Hype in an ICO

Hello everyone!

My name is Daniil Kapran, I am a sales manager at Platinum. Our company provides the full range of services which any STO requires. You can order PR and community management for your campaign now:

Moreover, we are proud to be a part of the most progressive online university — the UBAI. Today the University of Blockchain and Investing is launching ICO, and we believe this will be one of the most unique blockchain campaigns in 2019. And it’s not a mere hype! By the way, here’s all you need to know about hype in ICO👇

The cryptocurrency markets, like all financial markets, are greatly influenced by human behavior shaped by human emotion: greed, exuberance, hope, fear and selfishness. In this lesson you will learn about the role of hype in an ICO. You will see how hype factors into the entire cryptocurrency market. You will see real-world examples of where hype has been used, for better or for worse.

Lesson Objectives:

By the end of this lesson you will have learned the following:

- You will know what hype is in the crypto world, and its influence on pricing and trading decisions.

- You will understand common ICO narratives and the amplifying effect of hype in the market.

- You will understand common ICO narratives and the amplifying effect of hype in the market.

- You will learn the overall influence hype can have on a team and anyone involved with an ICO project.

Terminology:

Hype: is the public sentiment and sometimes over-heated expectations related to a cryptocurrency token.

Bitcointalk.org: is a public Bitcoin forum to discuss cryptocurrencies and ICOs.

VC: is Venture Capital. Early stage funding coming from an individual, group or company focused on selling for great profit in the future.

Benebit: was an exit scam ICO which purported to unify customer loyalty programs via the Blockchain technology.1.

What is Hype in Cryptocurrency

1.1 Introduction

The English Dictionary defines ‘hype’ as extravagant or intensive publicity or promotion. Therefore it is only right that we define cryptocurrency hype as extravagant or intense publicity and promotion for any kind of cryptocurrency.

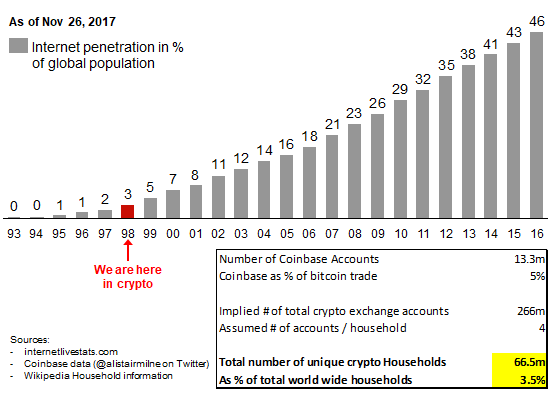

Recent research suggests there is a 60% chance that people around you have encountered the word ‘bitcoin’, or ‘cryptocurrency’ from one source or another.

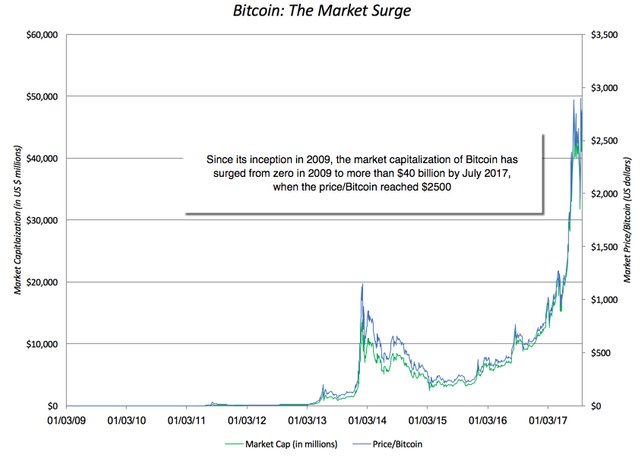

This widespread publicity was also catalyzed by the stunning and sudden rise of the price of bitcoin in 2017 (and other times as well), which led to a frenzy in FOMO, fear of missing out, which drove otherwise skeptical people to eventually believe in cryptocurrencies.

From that point, many people started to believe in the idea and potential of cryptocurrencies. This led to even further growth in optimism among members of the cryptocurrency community, which, in turn, drove demand and hype to absolutely atmospheric levels.

Follow the link to get the full course online and become the blockchain superstar:

There is an ongoing argument among financial experts about the nature and destiny of cryptocurrencies. One school of thought is that crypto is, in fact, the next evolution of money. Other people think crypto is nothing but a bubble or fraud and will eventually fade into oblivion.

That debate aside, one simply cannot overlook the obvious popularity of cryptocurrency. Many businesses both online and off, across all industries, have begun to experiment and implement payment solutions accepting all kinds of cryptocurrency. Also, following the success story of bitcoin, many other cryptocurrencies have appeared in the market, and many businesses are exploiting this hype. Given so much optimism and expectations for profit by so many people, professionals of all sorts are beginning to realize the potential of crypto ventures and investment opportunities.

1.2 Roles of Hype

It is a fact there is hype in the cryptocurrency industry. It is also a fact that investors often trade and hold positions based on that hype. But before speaking about the role and purpose of cryptocurrency hype, let’s take a look at the major causes behind it.

Ever increasing media coverage has brought the entire crypto sphere into the limelight. Just the media calling bitcoin “Digital Gold” has coaxed people into buying and hoarding bitcoins for themselves.

Increasing groups of cryptocurrency believers have spread the idea that cryptocurrencies are a unique store of value, uncorrelated to other more traditional asset classes. There is also a significant number of individuals who purchased bitcoins before the sudden rise in value and are now hoarding their currency like gold, seemingly unwilling to sell at any price.

1.2 Roles of Hype

The money to be made in crypto has attracted a great number of miners. We have previously discussed the key role and value of coin miners to the integrity of the blockchain. These miners help support not only the price and the maturity of bitcoin, but also the blockchain technology on which bitcoin depends.

Well-known and widely-respected investors like Barry Silbert (Chief Executive Officer and founder of Digital Currency Group), Blythe Masters (former managing director at J.P. Morgan Chase & Co, and current CEO of Digital Asset Holdings) and many others like them, have placed their trust, and significant amounts of their money, in crypto.

The prestige of these investors, as well as the growing maturity of the overall crypto community, are attracting increasingly large amounts of capital to Initial Coin Offerings as a funding mechanism for businesses all over the world.

1.3 Roles of Hype

Given the aforementioned reasons supporting hype, we can say that hype has helped propel price movements, both positive and negative.

1.3 Roles of Hype

The increased demand for cryptocurrencies from speculators, true believers, and investors seeking diversification, have all contributed to bitcoin’s phenomenal price gains.

A good success story always comes in handy when pitching ideas to investors. The success of bitcoin so far, and the publicity it receives, will continue to mold how new prospective buyers view the asset.

So we can say that hype in cryptocurrency has paved the way to help many new ICOs succeed, even with no specific relation to Bitcoin or its Blockchain technology. That feat would have been nearly impossible 7 years ago.

1.3 Common ICO Narratives A Brief Introduction

An ICO is a funding mechanism that a company uses primarily to raise early stage capital. So far it has largely been blockchain-based technology solutions which employ “Tokens” (cryptocurrencies or digital assets) that are functionally used in the company’s solution, so as to give them a relative value.

1.3 Common ICO Narratives A Brief Introduction

These days, there are a large number of companies constantly ‘pre’, ‘on’ or ‘post’ ICO. But the first ever recorded ICO was by Mastercoin in 2013. Their campaign lasted for almost a month, with Mastercoin raising up to 5,000 BTC, then valued at $500,000 USD. A year later, Ethereum was launched. And in 2015, the Frontier, an experimental release of Ethereum platform was released. A month later, Augur Token was launched. Since then, many other ICOs have followed. In 2016 alone, ICO sales raised up to $103 million with ICONOMI and SingularDTV leading the sale with $10 million and $7.5 million.

We saw an exponential rise in the values raised by ICOs in 2017 as a result of the sudden rise in the value of bitcoin. By the end of 2017, over $2 billion was raised from more than 92 ICO sales with Tezos and Bancor leading the way with about $230 million and $153 million each.

In many ways, ICOs were made possible by the ease with which companies were able to create their ICO tokens on the Ethereum Blockchain technology. With the success of bitcoin and the explosive growth of ICOs for various purposes, the market has shifted solely from the topics of blockchain tech and cryptocurrency solutions, to more specific and practical applications of these solutions to actual real world problems.

But at the same time, there has also been a large number of scams as a result of the lack of regulation and insufficient oversight. This is something to always keep in mind when you are considering ICO investments.

Follow the link to get the full course online and become the blockchain superstar:

Contact me via LinkedIn and I will tell you more about Platinum and the UBAI activities in 2019: