Rise of the Phoenix: Stellar Lumens XLM

Update: 20190328, I have found errors in this article please disregard for the time being.

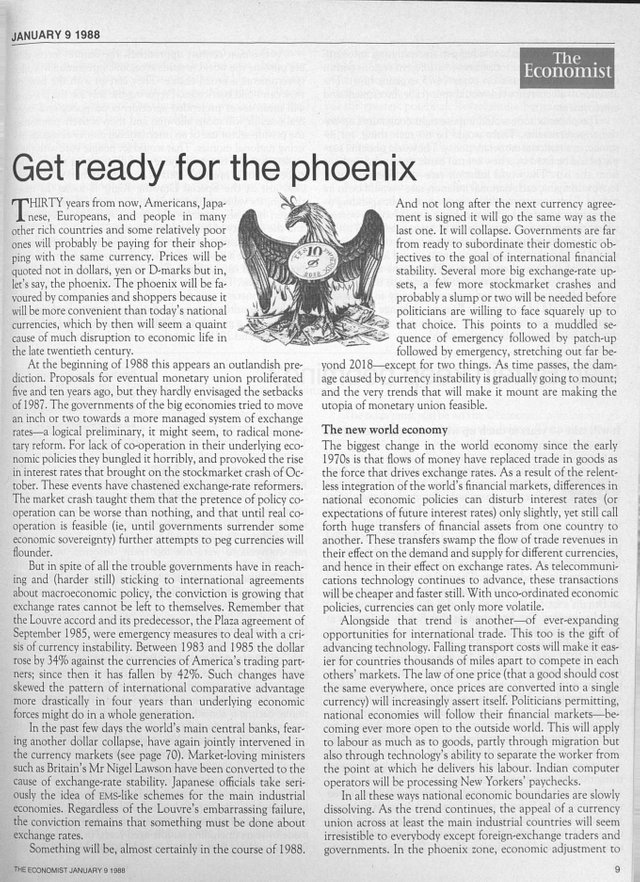

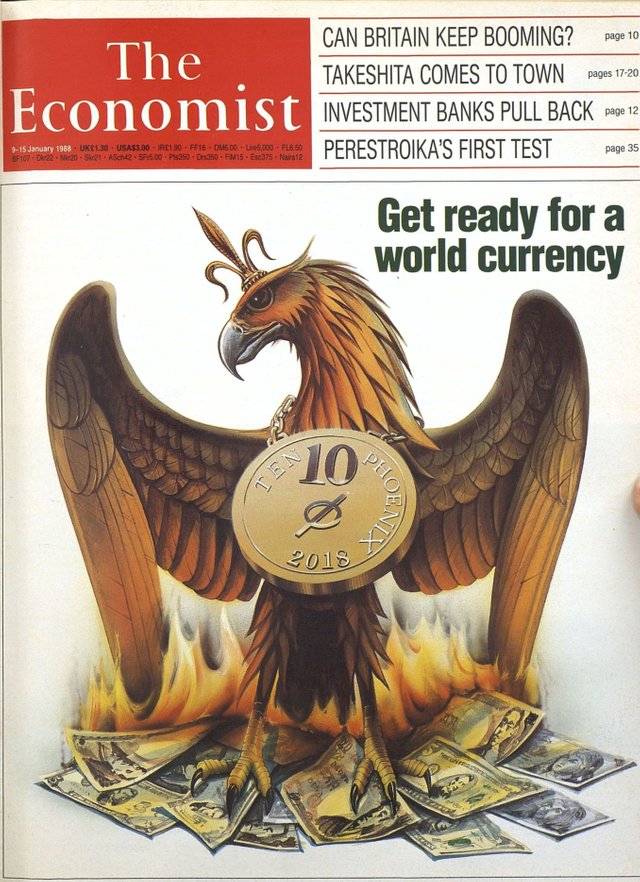

January 9th, 1988

The Economist released the "Get ready for a world currency" edition of their weekly print, featuring a phoenix standing atop numerous paper currencies; currencies which had been set ablaze.

Within, on pages 9 and 10:

The phoenix will be favoured by companies and shoppers because it will be more convenient than today's national currencies

Convenience matters. Fast transaction processing times are an essential component of convenience that is lacking in most distributed ledger technology (DLT) projects.

The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate--and hence, within narrow margins, each national inflation rate--would be in its charge.

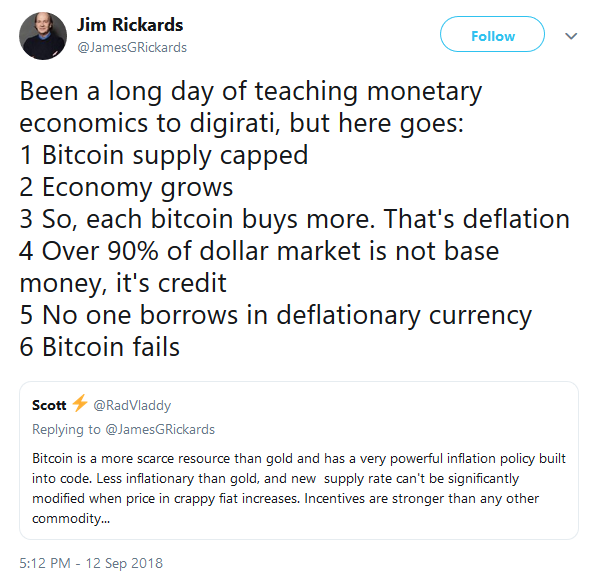

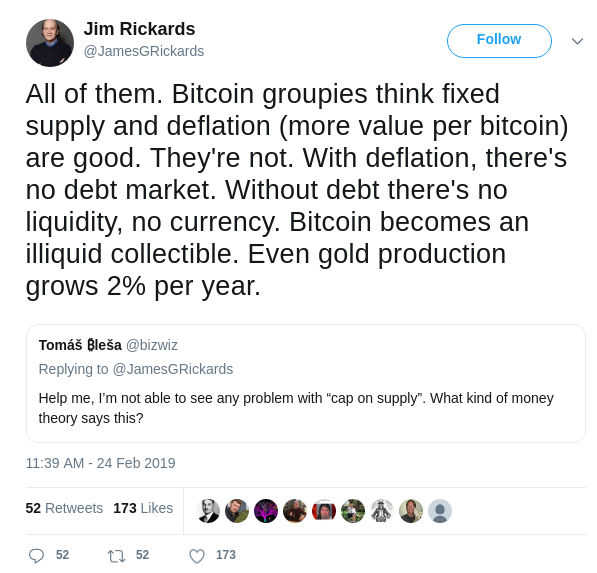

The phoenix will be (and is) inflationary. A few examples: Bitcoin (21m), Ripple (100b), Litecoin (84m), Cardano (45b), Zcash (21m), MIOTA (2.8b), NEM (9b), and Maker (1m) are not candidates for the long-awaited phoenix designation due to their programmatically instilled hyperdeflationary monetary polices. Policies many would argue are permanent.

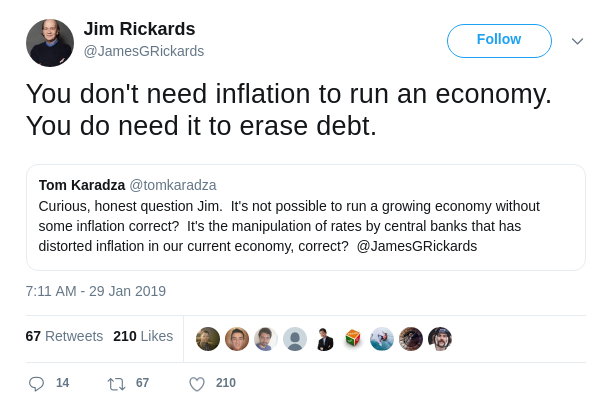

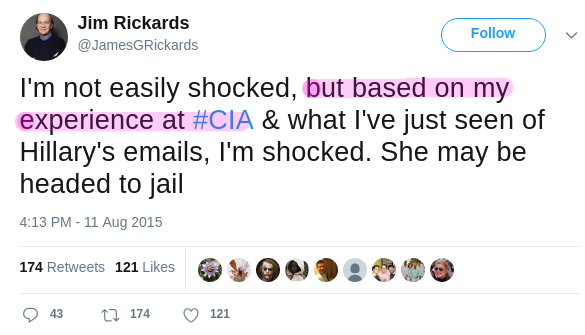

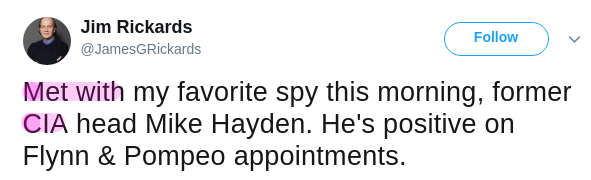

Jim Rickards talks about Stellar Lumens XLM

Contrary to the hyperdeflationary assets are a class of inflationary assets including Ethereum (ETH), EOS, Stellar Lumens (XLM), and Monero (XMR). These assets, by measure of the inflation requirement metric alone, set in The Economist's phoenix article, would be eligible for the phoenix designation.

As time passes, the damage caused by currency instability is gradually going to mount; and the very trends that will make it mount are making the utopia of monetary union feasible

The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, it's value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.

Modern implication: the phoenix will probably start as a platform with the capability to efficiently host Central Bank issued Digital Currencies (CBDC's) and stablecoins. IBM Blockchain Lead Predicts Central Bank Digital Currency On Stellar ‘Soon’.

Ethereum is likely too slow and lacks the scalability necessary to fit this mold.

Ripple lacks an inflationary component and is subject to underlying stability problems.

Zcash lacks the technological mechanisms necessary to host national currencies on its platform in addition to extremely slow transaction settlement speeds and a hyperdeflationary monetary policy. Its current low transaction rate of 26 tx/s can likely be remedied via zk-snark transaction bundling optimizations, however.

EOS seems promising, however independent benchmarking has revealed the technology does not live up to the hype maxing out at 250 tx/sec

Jesse Lund has stated he no longer holds Ethereum or XRP: Video link

Comparisons

Jed McCaleb designed Stellar Lumens XLM to be inflationary, experiencing 1% yearly, contrary to the hyperdeflationary XRP.

Jed has recently raised the question to the Stellar community: "should we push to get rid of inflation?". No action to bring the idea of removing inflation to fruition has been made public. Yet to be determined if this proposed push is serious.

Stellar has a history of giving away mountains of coins away, free of charge. During a world liquidity crisis, might this be seen as advantageous for a fund such as the IMF?

Ripple is unable to give away the vast number of coins it holds; the coins are cryptographically locked in escrow. In a crisis scenario their coins are simply stuck.

Stellar's distribution mechanism appears much less static than Ripple's, and is open to modification by its governance board. https://www.stellar.org/about/mandate/#Lumen_Distribution

- The phoenix will, in all likelihood, be outfitted to conduct private transactions, such as is available with Starlight.

Translation: national currencies will be built upon the phoenix protocol. As the economic instability inherent in debt-backed fiat currencies certainly escalates over time, countries will migrate to the underlying phoenix fallback protocol.

May 1st, 2019

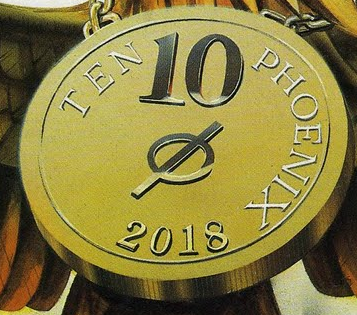

Pencil in the phoenix for around 2018

In December 2018, bearableguy123 posted a new riddle which points to early May 2019 as a day of illumination by the sun, the sun being a well known association of the phoenix.

This begs the question, why May 1st, 2019. Why is it special?

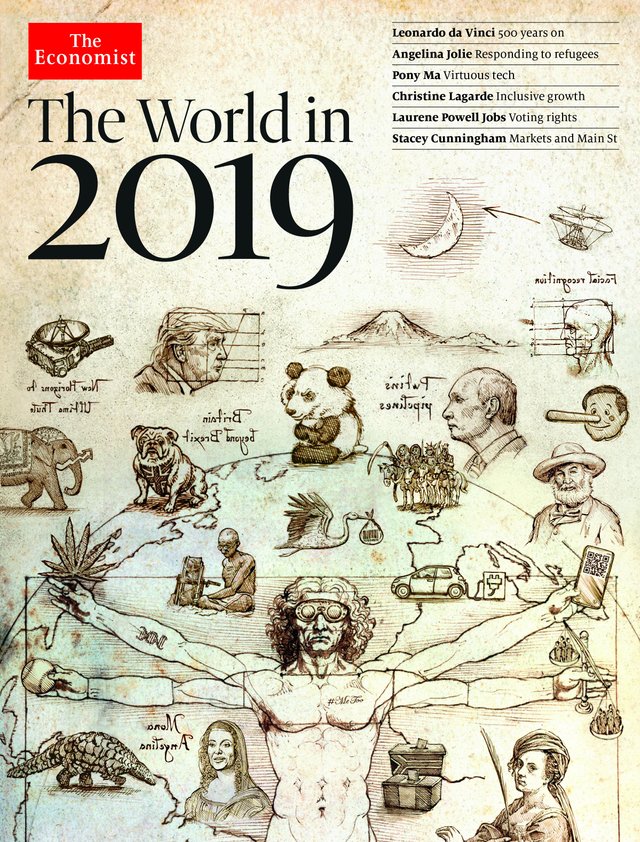

Look to the current release of The Economist and its rendition of Leonardo Da Vinci symbolism throughout. (Notice Leonardo's backwards handwriting on the cover)

Pay close attention to the top right corner

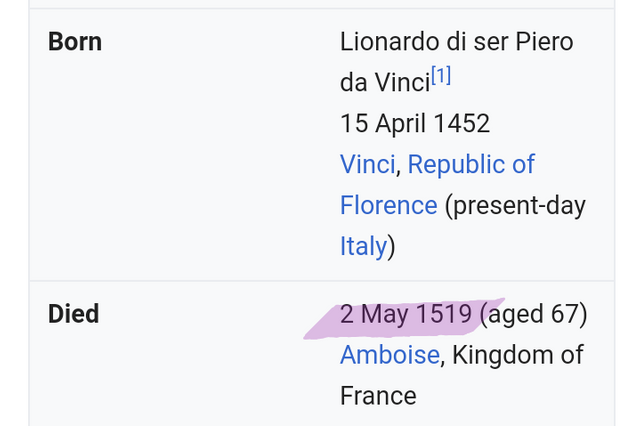

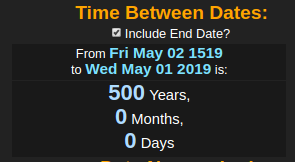

The 500th anniversary of Da Vinci's death is May 1st, 2019. This date corresponds to the time around The Economist's first prediction of the rising phoenix in 1988, and also to the newest bearableguy123 riddle, Christmas edition.

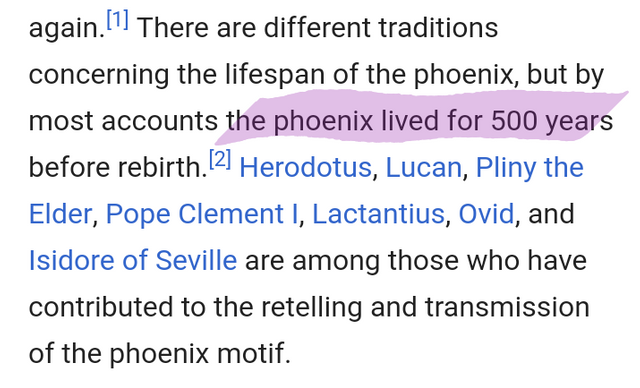

The phoenix rises after 500 years of life.

The rise of the phoenix may be caused by the explosion of the debt bomb in the first half of 2019.

A similar image is presented on the cover of The Economist 2019 edition

May 1st is known as May Day. A holiday of occulted significance.

Notice how bearableguy123 presented the upside down rocket.

Notice how he reversed his name on Twitter.

Notice how Leonardo liked to write backwards.

The occult law of reversal is at play.

New Stellar Logo

My phoenix article was originally posted far in advance of Stellar's new logo and medium article release. I withdrew the article out of worry for upsetting the natural balance of happenings. With Stellar now openly showing their hand, there is little reason to withhold this information.

https://medium.com/stellar-development-foundation/announcing-the-new-stellar-logo-81eb4fafe1b0

.png)

Logo looks familiar

Could Stellar have simply fabricated this logo to match the phoenix as a marketing ploy? Sure, if taken on its own without background information and evidences. But when combined with the technological requirements set forth above and yet unreleased data, the likelihood of such evaluating as true trend towards Ø

There is so, so much more to the story beyond the details presented here.

The information presented herein is speculative in nature and shall not be regarded as financial advice.

i'll read the part II now because i still dun get the point on ur post ;)

Hmm? Jed is Sato ?

Jed created Ripple

https://steemit.com/cryptocurrency/@kendrahill/the-currency-of-lucifer

https://steemit.com/ripple/@kendrahill/ripple-stellar-team

Interesting but no citations in either of these

Insiders don't usually have anything to cite. I've read over Kendra's almost 500 contributions on Steem and I'm fairly convinced she's the real deal.

Interesting! I have a view that the "Phoenix", regardless if it is XRP or XLM (or Dogecoin), won't be as a monumental short term increase as Bearableguy123 predicted. But we should've know 2018 would've been the Bear market just by Bear-able's name, but that is a discussion for another day. Looking forward to your later Parts!

coinbase has listed xrp for institutional custody months ago. There is no security issue, thats FUD( US FUD since xrp is considered a currency in other countries). refer to paragraph 12. https://www.sec.gov/news/speech/speech-hinman-061418