The Dollar Liquidity Storm

Introduction

I will start this piece off by demonstrating how the dollar can have far-reaching international effects upon the economy in a very simple form by showing a chart of the USD Index compared to a chart of Brent oil ETF.

So, in other words, the top chart represents dollar performance since 2010

The bottom chart represents Brent Oil ETF since 2010

And in particular, what should stick out to everyone is the huge vertical moves in 2010 and 2014

Notice how they are the mirror-image of each other? I have labelled them A and B as I have further points to make shortly.

The obvious conclusion here is that it was a huge run of dollar strength which helped destroy Brent oil.

So what you're actually seeing here is a great example of what serious dollar moves can do for assets. Even with with as much market liquidity as oil. Thus, dollar politics are hugely important.

This is relevant and I make this example because the biggest upcoming event for the next decade is the upcoming dollar liquidity storm.

Now, if you look at B in particular then the timing of this is particularly interesting.

The dollar bull-run which crushed Brent Oil coincides with Bernanke's announcement of the end of QE and tighter overall monetary policy in the future.

So in short, the FOMC killed Brent Oil by unleashing a dollar bull run and pretty much sent the world into the good type of deflation (lower prices as a result of lower overheads) in the process.

We can see the signatures of oil recessions and such on the US inflation chart. You'll find very similar patterns present in both by looking at the comparison below.

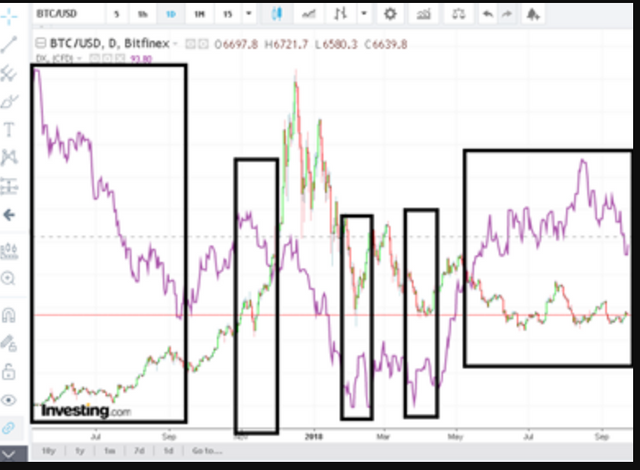

Another good example is the crypto markets.

Often having relatively low trade volume, they are highly susceptible to dollar value movements.

Here is a cross-comparison between Bitcoin and the USD index.

A lot of the really big turning points in the market correlate quite nicely with USD spikes/dips causing similar spikes/dips on the price of the BTC/USD trading pair.

These are a good example of how the dollar can have huge far-reaching impacts upon asset prices and often, as a result of impact upon front-line commodity prices such as oil, the dollar exerts influence upon prices on the high street and thus, economic policy and forward guidance from central banks and governments internationally.

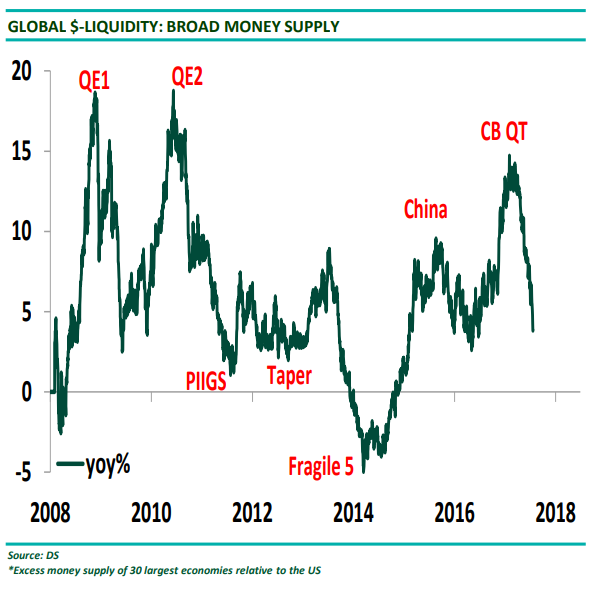

The Coming Dollar Liquidity Storm

The return of a strong dollar as a result of the FOMC normalising their national economic policy is going to have enormous impacts upon world finance and creates a unique set of opportunities and hazards

The Role Of The Federal Reserve

Lets get a little further into this. First, lets go back to the action the Federal Reserve took in 2008.

This was an unprecedented liquidity focused strategy designed to stave off a depression. The FOMC took highly aggressive action including cutting interest rates to near-zero levels and unleashing a huge Quantitative Easing program (among other measures).

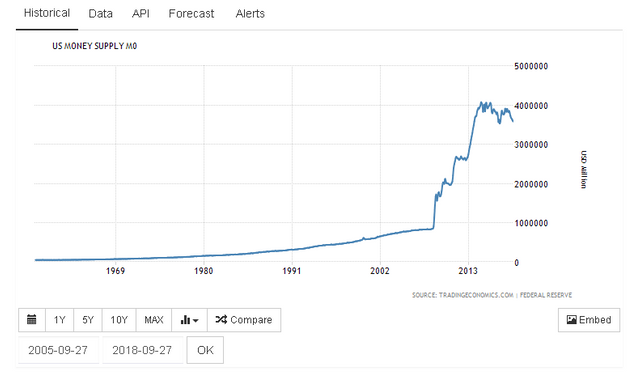

We can see the effect of this upon the US M0 Money Supply index.

And to put this in context, here's the historical chart.

The rapid rise in 2008 was largely due to Federal Reserve stimulus measures designed to keep the national (and international) financial system liquid.

Now, consider where we are on that timeline. We're basically coming over the hill as the Federal Reserve is withdrawing a lot of those liquidity and stimulus measures. As of 2014 for instance, QE began to taper down. Thus, dollar liquidity is going to start dropping from here.

If we think about it, the decision by the FOMC to end quantitative easing back in 2014 was not an isolated incident. It's part of an ongoing policy started by Bernanke and continuing under Powell to normalise the monetary environment we live in back to pre-crisis conditions.

This is a wide ranging drive which includes bringing interest rates back to pre-crisis levels and also allowing special liquidity programs such as the crisis-related Commercial Paper Funding Facility (CPFF) to expire and so on and so forth. All as part of a drive to normalise the United States and by extension, the global monetary environment and ultimately, withdraw and reload crisis measures such as QE an interest rates policy in case the FOMC has to take similar actions in the future.

As a result we are going to see vastly reduced dollar liquidity internationally and higher interest rates in the USA and of course higher interest rates also affect dollar liquidity by making it more expensive to borrow cash sums denominated in USD.

This is going to have a huge impact upon the dollar's value and thus, everything that is traded and priced in dollars.

Lets look at the dollar's performance.

The Dollar Bull-Run

The effects of FOMC policy are obvious simply by looking at the Dollar Index which catalogue dollar strength against a basket of competing currencies.

Over 4 years the dollar gained around 28% bottom-to-peak.

Now, interestingly enough, this created two specific patterns which are now part of the dollars longer macrotrend and it's short term technical outlook.

The first can only be seeing by looking at the dollars rough path over the last 60 years.

We've seen continuous lower peaks and lower lows - creating a rough downtrend.

This trend is a result of many factors including the end of Bretton-Woods, declining confidence in the American economy, declining confidence in the dollar internationally, attempts by governments and the Federal Reserve to devalue the dollar to boost competitiveness, etc. etc. and so forth over the past 60 years or so.

Now let me highlight a particularly interesting part of this graph.

And zoom in for a closer look at the shape here.

The most interesting part of this graph by far is the fact that we have an inverted head-and-shoulders shape forming. This suggests another dollar-rally is imminent if this pattern concludes as it has begun.

What are the possibilities here? Well, assuming the pattern completes then we'll be looking at a dollar valued at well over 100.00 over 2019/2020 or so.

The consequences of this in practice are potentially huge.

Firstly, the dollar may breach it's 50 year long downtrend.

The USD is already pressed right up against the overhead resistance trendline (B) and if you look at the section marked (A) you will see the tell-tale inverse head-n-shoulders signature - suggesting that the dollar will rally well past 101 before any correction.

The prospect of any breach to the upside of 101 would open up the range on the upside and put the trend in serious danger - suggesting the dollar could surge perhaps even higher towards the 120 level (the last time we saw a dollar this strong was around the year 2000).

Secondly, the impact of a stronger dollar rallying to heights we have not seen since the late 1990s would have enormous detrimental effects upon certain features of the global economy which are priced in dollars (such as commodities and in particular oil) and thus have the potential for large-scale contagion.

Developing Markets, Debt And The Dollar

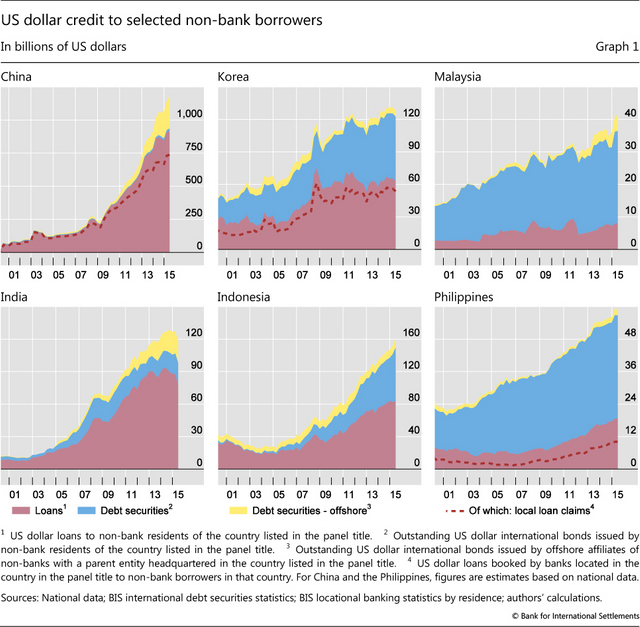

One of the main victims of FOMC policy and the dollar bull-run are going to be debtors who took out huge amounts of loans denominated in dollars which often come with floating interest rates while the monetary environment was relatively accommodating.

Many of these happen to be in Asia. South Korea for instance despite having a reputation as a business-friendly tiger-economy, has overall financial sector debt ratio of 82% of GDP while in Japan the ratio is closer to 150%. Much of which is priced in dollars and so therefore is susceptible to changes in FOMC policy and a stronger market-price for the dollar.

This page from the BIS shows in graphic terms how non-bank institutions have followed a similar path - gorging themselves on dollar-denominated debt at the bottom of the market since the Federal Reserve relaxed policy.

Due to simple lack-of-foresight (or perhaps the knowledge that those responsible for taking out the debt would be long-gone by now), then the developing world has ended up borrowing itself into a corner and now of course, the game is changing as interest rates rise and the dollar appreciates.

This has the effect of causing debt piles to grow because of course the exchange rate of national currencies versus the dollar which loans are denominated in is dropping. Thus making the debt seem larger when priced in dollars and paid in national currencies.

Not only this, but the draining-off of dollar liquidity by the Federal Reserve is actually leading to a dollar shortage because the market response to federal policy is to hoard dollars while they appreciate. This is one factor which is causing a dollar bull run. People know that it is going to appreciate in response to FOMC policy and so they buy and hold the USD as they have zero incentive to dispose of them and every incentive to save and hold onto them.

It's often been said that the man who saves is the ultimate villain when it comes to the liquidity of the system and this is none more true than in an environment of appreciating currencies and increasing interest rates.

Thus, actually acquiring dollars to make dollar-denominated payments is becoming ever more difficult and commanding higher premiums because the supply of dollars and dollar-denominated reserves is in free-fall in the largest economies outside the USA.

This must eventually lead to scarcity based appreciation further adding to the dollars impressive run of performance and making it ever more difficult for debtors to afford their repayments.

So the stage is set for a developing markets siege. The markets rout could spread to all of Asia as the FOMC drains liquidity and normalises rates while the dollar outperforms it's rivals. This has huge implications for their ability to actually service debt and thus for their creditworthiness and their ability to finance their own operations via the credit markets.

The Dollar Reserve Contagion

Asian markets are all very well but... how does this affect the west?

One must bear in mind that the official world reserve currency is of course the United States dollar... so the responsibility for managing the worlds liquidity falls to... the United States.

Holding reserve currency status might grant the USA enormous financial power on a global scale but it comes at a high-price - the responsibility of liquidity-master for the entire planet.

In an interesting paper by the IMF, the economist Robert Triffin highlights the means by which the USA services the world with dollar liquidity.

"If the United States stopped running balance of payments deficits, the international community would lose its largest source of additions to reserves. The resulting shortage of liquidity could pull the world economy into a contractionary spiral, leading to instability."

(quoted from https://www.imf.org/external/np/exr/center/mm/eng/mm_sc_03.htm)

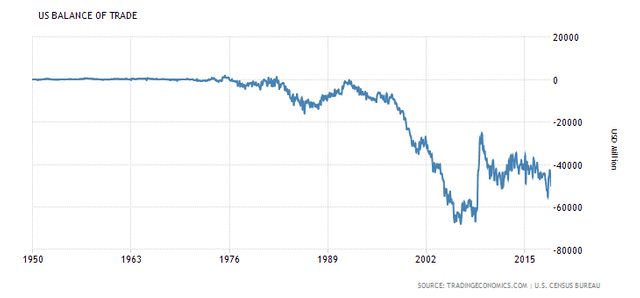

So thus the US trade deficit is actually an enormous liquidity subsidy to the world-at-large.

The problem now becomes, that if the USA does not consume enough via imports, then global liquidity grinds to a halt.

This is one reason why recessions in the USA often have a contagionary effect upon the world at-large. The fact of such a substantial importer cutting back it's purchasing is substantial enough, but this has the double-effect of reducing the dollar supply which is actually needed to make and receive payments. The result is that acquiring dollars to make such payments gets more expensive which compounds the scarcity effect.

The scarcity effect also has a direct impact upon market valuations.

As we know, the president is pursuing an export-based strategy and is trying to kickstart American exports and encourage people to buy American products over imports. The problem with this however, is that while it is indeed cutting the trade deficit, it is going to have a detrimental effect upon total dollar liquidity internationally and thus upon the international financial system.

The unfortunate thing for the President is that the deficit, while grievous and fundamentally damaging, is effectively part-and-parcel of the USA's obligation as international reserve currency provider.

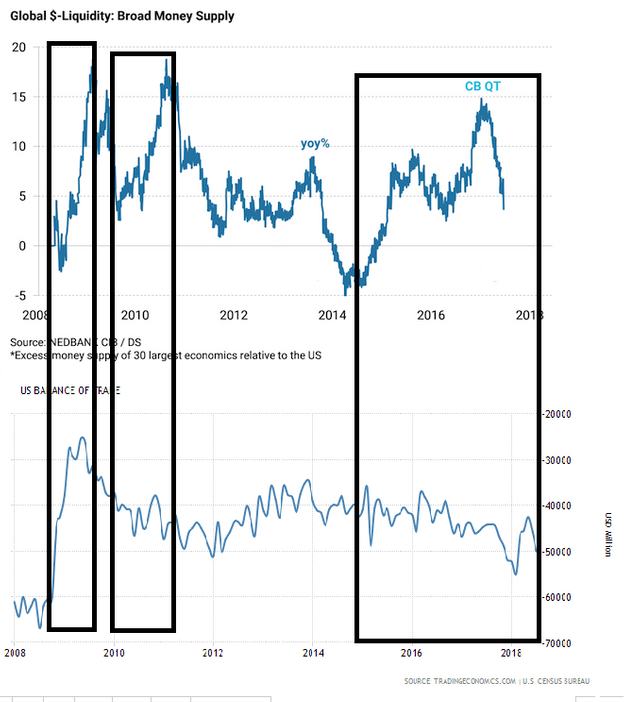

I also consider that there are some subtle though unfortunately far from concrete inverse correlations between Total World Dollar Liquidity and the US Balance Of Trade charts. More evidence of the relationship between American imports, the trade deficit and total global dollar liquidity.

What does all this mean?

In short, we're staring down the barrel of another credit crunch originating from the USA with contagion vectors to and from Asia, Europe, Canada and Latin America.

If the Asian economy grinds to a halt then the USA might also lose it's ability to run deficits, and thus lose it's liquidity provision channels to the rest of the world.

It's unfortunate to say that we're by no means ready for monetary policy normalisation yet and I would not be surprised if we saw serious liquidity crises starting off in the corporate sectors of western economies.

The Bond Market Siege

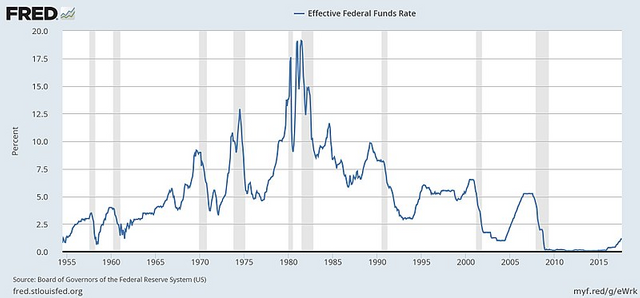

Interest rates have been at a record low since the financial crisis in 2008.

The Federal Reserve and other central banks did this for many reasons but ultimately their goal was to fight the bad sort of deflation (contraction of monetary supply and credit) which kicked in during the credit crunch. It's important to bear in mind the wider context however, and that is that the Federal Funds rate had effectively peaked and was well into it's downtrend already so the cut itself should not have come as a surprise to anyone.

What's interesting about our current point-in-time is that central banks are effectively attempting to reverse this trend and aiming for a rate of probably around 5% if not higher in the long run.

This is going to have profound consequences for the world as this will negatively impact a lot of the borrowers who took out and rely on debt which has a floating interest rate that tracks the market base-rate.

A lot of these debtors are corporate and sovereign investors raising money through the bond markets which are particularly vulnerable to an environment where interest rates begin to rise.

Why? Well, because yield rates on bonds are going to rise from here. This means that newer bonds will carry higher average yields which makes them worth more than older bonds issued in a low-interest rate environment.

Thus the incentive becomes to sell the older bonds. This is why current FOMC interest rates policy is essentially a bearish signal for the bond markets.

Factor into this mix that the FOMC are going to be hiking rates for a good few years even though the rates rises overall are by themselves very small. Why would you buy bonds in an environment of rising yields, knowing full-well that bonds issued today are going to lose value versus the bonds issued in a year or two's time?

The depreciation of your bond will wipe out some of the benefit you will receive from it's yield anyway. So the incentive for bond investors is to sell-up and wait for the FOMC to stop hiking rates so they can buy bonds when yields stabilise.

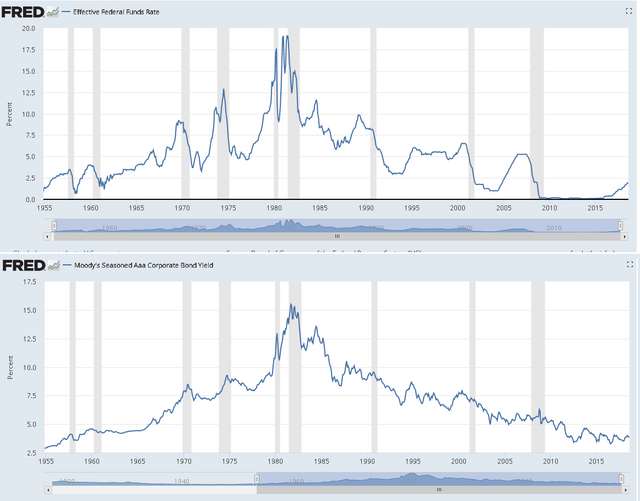

Here is a comparison between the Effective Federal Funds rate and Mood's AAA Corporate Bond Yield rate.

So we can see that Federal Funds Rates and bond yields are linked very closely.

I will be looking for a bond selloff at some point in the future because the pressure on bond markets is ratcheting up.

We must also remember what exactly the bond market is financing.

How Bond Market Contagion Will Spread Into Equities

Equities are on a similarly impressive run and so far have done well to hold-up against the prospect of a strengthening dollar. However, we must ask ourselves why.

Some of you will know where I am going with this from reading my previous pieces on what drives the stock market in the late 2010's. I have covered this in detail in the past. However it's only recently that I fit this into the overall pattern of what exactly is going on in the markets.

Now, to sum up, one of the main reasons for the stock markets being as high as they are now is the prevalence of corporate buybacks.

Since the great recession, grass roots traders, investment firms and such deleveraged from the stock-market en masse. We can see the exit of these demographics from the stock market in the volume statistics of many well-known listed companies.

Here is a volume and price chart from AAPL for instance.

Now as you'll see from the trend indicators, while volume set itself on a downward path as certain demographics fled from equities and stopped buying them, the price actually kept climbing.

So as demand declines, the price increases. This is the opposite to what we'd normally expect to see in a healthy market.

The reason for this is that much of the price action is not driven by people or institutions buying shares. It is driven by companies buying their own shares back from holders in what is called a buyback. Apple Inc.of course are a prime example of this.

"Apple is handing cash back to its shareholders at an unprecedented rate.

The iPhone maker repurchased $43.5 billion of its own stock during the first six months of this year. Not only is that up from more than $14 billion during the same period last year, but the company’s repurchases in the past two quarters also rank as the biggest in history, according to Howard Silverblatt, a senior index analyst with S.& P. Dow Jones Indices.

Among companies in the Standard & Poor’s 500-stock index, each of the five largest quarterly stock buybacks on record was by Apple."

(Quoted from https://www.nytimes.com/2018/08/01/business/dealbook/apple-stock-buybacks.html)

I have covered this in detail in another article here https://steemit.com/apple/@intellivestor/don-t-be-fooled-by-apple

AAPL have been raising money for their huge share repurchase programs directly from the bond markets. This is the same for many other companies in the S+P500 and other indices across the world. So thus, most of the demand is being sourced directly from the bond markets.

This is how a bond market selloff or even a crash will cross over into equities. When companies can no longer sell bonds to investors, then stocks will lose one of their primary sources of demand - the bond market driven corporate buyback schemes.

To Conclude

And to conclude, this is how the current liquidity storm which is going to emerge from the President's office as well as the Federal Open Markets Committee will eventually take out the stocks and bond markets and cause severe sovereign debt crises in the process.

We have to remember what a liquidity crisis actually looks like in practice. Common perception is that recessions are inflationary events, however, the opposite is often the case because without sufficient flow of money (or lack-of-liquidity) then ultimately business grinds to a halt and thus so too do economies of scale.

Assuming everything unfolds as described, then this is going to be incredibly bearish for most investments over the next few years and affects every part of the economy due to the omnipotence of the dollar. So I advise watching the FOMC very carefully and checking the dollar index against your long positions. Additionally, get ready for some big short opportunities against weakening equities and bond markets!

This is an awesome post. Thanks!

Hey thanks. Appreciated. If you like it please share it!

Sure. I resteemed another post of you. For this post you won't get rewards because it is older than 7 days. Nonetheless resteemed 😎

I upvoted your post.

Best regards,

@Council

Posted using https://Steeming.com condenser site.