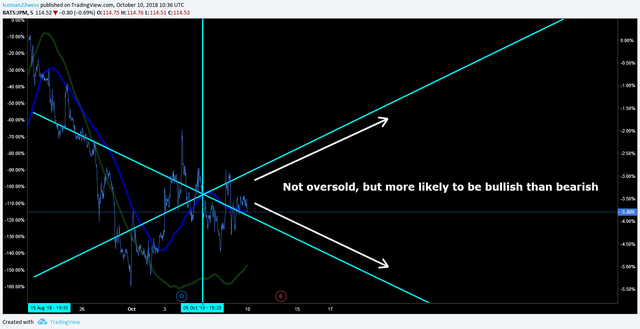

If I had to pick a direction, I am leaning bullish right now. These expanding wedges below tend to show that the price always wants to get back inside the wedge. It doesn't really tell you if the trend is bullish or bearish, but can give you a quick way to see if the sampled data is expressing the asset is oversold or overbought compared to recent volume trends.

Here are a few current examples of what I have charted.

15 min Slightly set back:

15 min Current:

5 min slightly set back:

Now just to paint a picture of how these charts look when they complete. Here is a typical example taken from a random spot on JPM.

As you can see, these lines also frequently act as support and resistance trend lines.

This bullish sentiment would only be a blip in the long term radar. Over the course of 2019, this stock looks like it needs to start making a correction back to the general uptrend line.

This means that no matter how these short term wedges look, the big picture is going to start looking down sooner or later, and stresses the importance of hedging the position, or taking long term shorts now while the price is high.

I think my personal plan here is to take a short position long term (+3 months) before earnings, hedging with a short term bullish position. Should the price go up after earnings, I will add to my short position.

-Icee

Please leave me an upvote and remember this is not trading advice.