Backed by Nothing?

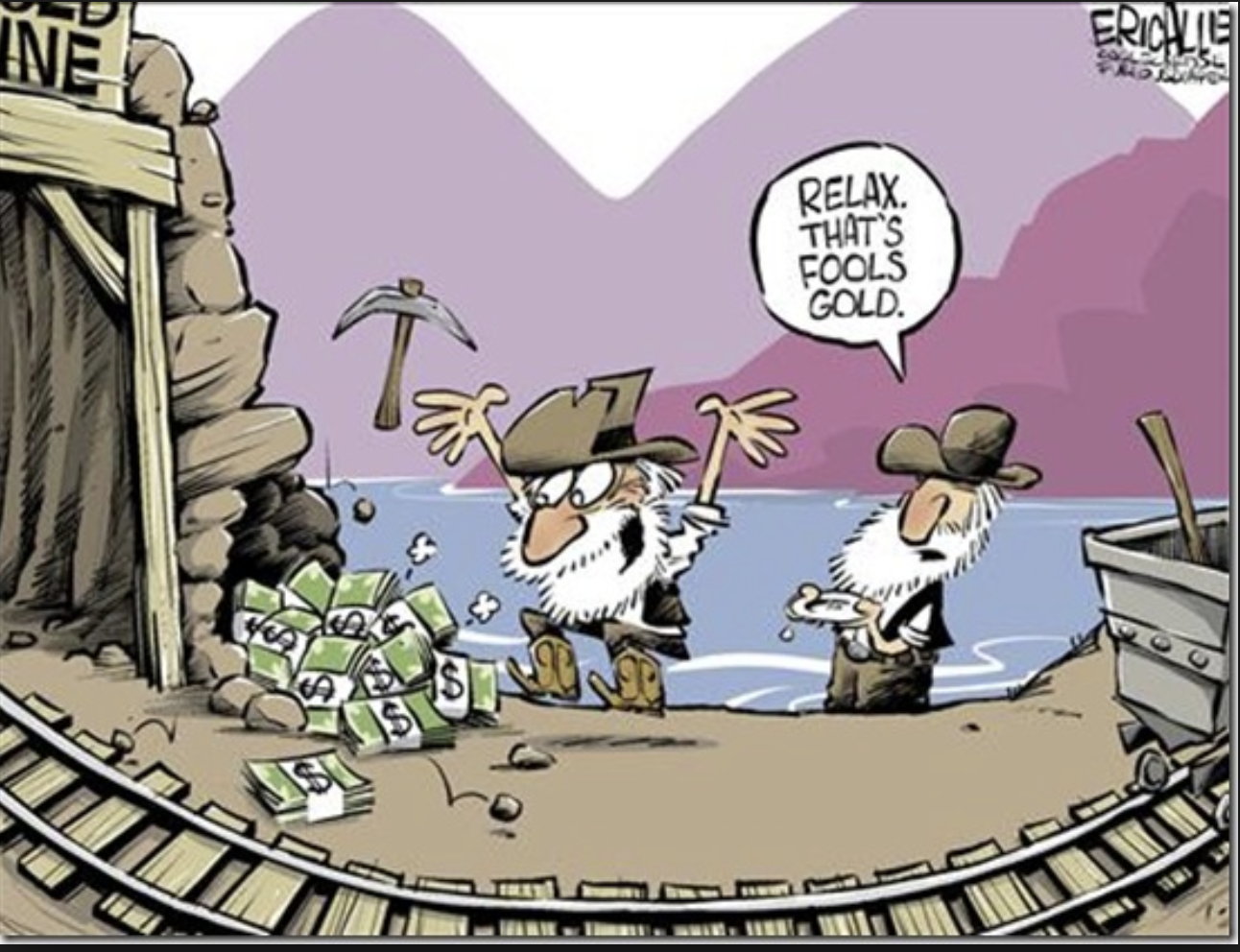

A lot of respected people, for example Doug Casey, used to say that cryptocurrencies are "backed by nothing” and therefore somehow inferior to the “full faith and credit of the US government”. But they have since changed their tunes after realizing that cryptocurrencies have far superior backing to those of big banks or governments. In fact, because of their immense power and faux legitimacy, there is no worse counter party than a big bank or government.

You would be far better off backing a currency with shares of Apple Stock, which is at least somewhat accountable to its shareholders and sensitive to its public reputation.

Cryptocurrencies can be backed by many things, including Apple Stock or gold in a reputable depository in a state that recognizes gold as legal tender (e.g. UPMA in Utah). In these cases there is still some counterparty risk in that either company could come under government coercion or internal scandal. But even in such cases, they would have some degree of backing value. If the backing collateral (value of the company) is more than double the outstanding currency, then this risk can be largely mitigated.

But the reason cryptocurrencies were invented is to completely remove counterparty risk. If you think of Bitcoin as the Decentralized Autonomous Company (DAC) that it is, and think of bitcoins as “shares” in that company, and the service performed by this company is to transfer ownership of those shares to anyone else in the world, then bitcoin is backed by the demand for its services and speculation about that demand - just like Apple stock.

Except that no one can seize your bitcoins like they can seize your Apple Stock.

Fancier unmanned companies are an even better counterparty free backing. BitShares is a smart coin factory and decentralized exchange and BTS is thus backed by the value of such a counterparty free, highly useful unmanned company. Priceless.

About the Author

That sounds like something i would say!

~ @bluerocktalk🖖

I am truly amazed at how many gold bugs that I used to listen to have flip-flopped and now are into the crypto's.

Gold and silver are manipulated for now, but they will have their day again so I recommend buying bitshares and HODL your gold and silver!

You have no idea! I first heard of Bitcoin through the Mises Institute's blog back in May or June of 2011. The entry reported on the hacking of Mt. Gox - yes, it was hacked in 2011. That post and related ones intimated that Bitcoin was a "pet rock" standard; mainstay commenters on the blog made it explicit. I still remember some Bitcoin evangelists holding their own against the "only gold is money" flak in the comments section.

Fast forward three years, and the Mises Institute starts accepting Bitcoin. It's now a Bitcoin booster.

Same with Zero Hedge. In early 2014, the mainstay commenters there were dumping on Bitcoin whenever it was mentioned in a post. There was a localbitcoins seller named Fonestar who seemed to delight in being the lone man arguing against a whole crowd: that's what he was doing. Again, the same scoffing: only gold and silver are real money, Bitcoin is a phantasm, etc.

And look at ZeroHedge now!

@stephenkendal is one of the folks who crossed over from precious metals to cryptocurrencies. That's why he still makes comments on gold and silver stocks; he had a legacy following on Twitter from his gold- and silver-bug days.

Another one, interestingly enough is perennial bull and #Monero whale Risto. He came into Bitcoin after getting out of dealing silver. He made a lot of money, some of which he rolled into XMR, but he was also notorious for hysterically predicting that Bitcoin would skyrocket to $1 million a/o 2015 - and then checking himself into a Finnish mental hospital after a nervous collapse. Still, the fellow's made out damned well and he deserves some admiration for sticking to his guns.

Now that you've broached the subject, I wonder how many crypto-rich will transfer some of their gains into gold and silver.

This is interesting stuff NXT..thanks for sharing...cheers friend

Man brother you know your stuff, just picked up a new follower!

Thanks, and likewise!

I agree! I like to ask people this, "what if every time you posted, commented or liked something on Facebook, you earned a fraction of Facebook stock? How much stock would you have today? We'll FB doesn't give you stock for engaging...but Steemit.com does! Check it out!" That analogy has started to turn heads. I do agree the coins are like stock in companies like Apple! Thanks for the post!

That is a great point. Facebook I think Steemit is far advanced and a contender for one of the best DACs of 2017.

Sadly most of the people who I told about Steemit told me AGHH that is a scam, it is a scam WHY WOULD I make any money just from commenting, sadly some people will never change the way they look at "crypto world" and Steemit until it beacomes mainstream

Yeah, I get that quite a bit as well. If they don’t get it now they will soon enough, it’s the ones who adapt early that will get the most rewards!

And this is why I love BitShares :)

Bitshares,Steem and EOS-in Dan and Stan we trust!

@stan,

Who backed Fiat? For me no one! Banks (Central bank of the country) make them in the thin air. There are no ledger how much of Fiat printed and how much of fiat in the market place.

But in crypto world, everything is in a ledger. So if someone says crypto is not backed by anything, I would like to say, whole world backed it, only banks hate to do that :D Coz they fear to hear the truth!

Cheers~

The one thing I think most people overlook with the BTS exchange is being able to quickly swap into gold, silver, and fiat backed coins (bitUSD etc). My one gripe with the exchange is not being able to trade many of the top100 coins, @stan is there any plan to add more coins, I see some on there like OMG, but I don't know how often they are added or the process that needs to happen for them to be added.

I also like the bitMetals markets. It is interesting to see how new DEX users will interact with AG & AU.

Unfortunately at the moment only Gold is tradable - Silver is in a global settlement period.

So was the Mises Institute a/o 2011, when I first heard of Bitcoin (through one of their blog posts.) I have to say, the Bitcoin evangelists in the comments section did hold their own: so much so that I almost signed up for Bitcointalk back then so as to write a post on why Bitcoin did satisfy Mises' regression theorem. In part, because the "only gold is money" crowd struck me as peremptory.

I didn't sign up then because I choked: after looking around about hackings, I saw "keystroke logging malware" and went into nerd fright. That fright combined with writer's ego caused me to choke.

Bitcoin, and of course Bitshares, are a real treasure for economics in that they're living case studies about how speculation can create real value down the road. I'm painfully aware of how much of an outlier this is. But Bitcoin, and of course, Bitshares, managed to attract a whole crop of doers who had great ideas but lacked the capital to implement those ideas. The rocket-up of crypto gave them the capital, or at least the confidence, to go ahead with the implementation.

Here's a quick hypothetical example: imagine an alternate me who was not frightened off in 2011. "I" bought 1,000 Bitcoins in '11 and held onto them until Bitcoin broke $1,000 at the end of '13. At that point, I feel a tug of obligation because I essentially rode my way up to affluence.

So, I buy a well-trafficked store, equip it to accept cryptocurrencies in payment, stuff crypto brochures in the bags of every customer, and put a big sign on the front window saying "Bitcoin Accepted Here!" Even if the Bitcoin trade proves to be minimal, I'd still be evangelizing for Bitcoin as a straight currency.

Bitshares went through a similar growth. Its speculative value has attracted real businesses.

It's almost magical. As an important bonus, the ideology of decentralization has gotten a huge push because of crypto's huge collective market cap.

"Nerd fright". Well said. It's important to appreciate the difference between innovator/early adopter mentality and the general herd mentality. Predicting the herd response lets you have a lot of fun riding that wave up and down.

Cryptocurrency is backed by mathematics, cryptography, the internet, and the global distributed network of computer hardware and software that is the foundation of our technological society.

There is no better and safer backing than this. Much better and safer than gold or precious metals, which can be seized or manipulated by governments.

Bitshares, HERO, GOLD, SILVER - ALL SOUND MONEY

@stan your post is marvellous, it's absolutely out class. Its full of information about cryptography and it's help me a lot.

You are a excellent blogger.

Please support me

Thanks