VOYAGER CHAPTER 11, and what the company has sent out to clients

JULY 6TH 2022

Dear Monetary Realist,

Earlier today, we began a restructuring process aimed at strengthening Voyager Digital’s financial position. To accomplish this goal, the company and its main operating subsidiaries voluntarily filed for Chapter 11 protection.

Given the confidence you placed in Voyager when you joined the platform, we know this may be disconcerting news. To that end, we want you to know that we made these decisions specifically to protect and maximize the value of the assets on the platform for all stakeholders, including you, our customers, who remain our focus.

To be clear: This does NOT mean Voyager is going out of business. The restructuring process is intended to help companies stay in business, which is exactly what we intend to do. Being able to continue operations is a key benefit of a restructuring, a well-established legal process through which companies reorganize their financial obligations. In the meantime, we are continuing discussions with various parties regarding the company’s go-forward strategy.

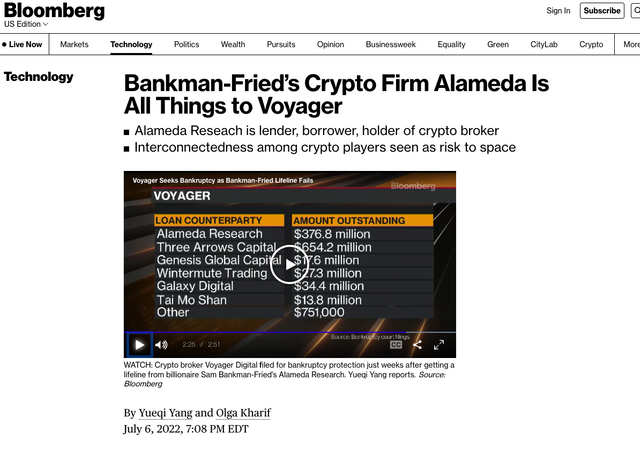

Voyager was created with the idea that investors deserve a platform that provides access to crypto assets with simplicity, speed, liquidity, and transparency. While we strongly believe in this future, the prolonged volatility and contagion in the crypto markets over the past few months, and the default of Three Arrows Capital (“3AC”) on a loan from Voyager, made this course of action necessary. Through this process, we intend to create an efficient path to resume account access and return value to customers. We are also pursuing all available remedies for recovery from 3AC, including through the court-supervised processes in the British Virgin Islands and New York.

The proposed Plan of Reorganization (“Plan”) would, upon implementation, resume account access and return value to customers. Under this Plan, which is subject to change given ongoing discussions with other parties, and requires Court approval, customers with crypto in their account(s) will receive in exchange a combination of the crypto in their account(s), proceeds from the 3AC recovery, common shares in the newly reorganized Company, and Voyager tokens. The plan contemplates an opportunity for customers to elect the proportion of common equity and crypto they will receive, subject to certain maximum thresholds.

Customers with USD deposits in their account(s) will receive access to those funds after a reconciliation and fraud prevention process is completed with Metropolitan Commercial Bank. The Company continues to evaluate all strategic alternatives to maximize value for stakeholders.

We understand this unexpected news may create both concern and uncertainty. Additional information about our path forward can be found in our press release and blog post.

Information on the restructuring, including relevant court filings, is available at https://cases.stretto.com/Voyager, or by calling +1 (855) 473-8665 (U.S. toll-free) or +1 (949) 271-6507 (international).

We’ve worked hard to share everything we can at this point; you have our commitment that we will keep you updated.

Regards,

Team Voyager

©2022 Voyager Digital, LLC. VOYAGER is a trademark of Voyager IP, LLC, a wholly owned subsidiary of Voyager Digital Ltd. All services provided by Voyager Digital, LLC, a FinCEN registered company. Investments are subject to market risk. 701 S. Miami Ave, 8th Floor, Miami FL 33131. All rights reserved. Terms of Use. Risk Disclosure.

Voyager VOYG is listed on the TSX. CANADA: VOYG | US: VYGVF

JULY 1 2022

Voyagers,

Today we made the difficult decision to temporarily suspend trading, deposits, withdrawals, and loyalty rewards. The app will be down for a short transition period. After that, you will still be able to view market data and track your portfolio, and you will receive rewards payments for the month of June.

We understand the significant impact of this decision, which is why we tried hard to avoid it—including by securing a credit facility from Alameda Ventures and lowering daily withdrawal limits. But the failure of a borrower, Three Arrows Capital (3AC), to repay a substantial loan from us means this was the right path forward. Voyager is actively pursuing all available remedies for recovery from 3AC, including through the court-ordered liquidation process in the British Virgin Islands.

As a result—while far from optimal—this decision gives us time to strengthen our balance sheet, a necessary condition to protect assets and preserve the future of the Voyager platform we have built together. We are exploring a number of options and hope to have more to share soon.

More details can be found on our blog. We know it does not answer all of your questions, but we are working diligently to get you those answers and will continue to keep you updated.

Regards,

Team Voyager

©2022 Voyager Digital, LLC. VOYAGER is a trademark of Voyager IP, LLC, a wholly owned subsidiary of Voyager Digital Ltd. All services provided by Voyager Digital, LLC, a FinCEN registered company. Investments are subject to market risk. 701 S. Miami Ave, 8th Floor, Miami FL 33131. All rights reserved. Terms of Use. Risk Disclosure.

Voyager VOYG is listed on the TSX. CANADA: VOYG | US: VYGVF

JUNE 30th: WHILE THEY KNEW WHAT WAS GOING ON WITH ARROW

voyager weekly logo

Hi Voyagers,

Reminder regarding Sanctions Compliance:

As part of Voyager’s sanctions compliance program, we periodically remind customers of their obligations to comply with U.S. law and the Voyager Customer Agreement.

Voyager customers must comply with all applicable laws, including without limitation the sanctions and embargoes administered and enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC). Absent authorization from the U.S. government, Voyager customers are prohibited from sending funds to, receiving funds from, or otherwise transacting with parties identified by, OFAC as Specially Designated Nationals, parties published on any other restricted parties list, or any parties located in regions subject to U.S. embargoes or comprehensive sanctions (the “Restricted Jurisdictions''). As of the date of this notice, Restricted Jurisdictions mean Cuba, Iran, North Korea, Syria, and the Crimea, Donetsk, and Luhansk regions of Ukraine.

Any attempt to transact or otherwise use a Voyager account to deal with any such party is a material breach of the Voyager Customer Agreement, and may result in suspension and closure of your Voyager account and, if warranted, referral to U.S. law enforcement authorities to determine whether civil or criminal penalties may apply.

If you have any questions regarding your obligations to comply with U.S. sanctions laws, please refer to OFAC’s website.

Regards,

Team Voyager

©2022 Voyager Digital, LLC. VOYAGER is a trademark of Voyager IP, LLC, a wholly owned subsidiary of Voyager Digital Ltd. All services provided by Voyager Digital, LLC, a FinCEN registered company. Investments are subject to market risk. 2500 Plaza 5, 25th Floor, Jersey City, NJ 07311. All rights reserved. Terms of Use. Risk Disclosure. Unsubscribe.

Voyager VOYG is listed on the TSX. CANADA: VOYG | US: VYGVF

Your post was upvoted and resteemed on @crypto.defrag

hey thank you very much. this stuff with VOYAGER is crazy. i Just keep reading and finding out just how much risk they took and it is mind boggling