“XTRD” Merge the Exchange of Crypto Change

Website : https://xtrd.io/

For More Details Read The White Paper : https://xtrd.io/xtrd_whitepaper.pdf

XTRD Official presentation

XTRD Product & Solution

XTRD IS LAUNCHING THREE SEPARATE PRODUCTS IN SEQUENTIAL STAGES TO SOLVE THE ONGOING PROBLEMS CAUSED BY HAVING SO MANY DISPARATE MARKETS: LOW PER-MARKET LIQUIDITY, UNFAMILIAR INTERFACES THAT LAG BEHIND FINANCIAL INDUSTRY STANDARDS, AND DECENTRALIZED EXECUTION IN CRYPTO.

Goal

Their goal is to build trading infrastructure (software and hardware) in the crypto space and become one of the first full-services shops in the cryptocurrency markets for large traders and funds.

Issue within Crypto-Space

Complex Web of Exchanges

The combination of KYC’s various policies, APIs, funding, and interfaces will lead to a fragmented liquidity structure for crypto-change. The major concerns about traditional cryptogram market participants range from liquidity and prevention of hacking to inconsistent deviations and counterparty risks.

High Fees

The execution cost is one of the big factors. Typical currency exchange commission’s range from 0.1% to 0.25% per transaction i.e. that is 10 to 25 basis points, but effective fees are much higher when taking into bid.

Thin Liquidity

A large institutional contract, representing a significant percentage of the daily volume, can move the product market and related products to a 5-10% exchange rate. This means that the only purchase of $ 1,000,000 bitumen may cost an extra $ 50,000 to $ 100,000 per transaction due to lack of liquidity if it is not properly managed. However, to reduce the cost of an exchange, we can try to spread the order over time. But since the cost of bitcoin can vary greatly throughout the day, simply delaying the execution time does not solve the problem of price changes.

Time Vs Slippage Cost

XTRD Solution to Minimize Crypto space Issue

To reduce the cost of an exchange, XTRD can try to distribute the order over time. But since the cost of bitcoin can vary considerably throughout the day, simply delaying the execution time does not solve the problem of price changes. Therefore, XTRD launches three separate products in a series of stages to address the problems caused by many different markets: low oil liquidity, non-financial interfaces that are held back by financial industry standards and decentralized execution in crypto.

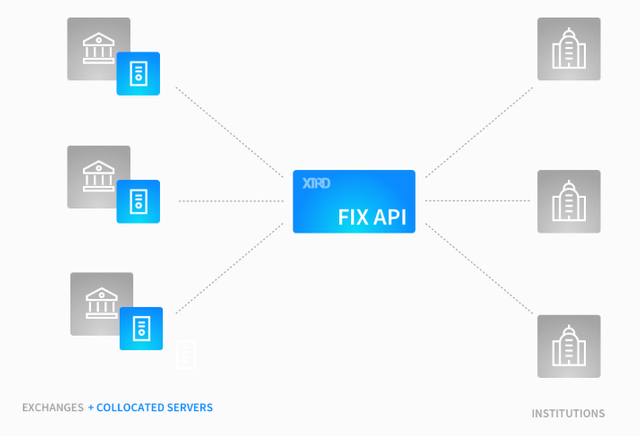

IMPLEMENTATION OF A MULTI EXCHANGE FIX API: XTRD will launch a Universal Financial Fixed Financial Information interface which will be linked to all encrypted currency exchanges to facilitate access to all major algorithmic markets, large institutions and hedge funds to all cryptographic currency markets by coding only one FIX app.

LAUNCHING THE XTRD PRO TRADING PLATFORM: XTRD will release XTRD Pro in 2018 – a highly stable, multi-stored standalone trading platform for active traders. The platform will include, among other features, advanced consolidated order books, keyboard shortcuts, and custom 24×7 up-date order types,

SPA (SINGLE POINT OF ACCESS) CROSS-EXCHANGE EXECUTION: This platform will create a single point of access during stage 3 of development. It will summarize the liquidity between crypto currency traders. Moreover XTRD creates a single point of access to the overall liquidity between merchant exchanges. This aggregation allows traders to clear at the best possible prices, while at the same time providing the lowest possible transaction costs, as well as the possibility of an atomic swap 4, all of which have only one client side account.

XTRD Platform Features

The program will combine three main platforms namely; the Xtrade pro-trading, the multi-exchange FIX API, and the cross-exchange single point of access for liquidity aggregation. The team is determined to provide a reliable and secure trading environment. Their systems are intricate, and the following are the offered solutions:

Multi-Exchange FIX API (Release Q2 2018)

The FIX API entails a Financial Information exchange protocol. It shall be used by the traders to access multiple exchanges through a single API. It introduces a pro-trading platform that is made up of low-latency software that is robust and cuts across the exchanges. The main purpose of this system is to reduce the risks associated with operating multiple accounts on several exchanges.

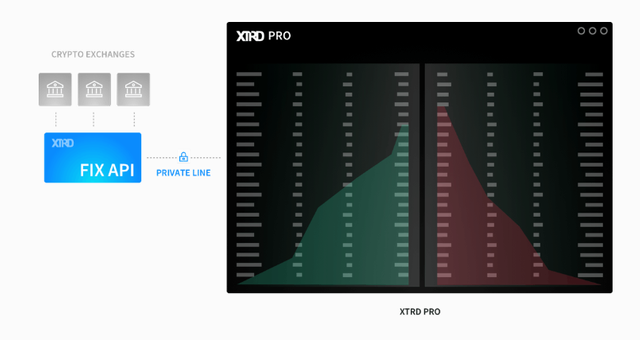

Pro-Trading Platform (Release Q3 2018)

After the setup of a multi-exchange FIX API, XTRD shall launch a comprehensive pro-trading platform. It will include special features such as advanced consolidated order books, custom order types, and hotkey order entry. Essentially, if a particular user requires executing a transaction at a different exchange, the XTRD platform will permit the action by using their user’s specific inventory account to organize the trade. This will be done through the Single Point of Access (SPA).

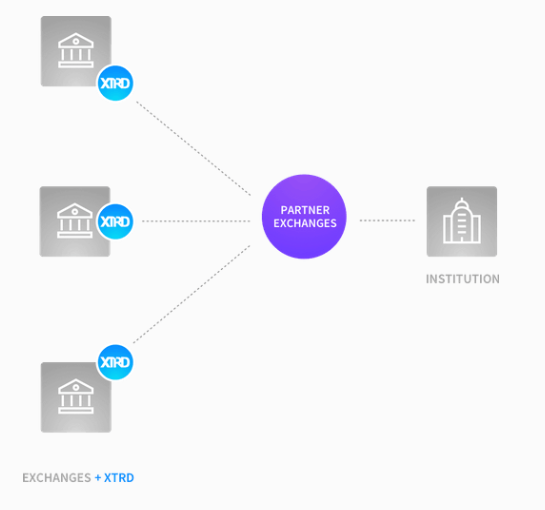

Single Point of Access (SPA) (Release Q4 2018)

This is the third and the central step of development in the XTRD program. As mentioned above, XTRD intends to create a single unified platform that will create the replacement of aggregate liquidity for cryptocurrency traders. The SPA platform makes that possible by providing a systematic transaction for traders.

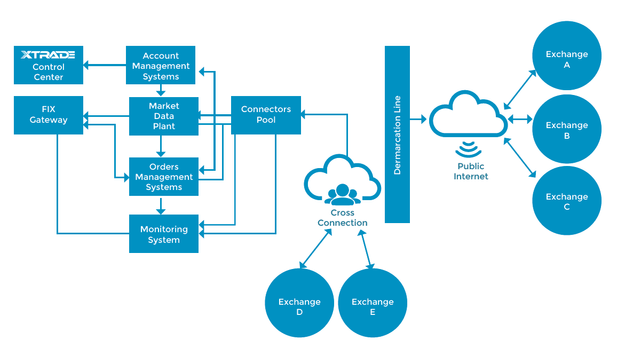

XTRD Top Level Architecture

FIX API

A FIX API is a proven, decades-old method of connecting markets. We have created our own that connects all of the major cryptocurrency exchanges. Whether you’re part of an institution, a hedge fund, or if you’re an algorithmic trader – this changes how you’ll look at crypto forever.

SPA

In this case, we mean a Single Point of Access. Trade all exchanges with one account. XTRD will aggregate liquidity across exchanges by launching a unified, Single Point of Access. We’ll be forming joint partnerships with crypto exchanges to bring a broader horizon to the market.

XTRD PRO

XTRD Pro is a downloadable solution to the fragmented markets. You’ll have access to all cryptocurrency exchanges and all your accounts from one application.

XTRD Pro is a standalone trading platform that won’t suffer outages. Make more profitable choices with hotkeys, custom buy orders, and consolidated booking.

XTRD DARK

Cut out the middlemen. We match sellers with institutional buyers for enormous crypto to fiat trades. Decentralized dark pools can’t take fiat or complete KYC. Through our banking partners in the US, the UK, and in Hong Kong, we do KYC and enable fiat to crypto. Instead of paying the standard 12% commission, you’ll pay less than 1% when working through XTRD Dark. You’ll save millions.

Issues in the Crypto Space

The following problems are associated with cryptocurrency trading:

A complex web of exchanges:

A mixture of differing KYC policies associated with APIs, funding, and interfaces will result in a fragmented patchwork of liquidity for the cryptocurrency. Major concerns for traditional cryptocurrency market participants range from liquidity and hacking prevention to unmitigated slippage and counterparty risks.

High fees:

The exchange commissions associated with trading of cryptocurrencies typically are in 0.1%-0.25% range per transaction, which are 10 to 25 basis points. The effective fees of transactions are much extraordinary when taken into spreads and bids maintained by the exchanges.

There is generally no central control or authority for examining internal exchange orders that systematically separates customer activity from proprietary activity, which can ensure fair pricing.

Thin liquidity:

If not managed correctly and performed only on the exchange, a single order to purchase USD1, 000,000 worth of cryptocurrency can cost an additional USD50, 000-USD100, 000 per transaction to the investors due to the lack of liquidity.

XTRADE Solutions

Three separate products in sequential stages will be launched by XTRADE to solve the problem of low per market liquidity, decentralized execution in cryptocurrency space, and unfamiliar interfaces.

Stage 1: Implementation of the Multi-Exchange Fix API

Xtrade will launch a universal low latency Financial Information exchange (FIX) based API that will be connected to all cryptocurrency exchanges to make it easy for significant algorithm traders, major institutions, and hedge funds to access all cryptocurrency markets by coding to just one FIX application.

Stage 2: Launching the XTRADE pro-trading platform

A highly robust, multi-exchange stand-alone trading platform will be launched by Xtrade in 2018 for active cryptocurrency traders around the world.

Stage 3: SPA (Single Point of Access) cross-exchange/liquidity aggregation

This platform will create a single unified point of access during stage 3 of development. It will aggregate liquidity across exchanges for cryptocurrency traders. In addition, it will enable traders to clear at the best possible price while systematically delivering the lowest possible transaction cost. It will also deliver atomic swap capability all within just one client-side account.

XTRD Key Benefits

Faster Trades: XTRD database connections process order just as fast as anything on Wall Street. They have built optimized databases all across the United States that Provide low latency order execution in the milliseconds.

Reduce Your Risk: We have heard the horror stories about users being unable to recover their currency after sites have been hacked or have gone down. All we need to do is use XTRD’s balances in our transaction.

Increase Your Liquidity: When we purchase or sell through XTRD Pro, orders are placed through multiple exchanges so everything that you’re buying or selling will be picked up. This is especially valuable when we’re placing large orders or when there is high price variability of cryptocurrencies across exchanges.

Fewer Fees: Making large and high-volume purchases is a pain using current methods of cryptocurrency trading. Their FIX API splits orders across the exchanges, reducing our fees.

More Exchanges: They are forming Joint Ventures with all of the top cryptocurrency exchanges. If we can think of it, it’s probably on the list of exchanges that we’ll be able to buy and sell with using XTRD Pro.

Complete Privacy: Rest easy because our order is completely secure. They have employed strong encryption protocols to ensure our orders securely flow through their proprietary system.

What is XTRADE’s (XTRD) new innovation?

This platform will make use of IPsec technology for end-to-end encryption on its execution network for protecting customers’ important data. Private internet transatlantic fiber connections and demarcation points are used by this platform to ensure that even non-collocated orders will execute 40%-60% faster, more securely, and more privately. Traders can write to the standard FIX API wrapper for accessing market data and executions for all exchanges. Users will be able to trade “100X faster” on this platform. Compared to public internet pathways, execution times can drop from 150-200 milliseconds to 1-2 milliseconds. XTRADE has a point of presence in many major data centers.

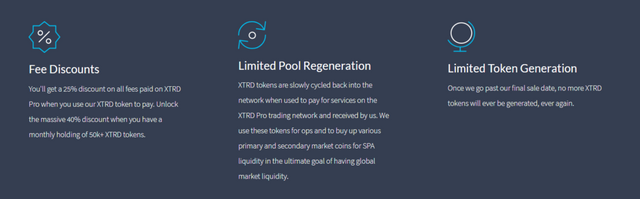

XTRD Token

The XTRD token will be used for paying transaction fees, as well as, discounts on XTRD services. According to XTRD discounts of 25% will be available to all token holders and discounts of 40% will be available to those holders who have an average monthly stake of 50,000 tokens.

The XTRD token sale ended March 31th with over 26 million USD contributed, raising 70% of the hard cap (45 million USD).

Token Price and Token Sale

XTRD token is an ERC20 compliant utility token, which is developed on the Ethereum blockchain just like other popular ICO tokens such as BunnyToken, Cibus, Amon, Aktie Social, Alttex, THEFANDOME.

It will be used as a primary means of payment by users for obtaining services rendered by this platform.

XTRD tokens will be sold by this platform to accredited investors through a SAFT (simple agreement for future tokens).

The price of one token will be USD0.10 during the ICO sale.

Eligibility

Participants need to be an individual or an institutional investor with a minimum of USD200, 000 income/year to participate in the ICO token sale. In addition, investors with assets over USD1 million can also participate in the token.

Token Sale Terms

Hard cap: $45M.

Base price: 1 XTRD = $0.1.

Already rose over 50% of their hard cap which is almost $25M.

Main sale: might get cancelled if XTRD sells out in the pre-sale (which ends March 31).

Token distribution: in 8–10 business days after the ICO end.

Token type: ERC20-compatible utility token.

Tokens will be generated after the sale so that burning of unsold tokens is unnecessary.

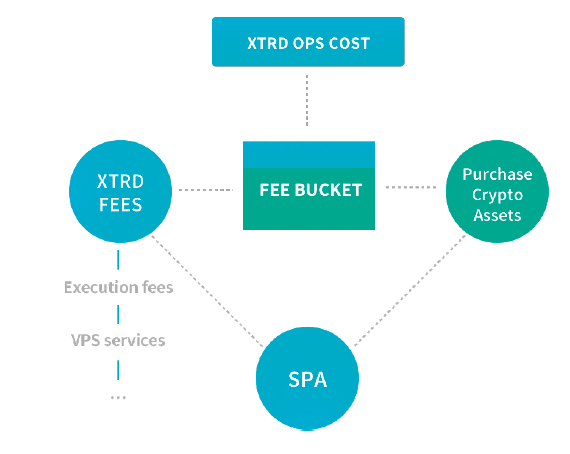

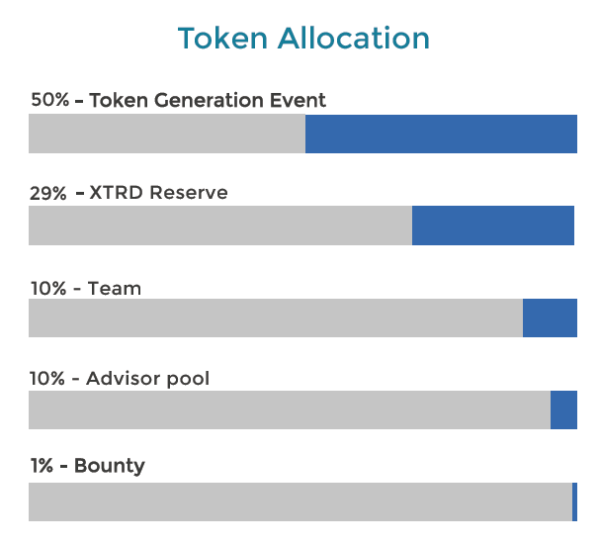

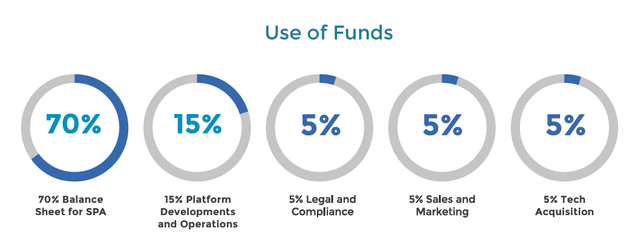

XTRD Tokenomics

XTRD Token Generation

Conclusion

It is a trading platform that orderly connects multiple cryptocurrency exchanges into one simple API and allows the user to find out that how to invest in ICOs. Users will be able to trade and exchange different cryptocurrencies around the world by using this platform. Investors will enjoy benefits such as higher liquidity, lower trading fees, and faster trading times by using this user-friendly platform. Advanced consolidated order books, customer order types, and hotkey order entry are features equipped in this platform.

The majority of ICO tokens such as Guardium, CryptoLoans, Ternio, BitCAD, CHERR.IO offer opportunities for smaller investors to participate in the sale. This token sale is designed for large investors with assets over USD1 million or income of USD200, 000 per year.

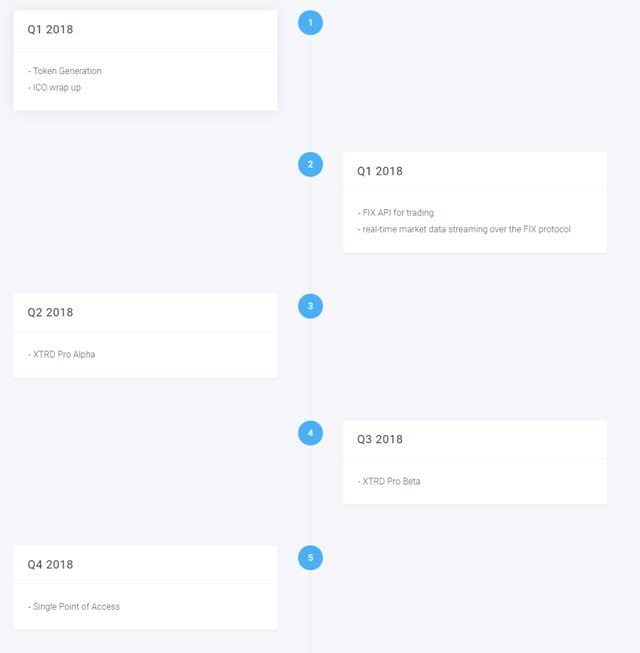

Roadmap

XTRD Team

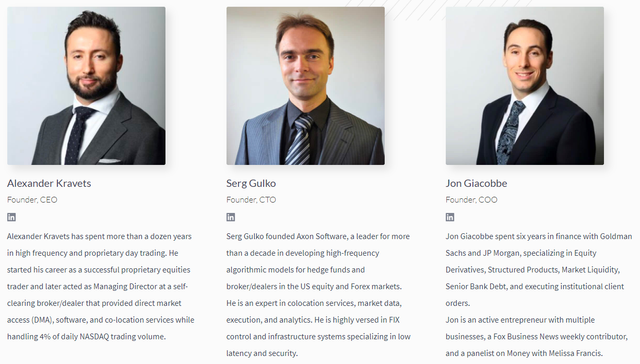

Founders

Advisors

Engineering

Partners

Follow XTRD Project On social Media

Website: https://xtrd.io/

Whitepaper: https://xtrd.io/xtrd_whitepaper.pdf

ANN: https://bitcointalk.org/index.php?topic=4477503

Telegram: https://t.me/xtradecommunity

#XTRD, #cryptocurrency, #cryptotrading

Disclaimer:

This article was written to the best of our knowledge with the information available to us. We do not guarantee that every bit of information is completely accurate or up-to-date. Please use this information as a complement to your own research. Nothing we write in any of our articles is intended as investment advice nor as an endorsement to buy/sell/hold anything. Cryptocurrency investments are inherently risky so you should never invest more than you can afford to lose.

...................................................................................................

MY INFO:

BITCOIN TALK PROFILE LINK : https://bitcointalk.org/index.php?action=profile;u=2166122;sa

ETH ADDRESS : 0xc3c1A319c81C0588DC6B81b791C13581dd3C4B01