Crypto Academy Week 15 - Homework Post for Professor @yousafharoonkhan

Good day Everyone,

Happy weekend. Am so happy to be one of the participants of Prof. @yousafharoonkhan class again this week. The class is so interesting that even a new intended traders will know how to place order in the crypto market. Below is the answer to the homework given to me by my lecturer Prof @yousafharoonkhan.

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

Order book can be be define as a list of items or things a buyer is intending to buy or sell at the market. If we should talk about Book, book is a layer of pages where we can write or print records for future purpose. If we should now add order that is "Order Book" as the name imples, is the book of Orders.

Order Book in cryto market can be define as a printed or written records and the record that show how a particular market can be sold to the buyer or buy from the seller. It can be said to be as a book that carry all the recorded information needed for buying any selling from a particular market which is either local or Crypto market. So, we can say an order book in crytocurrency market is a recorded book that can be placed by a buyer or seller to show all about a particular assest with is pair which may be SHIB/USDT for the buyer or sell willing to buy the coin to see or to buy and sell.

If we should now compare local market to crytocurrency market, they are two different market with a different order book. Local market is a particular market that is open for everyone to buy or sell a particular needs for human use or material things, It may be food, cloth, shoe, bag and so on. While on the other hand, cryptocurrency order book is all about buying and selling of cryptocurrency which is also known as digital currency.

However, Cryptocurrency is a digital/virtual currency that is created as an alternative to our traditional currency. If We should now combine it with market, under crypto, we have different digital currency like Bitcoin, Ethereum, Litecoin and so on but if we should now add market to the cryto it makes it cryto market. Cryptocurrency market is a place of market where traders or users can buy, sell or exchange a particular cryptocurrency for other cryptocurrency which we can also call digital/virtual currency i.e. Bitcoin, Ethereum, and so on or Traditional currency I.e. Naira, Dollar and so on. Below, I will be listing difference between Local market order and cryto market order.

Difference between Local market order and Crypto market Order.

| Local Market Order | Crypto Market Order |

|---|---|

| Here traders deals with buying and selling of things. It may be food or material things. | But here, Traders deals with buying and selling of different digital currency |

| Their market is not digital, it is physical. | There market is recorded, it is digital. |

| There is nothing like trading pair in market. | Crypto market is made up of trading pair. Cryptocurrency can be pair with any currency for an exchange. |

| Local market order can not be seen by everyone. It can only be accessible to the business owner, which doesn't makes it transparent. | But crypto market order book is a transparent one, disaplayed for everyone to see. |

| Here, sellers always want to buy according to their budget while seller too always want to sell in a price that will benefit them. | The price is listed on the public ledger as the price fluctuate. |

| Here, there is no automatic filling of predefine prices. | There is an automatic filling of predefine prices. |

| There is nothing like technical or fundamental analysis in local market. Their market can not be predicted. | Crypto market can be predicted using technical and fundamental analysis. |

| No feature like stop limit or OCO in local market order. | There is Stop limit and OCO in cryptocurrency market for traders to safe themselves from sudden loss. |

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

How to find Order Book in Binance

Binance Exchange is founded in 2017 but as at April 2021 it was rated the largest cryptocurrency exchange in the hole world in terms of trading volume. Binance is an online trading platform where trader trade cryptocurrency and it support many of the most commonly traded cryptocurrencies in the world. So, I will be using Binance Exchange to explain the steps of how we can find order book in the cryto market.

Firstly, if you do not have Binance Exchange account and you which to have one, you can register for Binance Exchange account by clicking here. There are two ways you can log into binance, the first one is through App and the other one is through website but I will be using Binance App to explain to us.

Login to your Binance app. After when you have login to your Binance app, you will find a market at the bottom line of the homepage which you can see in the below screenshot.

Click on market. After when you've click on it, it will direct you to a page where you can search for the crytocurrency of your choice with a pair of your choice. On the search space, I search for Shib under spot.

You can click on any pair of your choice after when you have search for the coin of your choice.

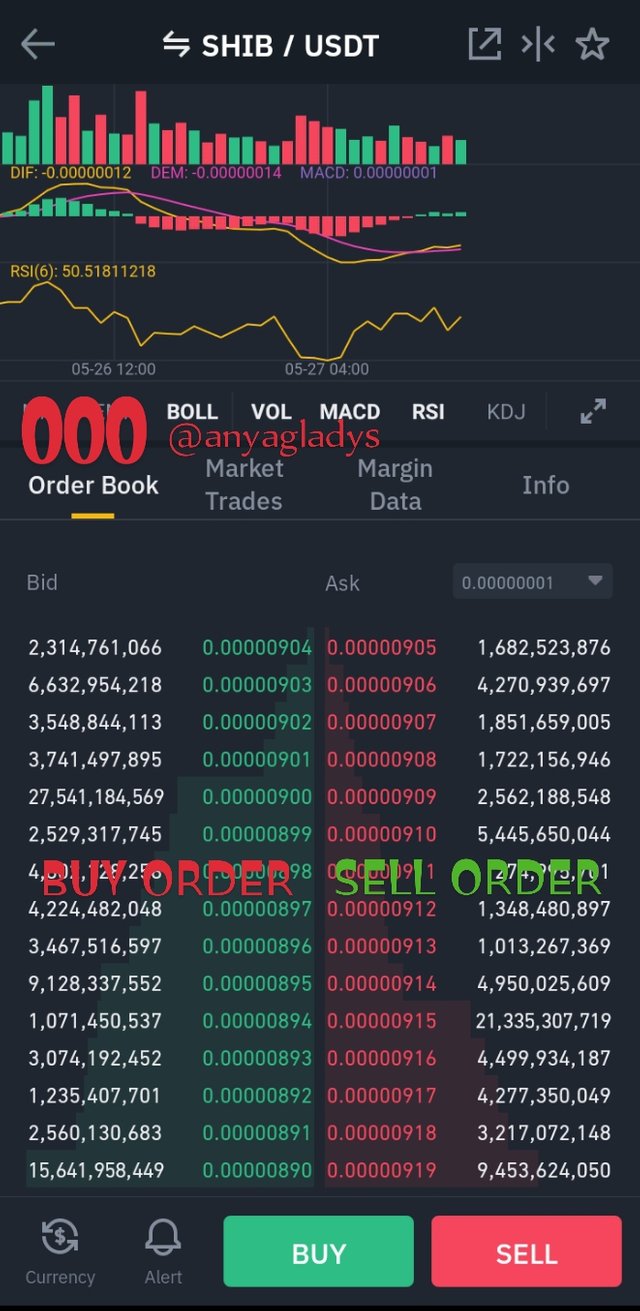

I clicked on SHIB/USDT and it took me to a page where I found SHIB/USDT Tradingview, the order book with buy and sell in line with currency and alert at the bottom line of the page as you can see from the screenshot below.

Binance

Binance

Trading pair

Trading Pair on an exchange refers to pairing two assets that can be traded together. For Example: BTC/ETH, This is a cryto trading in which a trader can buy or sell any of this assets for each other in order to buy a particular a asset. To explain more better, we can buy a crytocurrency with another crytocurrency. For example we can buy SHIB with ETH by pairing them together. While we can also buy ETH with SHIB coin.

Trading pair can either be cryto to cryto or cryto to fiat. i.e. SHIB/ETH or SHIB/USDT. SHIB/ETH is an example of cryto to crypto while SHIB/USDT is an example of crypto to fiat.

Support and Resistance

Support and Resistance is a very critical tool in trading. It's sometimes determine or predict the price of an asset. It may be tricky sometimes but they tend to be simple trading setups with high win rates. These key level are often established by human behavioural factor.

Support in crypto market trading can be said to be a price level where a downtrend is expected to pause due to a concentration of demand or buying interest. If the price of a particular assets drops, some traders take advantage of buying more of it, so that when it shot up it will be of benefit to them. While some won't take advantage becuase of the fair of lossing money. When the price of a particular assets decreases, the demand increase and that form resistance zone.

Resistance is a price level where an uptrend is expected to stop. We can also say it's stand in the market as a predication price of a particular assets. That, it will not be more than a particular price for a particular period of time. which means price of asset is expected to come down. It marks the point or give alert to traders to know when to place a sell order. Resistance level becomes a resistance zone when more than one resistance level occurs at roughly the same level.

Surpport and resistance is very important in trading especially for those that make decision based on technical analysis. Surpport and resistance do help traders to identify price points on a chart where the probabilities favour a pause of a prevailing trend.

Surpport and resistance can be identified by trends. Surpport occurs in crypto market when a downtrend is expected to pause due to a concentration of demand. While Resistance occur in Crypto market when an uptrend is expected to pause temporarily, due to a concentration of supply.

Limit Order

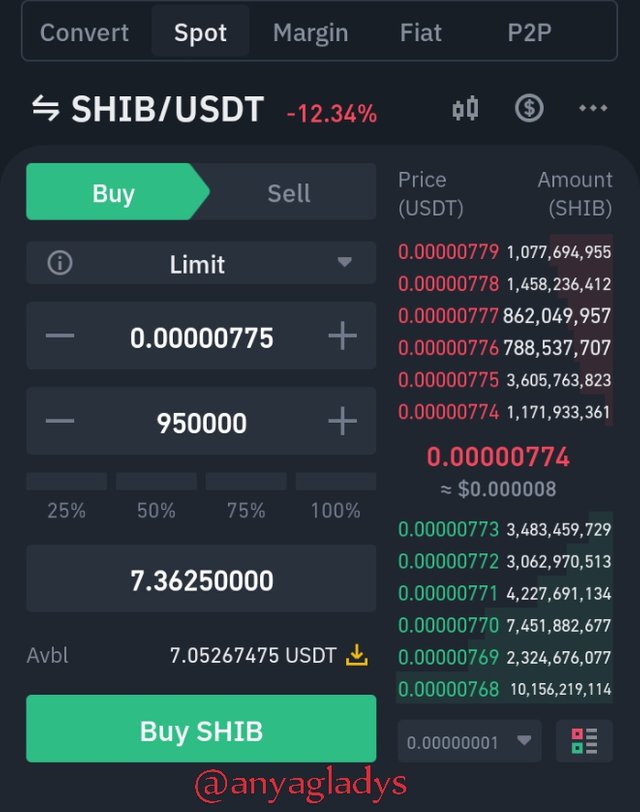

A limit order can be define as an order which traders place on the order book with a specific limit price. The limit price is determined by traders. Traders in cryto market may use limit orders to buy at a lower price or to sell at a higher price than the present market price. So, when a trader place a limit order, the Trader's order will only be fulfilled if the market price reach the trader's limit order.

Limit price do help trader to benefit from the market because it help trader most time for those that know how to use it well, to buy asset at a cheaper price. For Example: let say I want to buy SHIB/USTD, I will need to observe support and resistance before bbefor, If I do not want to start with loosing value of the coin am buying. So, it will be good for me to buy when I see that the price of SHIB as falls below the surport level.

Limit price will appear in the limit price space automatically once you click on buy. The current price of the market when you click on buy will appear on the limit space but it's always editable because if you don't quickly buy and the price fluctuate to another price, you will need to edit it if it is urgent before buying or you buy with the the selected limit price and wait for the market price to reduce or increase back to your limit price order before your order will be fulfill and apear in your wallet.

As you can see in the above screenshot, the price appear immediately with the page. It means the market as at when I click on buy, the same thing is applicable to sell order.

Market Order

Market place is different from limit order in a way that once you want to Buy or Sell(Trade) under market, the price is not editable, it will only be purchase in the present price of when you were placing the order. Fluctuation of price will not affect such price because it is not editable. If you place an order, it will be under open order and it will wait for the market to fall or increase to your market order before it fulfil and appear in your wallet. After that, the trader's market price will also appear on the public ledger under buy and this also applicable to market order of selling assets.

All what I explain like pair, Limit order, surpport and resistance, market order they are all for good for trader's especially those that understand it very well. Historically, it as really help trader's in making market decision and help them to limit their loss. I hope we enjoyed it.

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

Before I start explaing the important feature of order book I would like to show you the screenshot of my Binance profile as a verified member.

Binance

As I have been explaining the features of cryptocurrency market, I will be explaning the features of Order book in the crypto market.

So, crypto order book is the cryto record of market of how traders are buying and selling assets by pairing along with other details of crypto assets like market cap, volume, price etc. It is digitally written. On order book we see the price of a particular assets and also traders can see how price fluctuate by checking the order book.

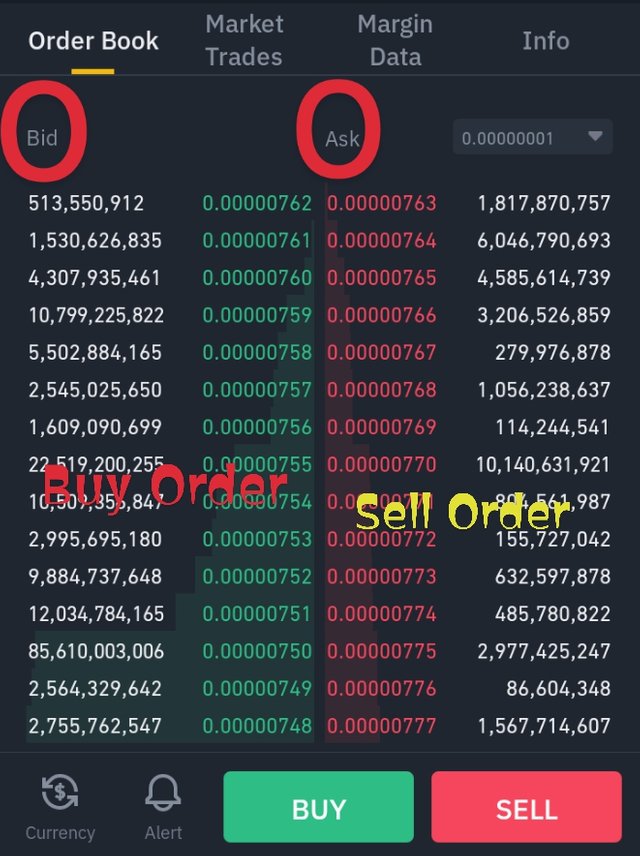

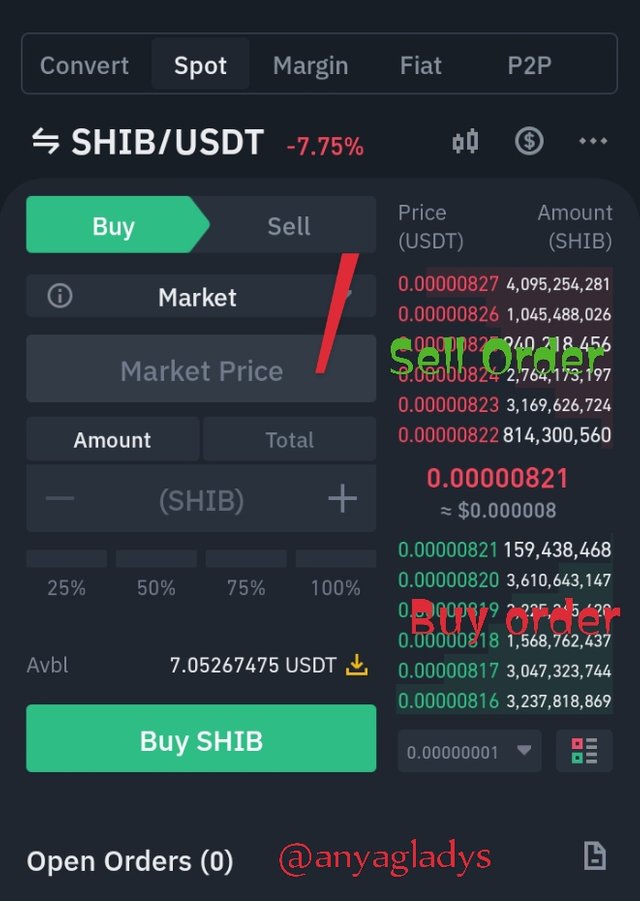

Binance

As we can see in the above screenshot, order book in crypto market is made up of buying and selling. The above screenshot represent the open order of SHIB/USDT from Binance exchange. Historically in crypto market buy order is always display in green while Sell order is always display in red. So, from the order book trader can see price of a particular trading pair and different price at which buys and seller are trading their assets.

In crypto order book orders are open and they are getting executed continuously. The price of a SHIB/USDT is not stable on the order book. It display as it fluctuate. So, if we check back the order book after some minute even seconds the price will have change.

Buy Order

Buy Order in cryto market can be define as the process of obtaining an assest from the market buy purchasing it with a cryto or fiat currency. I will be using cryto with fait as an example and to explain how to buy crypto from the market.

I will be showing us how to use buy order by using SHIB/USDT to explain. Firstly, after when you have logged in to your Binance account, at the bottom line of the homepage you will see Home, Market, Trade, Features, wallet.

As you can see in the above screenshot, click on Market, at the upper part of the page, you will see space for searching. Search for the coin of your choice with the pair of your choice.

I search for Shib and it brought Shib with different pairs. So I clicked on SHIB/USDT pair

It took me to the SHIB/USDT trading view page along side with Order book with buy and sell.

I clicked on buy, to purchase SHIB/USDT and it took me to the screenshot below.

The screenshot above is where we are to buy any coin we want to buy from the market after clicking on buy at the tradingview.

Here, in the above page as we can see that it display some information like the Order book at the right side of the page the buy in green color and sell order in read color.

And the second, we are to input the amount of the coin we want to buy, edit the limit order if you are not satisfy and confirm. But don't let us forget that any limit order you input will only be fulfilled when the market increase or decrease to the market limit selected by you.

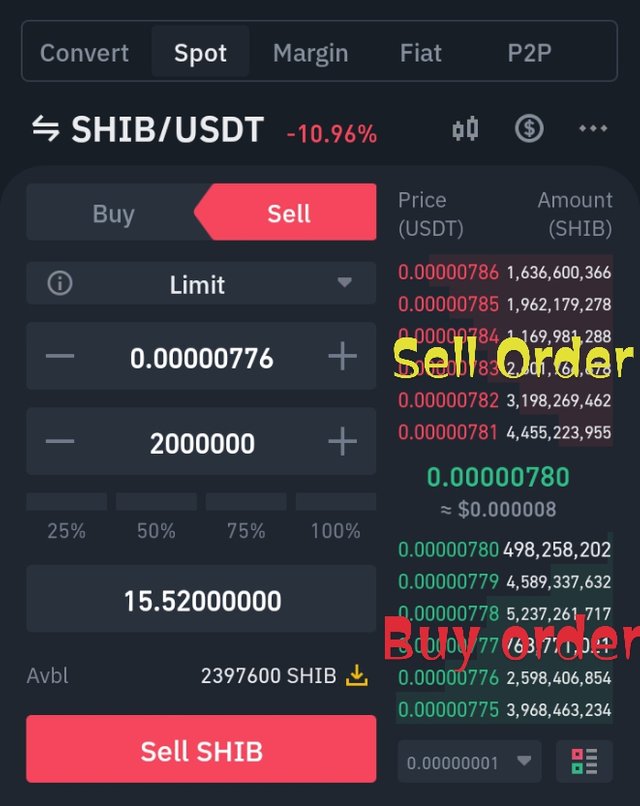

Sell Order

There is no much difference between buy and sell order, the only difference there is that we purchase coin in the sell order But we will be selling coin here in sell order.

Sell order in Crypto market is the process of selling assets by pairing it with cryto or fiat currency. For Example; I will be explaining with SHIB/USDT which is cryto/fiat currency.

You will also need to login to your Binance account as you've done in sell order. Click on market at the bottom part of the page, search for the choice of coin with the pair of your choice. It will take you to it trading view.

I search for SHIB/USDT to sell order as you can see in it trading view. The page it took me too also display tradingview along side with information like Order Book etc.

I clicked on Sell order to sell out Shib coin for USDT (fait) currency, as you can see in the screenshot below.

Historically and also in Binance excahange Buy order is displayed in Green while Sell order is displayed in red for traders to understand more better about the market.

I input the amount of shib coin am willing to sell for USDT. You can also edit your limit order in sell order but know that your order will only be open but be fulfilled only when the market reduce or increase to the limit order selected by you.

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

The next question to answer now is to explain how to Buy and Sell in Stop limit trade and OCO. I will be using my verified member Binance Exchange account to explain to us.

Stop Limit

Before I start explaing how to place buy and sell order in the crypto market, I would like to make us to first understand the meaning of Stop Limit in the cryto market. Stop limit can be define as the combination of stop loss and a limit order. Stop loss is a limit to stop loss at a particular level or price at the surpport level while limit order is mostly set by the market at the time trader click on sell or buy order. It sells or buy order in the price of which trader place an order at a particular time or period as the price fluctuate.

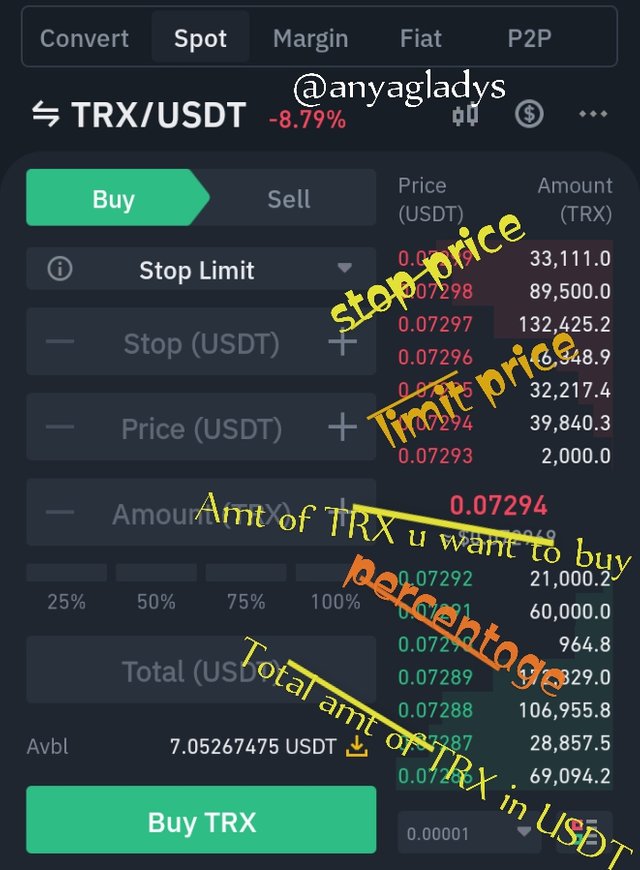

Stop limit is a type of setting made by traders to stop or reduce loss beforehand. Buying and selling order is not a good thing for traders to rush into. It will be good for trader's to have better understanding of surpport and resistance in order for traders to know when to enter it exist the market. For trader's to fix their stop limit price they have prices to set.

Stop price : This is the first price to set under stop loss. At this price, the stop limit order becomes limit order.

Limit price: The lower limit of target price . At this price the limit order is likely to get executed.

How to place Buy orders in Stop-limit trade

Before you can buy or sell order in Binance Exchange you would login to your account. At the bottom line of the home page click on market, type the coin of your choice and choose it with the pair of your choice.

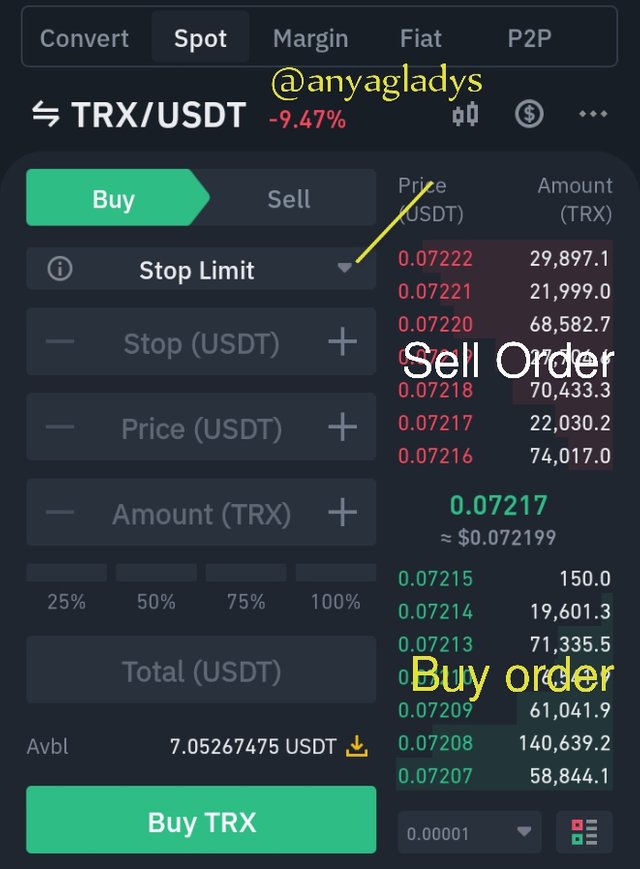

I will be TRX/USDT an Example. I search for TRX with USDT pair and I clicked on it, it took me to the screenshot below.

As you can see in the above screenshot, it display TRX/USDT Tradingview and order book in the page where TRX/USDT Tradingview is, with buy and sell in line with currency and alert at the bottom line of the page. So, I clicked on buy order and it show me the screenshot below.

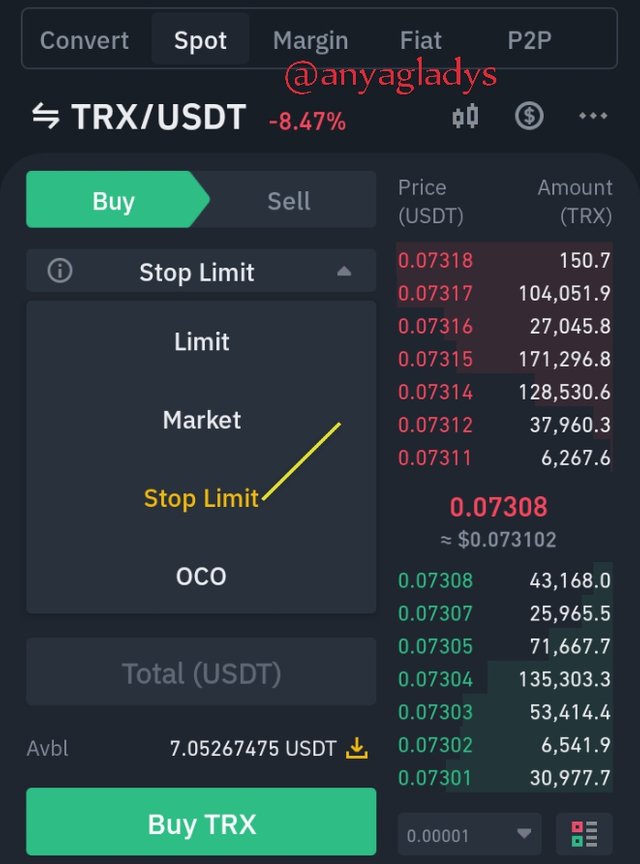

*** I clicked on Limit Order***

It shows me the list for me to select my choice. I clicked on stop limit as you can see in the above screenshot.

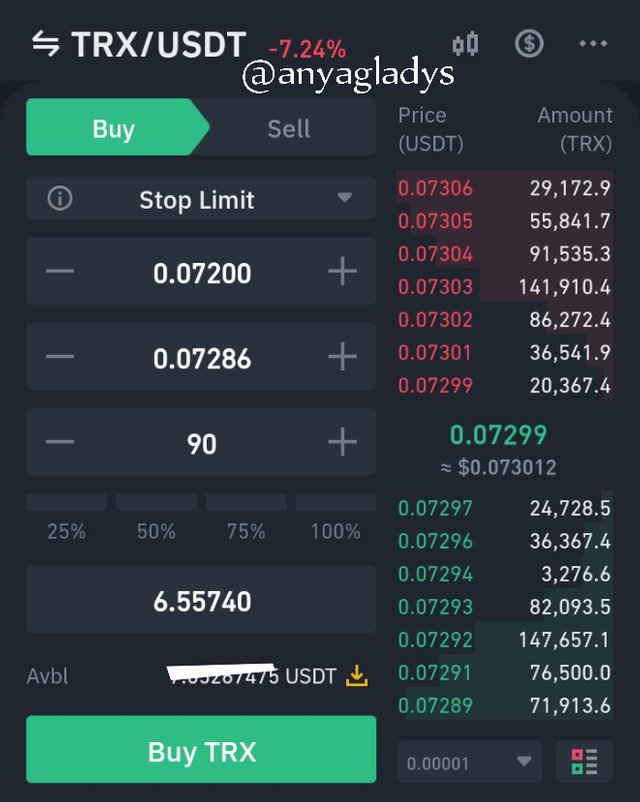

So, Let's now purchase our TRX/USDT using stop limit trade

I set stop price and limit price, Once price of TRX reaches stop price, our order will become limit order and will be executed at limit price.

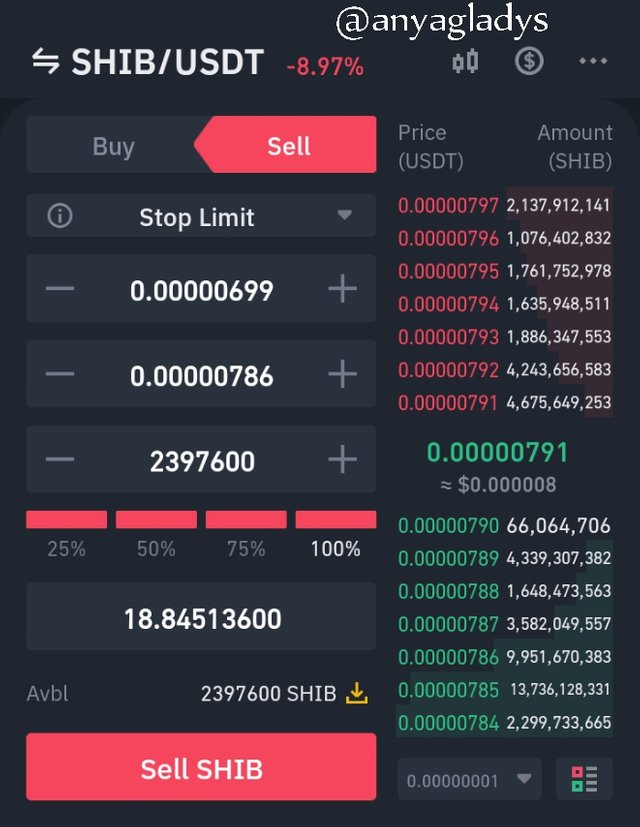

How to place Sell orders in Stop-limit trade

I will be using SHIB/USDT as an example.

I have set stop limit for Shib coin sell order and the percentage bar is full because am selling 100% of my shib coin. When the price of shib reaches stop price, order will become limit order and will be fulfilled at limit price.

How to place buy sell order in OCO.

OCO stands for Cancels-the-orders. That means, if one order is fully or partially fulfilled, the other one will be cancelled. OCO combines two market order. It order on Binance Exchange is made up of a stop-limit order and a limit order with the same order quantity. Both order must either be buy order or sell order.

- Login to your Binance account,

- Click on market,

- Type the cryto of your choice with the pair of your choice on the list,

- Click on pairs of your choice, it will display you the Tradingview of the pairs.

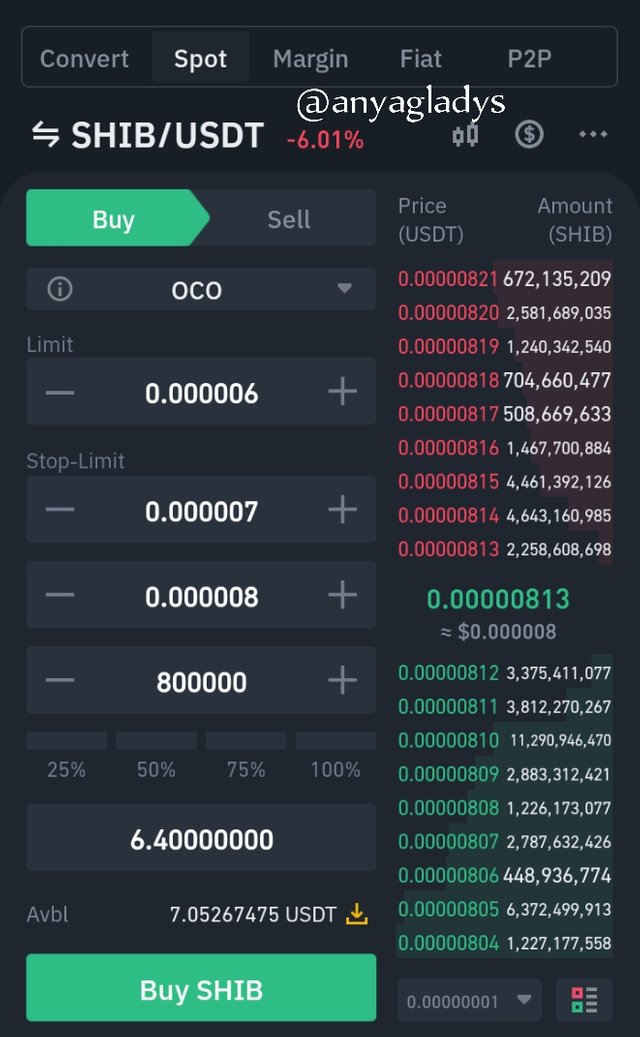

For example, for will be using SHIB/USDT as an example. Shib is trading between 0.000007 USDT and its resistance price of $0.000008 USDT. You would like to buy if the price drops to 0.000006 USDT or rises above 0.000008 USDT.

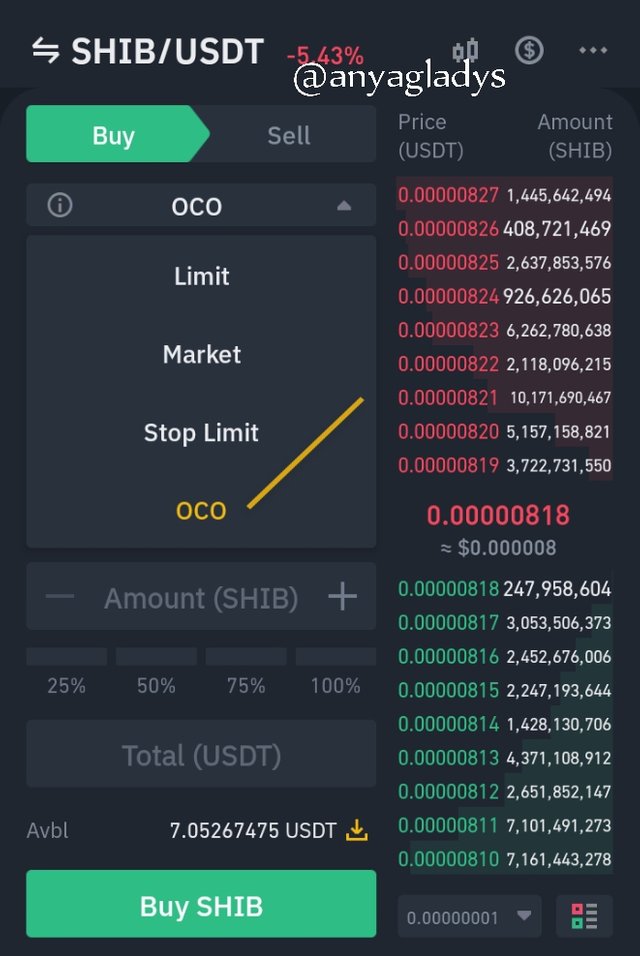

As you can see in the above screenshot, I clicked on OCO

Buy Order (OCO)

We can now create an OCO Buy order with a limit order at 0.000006 and a stop-limit order with a stop (trigger) price of 0.000007 USDT. You can then set the stop-limit order’s limit price to 0.000008 USDT.

So, the order will likely be filled when one order is fully or partially filled, the other will be automatically canceled.

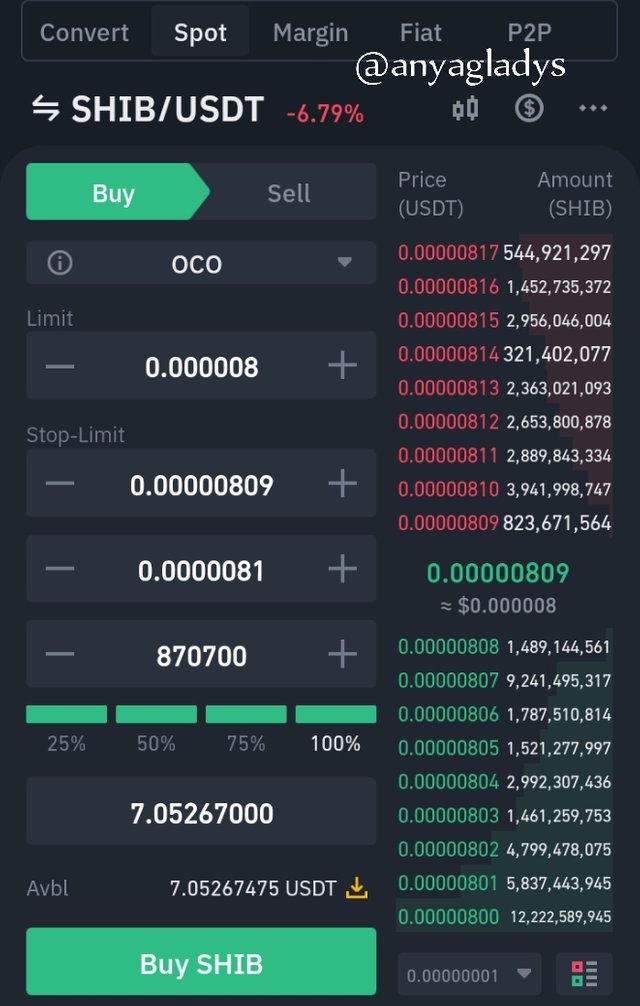

Sell Order (OCO)

Sell order doesn't have much difference from buying order, the only difference there is buying order is for buying or purchasing of assest from the crypto market. While sell order is the process of selling a cryto for another. Here in sell order I will be explaining how we can sell asset with the pair of our choice.

After when we have login in into our Binance account and we are in the market to select the crypto we want to sell, pairing with another. Select and click on the pairs. The next page will the tradingview of the the coin you want to sell. It will be good for trader's to always buy the idea of studying the surpport and resistance before making decisions of when to enter market and when to exit the market. I will be using SHIB/USDT to explain to us.

After when you have clicked on the pairs currency of your choice you want to sell, the next page will be Tradingview as I have mentioned before.

Click on sell, it will take you to where you will make you order, as you can see in the below screenshot.

If the price of the pairs touches limit price of limit order, it will be fulfilled and stop limit order will be cancelled. Also, if prices reduce and touches stop price, order will be be triggered and e fulfilled at limit price of stop limit order with cancellation of limit order.

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

From the beginning of this assignment we have learnt alot about cryto market. Especially, Order book. Order book is an important tool in crypto trading because it can be very helpful for trader's especially for those that understand how to read it.

In trading market, we have different options for trading some are limit Order, Market Order, Stop limit order, OCO etc. For Example; Let say you have an assest and heared from professionals speculators or made your research that there will be a shot up of the assest in the market, you can use limit order to purchase the order in order for the assest to be profitable to you and if it is not profitable, the loss will be minimized. And pls let us all have it in mind that also limit price are set to execute trade with some Profit or minimum loss.

Also, if you are a sharp sharp trader which Is also known as scalp trading. Maybe you love to see a very sharp gain from the market. If you can make order book your friend it will really help you in trading because it display how market fluctuate. With that, trader can quickly figure out the trend from the market.

Surpport and resistance in cryto market is also an important tool in the market especially for those that analysis market using technical analysis. If a trader is in the market to Bid or ask i.e. buy or sell it will be good for trader's to buy the idea of surpport and resistance in order to know when to enter market and when to exit the market in order to maximize profit and to minimize loss.

In cryto market we have different technical indicator which we can also use to improve our trades. If we trade on an exchange then we can also use technical indicator. The technical indicators are MA, boll, Trix, VOl and KDJ are popular in EMA and sub indicator and by understanding all of them, we can place order in order book. Understanding all of this will help us to make profit and minimize loss.

However, I want to share my experience in the cryto market with us during when I was still new to the system. I thought of buying one penny cryptocurrency without knowing much about the market. I wanted to buy some shib coin, thinking I can just make order any time I want. I made the order with studing the airport and resistance to know the trend, my $18 worth of shib when I was purchasing became $15 after when it process, $15 reflect in my wallet as the coin I purchased. It is always very very good to make research of the market before entering or existing it.

In conclusion, I want to say a very big thank to my lecturer Prof @yousafharoonkhan for the wonderful topic. He as thought me and also understood alot about the crypto market, Thank you very much. And Also to those that will be viewing my homework,

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 8.5

Thank you very much Professor @yousafharoonkhan for taking your time to read through me homework.