STABLE COINS VS. VALUE PRESERVATION

Source: http://www.preservevalue.com

Long before the advent of cryptocurrencies, consumers had one choice and one choice only: use their local fiat currency for everyday life. Whether it is the euro, dollar, lira, or rupee, even today, the average consumer is constricted by which currency their local grocery, gym, and bank do business in.

This is most commonly called fiat currency. This is currency that is backed only by the issuing government, who then controls the value of the money with monetary and fiscal policies rather than with an underlying asset. The goal of the government in this case is to create some semblance of stability while also not allowing the currency to devalue itself against inflation. However, sometimes these policies are not enacted with an eye on the preservation of purchasing power, and governments will readily increase or decrease a currency’s value for other reasons such as increasing exports or reducing interest payments on outstanding debt.

Due to the arduous processes and bureaucracy that burden most countries, enacting these policies can be painfully inefficient. Policymakers and other government officials must come to an agreement on which policies to push through, creating lag times and unnecessary expenses, and leaving the door open to corruption and human error. Compare this archaic process to one involving AI, where advanced technology takes the impetus off government officials and places it in the hands of an economical, incorruptible, and instantaneous custodian. In this way, AI is capable of replacing many of the managing bodies found in government, free of outside influence and private interests, and theoretically provides a far superior alternative to the norm.

Unfortunately as it stands today, the current system lends fiat currency some unpredictable volatility depending on the government’s economic policies and leadership. The same external factors that affect overall economies can thus trickle down and affect the currency, diminishing purchasing power and value.

History is littered with examples of fiat currency experiencing wild price swings due to a variety of factors, as theoretically, a fiat currency can fall to a value of zero at any time. One notable example is Argentina, who tried to peg their currency to the US dollar in the 1990’s in an attempt to curb hyperinflation and stimulate economic growth. Instead, the economy failed miserably, having a devastating effect on Argentina and its citizens for many years.

Obviously, fiat currencies are not the epitome of stability, and yet most of the world is content to live in a world where they are the norm. However, the concurrent advent of cryptocurrency and fintech has allowed there to be superior alternatives to traditional fiat currency.

CRYPTOCURRENCY

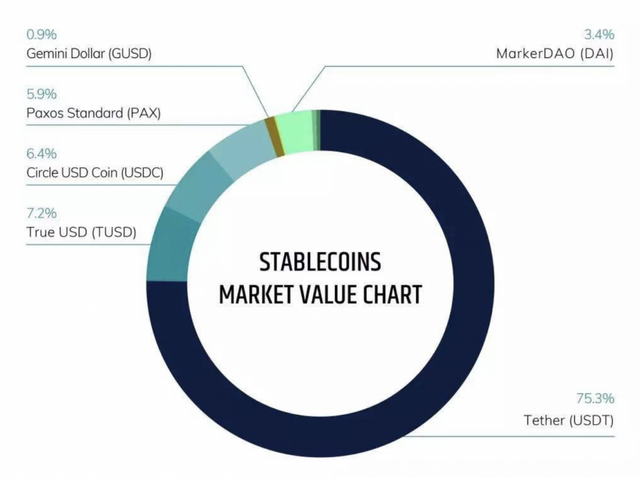

This is no different in the cryptocurrency industry with regards to volatility. Non stable coins are extremely volatile, with some boasting double digit swings within just a couple of hours, minutes, or days; even household names such as Bitcoin or Ethereum are not immune. Stable coins were the initial answer the free market came up with; usually pegged to another asset or currency to assure stability, these “stable coins” provide a vessel for investors in the cryptocurrency space to store value when they are not trading, or if they believe a certain cryptocurrency they have a position in may devalue.

With so many different stable coins on the market now, it is important to evaluate each of them fairly. When evaluating a stable coin, it is important to look at:

- Transparency – The transparency of each coin and their underlying system or platform.

- Stability – Question the mechanism which gives a stable coin its stability; is it based on an algorithm, collateral, or some other measure? And is it effective enough to withstand significant global economic downturns?

- Fallback Precautions – Another important aspect to look at is the plan for failure. The underlying assets must be stable and be able to hold value in the event of failure.

- Scalability – Can the system grow efficiently into a large ecosystem with more and more volume?

- Structure – The platform itself must be transparent and its operating costs must be taken into account. No one wants to pay exorbitant transaction fees.

All in all, evaluating any given stable coin is not a simple task. There are a multitude of factors with countless shades of nuance that must be considered, and each one has its own unique team of developers guiding and growing the technology behind it.

Stable coins are often divided into groups based on their stability mechanism. Some stable coins use a proprietary algorithm, some use a commodity, and some are pegged to fiat currencies. In addition to the underlying asset, most stable coins have a system that can be categorized in one of three ways:

- Collateralized Off-Chain: This sort of coin is a tokenized claim on a portion of a centralized asset.

Examples : Tether, True USD

- Collateralized On-Chain: These stable coins are issued based on the value of the underlying portfolio of assets. If the underlying portfolio is risk averse or less volatile, the stable coin reflects this stability in its price.

Examples: DAI, BRC, X8C, Augmint

- Seigniorage: These style stable coins are an algorithmically governed approach to expanding and contracting a stable coin’s money supply to keep the price stable. This is most similar to a country exercising monetary policy.

Examples: Basis, Carbon

These types of coins are very useful in the context of digital money, as they provide much less risk than most cryptocurrencies. Imagine the scenario when a borrower is in debt for 1 BTC and his liability can swing thousands of dollars in just a couple months. This makes stable coins an ideal vehicle for fundraising or as a settlement currency. Due to the extreme volatilities in the cryptocurrency market, there is a high demand for a coin that would allow traders to move wealth into “safer” coins when they expect another to devalue.

VALUE PRESERVATION

This preservation of value is the key regarding stable coins. Many coins store exact value, but what about shocks to the value of the stable coins themselves? With the underlying assets of most of these stable coins being exposed to market risk in one way or another, the coins can theoretically drop in value just like a fiat currency.

The only way to mitigate this market risk is to minimize the risk of the underlying asset. Coins such as Tether simply use the strength and the reputation of the underlying asset (the US dollar) in order to offer a perceived safety net. Similarly to a diversified portfolio, X8 aims to diversify the underlying asset by including 8 of the world’s strongest currencies, plus one of the most valuable of the traditional commodities – gold . The combination of these assets into a common basket eliminates much of the market risk that affects other stable coins.

It is not sufficient to store value in a society with constantly rising prices and thus less purchasing power. Just as some financial instruments or investment accounts offer growth to stored value, a superior stable coin should offer the same ability to offset inflation and other economic shocks. Entwined in the mechanism deployed by X8 Currency is an anti-inflation effect, a unique value proposition which no other stable coin provides. This ensures that an investor will not lose purchasing power in times of high inflation, and their purchasing power is sufficiently preserved.

Congratulations @echance! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!