China is selling US real estates while world economy is contracting

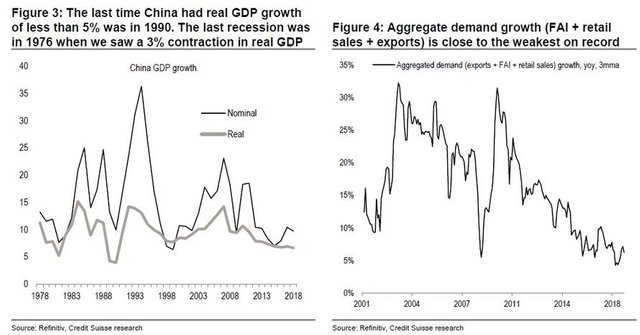

At first, two very important facts: The last time China had real GDP growth of less than 5% was in 1990 and their last recession was in 1976 when we saw a 3% contraction in real GDP!

The tensions are still heating up. Clearly, investors are not waiting for resolution. Many individuals and businesses have been selling off U.S. assets. But of course this isn’t directly related to the trade issues but it is compounded through uncertainty. Countless economic indicators have piled up showing that China’s slowdown is still continuing despite the rhetoric that everything is doing "just fine".

Chinese purchases of U.S. real estate last year dwindled to their lowest level since 2012, as Beijing kept up the pressure on Chinese investors to bring cash home during a period of worsening economic growth. Insurers, conglomerates and other investors from mainland China were net sellers of $854 million of U.S. commercial real estate in the fourth quarter, according to Real Capital Analytics. That marked the third-straight quarter Chinese investors sold more U.S. property than they bought, the first time ever these investors have been sellers for that long a stretch.

source: wjs.com

source: zerohedge

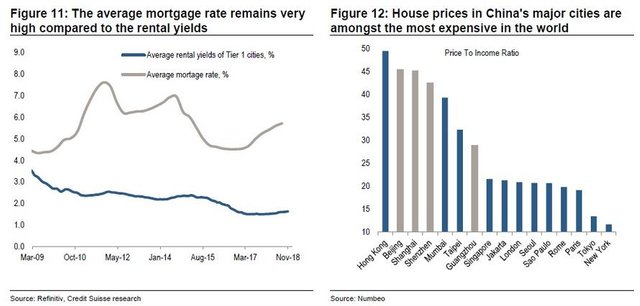

The left-hand chart is talking about the average mortgage rate, remaining very high compared to the rental yields mortgage rate. It's just interesting to see that specifically on the right-hand side, house prices in China's major cities are among the most expensive in the world!

We're looking at the price to income ratio and to give you an idea - the very very bottom of this list is New York. And New York is excessively expensive and we're not just talking about dollar terms. We're talking about price to income. So, wages that the average person makes and what the average home costs.

Left part of the list is much more expensive in terms of price to income than New York. You go along with that and you start to see these Chinese cities on the left. Hong Kong at the top of the list! it is insane. The highest on this list and there is no possible way that the average person is able to afford a place. There's just not a possible solution to this. They can't do anything to make it more reasonably expensive for people by let's say giving them money every month or letting them use some sort of tax credit. It's far beyond that.

So, we need to start asking ourselves:

Who do these assets (being priced at this level) really benefit?

Wouldn't it make more sense to have these assets like real estate be priced at a semi realistic level? Well of course not! That's ridiculous ;)

source: zerohedge

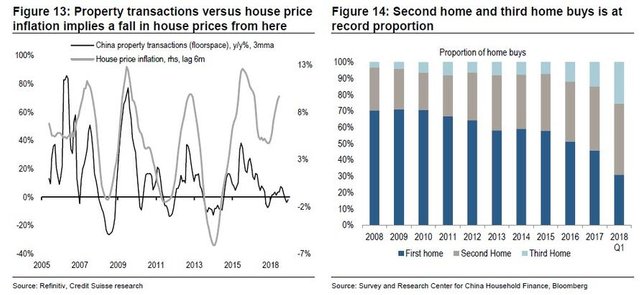

As most people say anyway, they feel very rich when their homes go up in price. Many people are using their home as an investment. They've been doing so for quite a while and it's only getting worse. Second home and third home buy is at a record high. Trend of home buys can be seen on the right side. As the years go on, they're purchasing more second and third homes. This data actually goes back into the first quarter of 2018 but it's very valid today. But that remains to be part of a issue in the future - property transactions versus house price inflation implies fall in house prices.

source: zerohedge

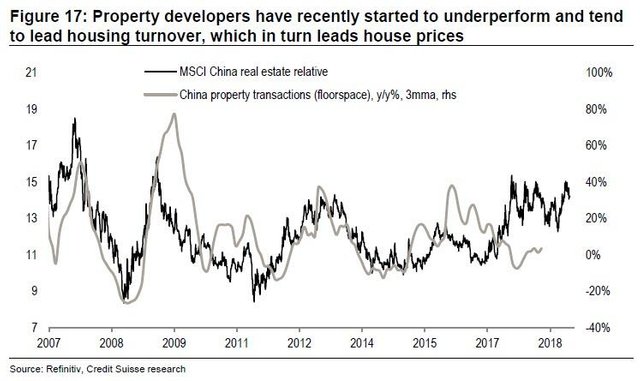

Future property transactions versus house price inflation implies fall in house prices. When you look at China's property transactions you could see the decline from 2015 up until present. On average it's been declining. And the house price inflation while it has moved up... this tends to be an indicator that we will see a decline. You can see the property transactions, which will in fact have to track and trace the behaviour of MSCI China relative.

source: zerohedge

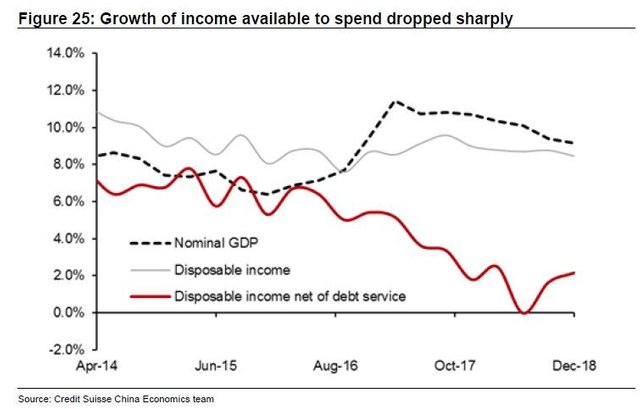

Growth of income available to spend dropped sharply. You can see the red line disposable income net of debt service and that has declined.

The last time China had real GDP growth of less than 5% was in 1990 and their last recession was in 1976 when we saw a 3% contraction in real GDP

Real GDP continues to decline. It's very very important to address, what has happened in China today. They're saying it's over 6% however we need to really come to our senses in reality. Take a look at the chart above. You can see what has happened since basically what we had here was the year 2000 when it rises like crazy and then there is a major contraction towards the financial crisis but after that continued his trend on the way up very rapidly. And then it didn't take long before the stimulus wears off and you can see that demand really really sliding down.

I hope you understand where is all this going.

@onepagex

Curated for #informationwar (by @wakeupnd)

Ways you can help the @informationwar!

@worldfinances, tvoja objava je dobila 100% upvote od @teamslovenia!

Kako dobiti upvote?

⚫ Pridruži se nam v Discord strežniku!

⚫ Uporabi TeamSlovenia upvote bot!

Kako lahko tudi ti pomagaš, da bo @teamslovenia bot močnejši?

⚫ Delegiraj steem power - 50 SP - 100 SP - 500 SP - 1000 SP - Po želji!

⚫ Sledi upvotom od @teamslovenia - Navodila

Ta projekt podpira Steem Witness @fbslo - Glasuj zdaj!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by WorldFinances from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

$upvote YOUR-POST-LINKand you will receive upvote on your post.Hi @worldfinances

As a follower of @haccolong this post has been randomly selected and upvoted by @hoaithu's Curation Trail with 20upvotes

This is random free upvote daily when you follow @haccolong

Hello, as a member of @steemdunk you have received a free courtesy boost! Steemdunk is an automated curation platform that is easy to use and built for the community. Join us at https://steemdunk.xyz

Upvote this comment to support the bot and increase your future rewards!

Dear @worldfinances

Amazing piece of work guys. I'm following any news from china and their property market as much as I can and reading your post was very thrilling :)

Would you happen to know what caused Chinese economy bull run in past few years? There must be some real reasons why their economy started booming so far in recent years?

It's worth to mention that "rental culture" doesnt exist in China. So most of purchased appartments are nothing more than "store of value". Very speculative.

Yours

Piotr

You are right. Over 90% of flats in China are bought up. But over 20% of all bought appartments are bought by the state! And those appartments are empty. They are doing that, so that they can make new loans, new credits, print new money... the only difference is that China and Russia want to make gold reserved money. But if this will keep up in same pace, China will end up same way as Japan. And..why their economy started booming? Which big corporations are doing business there? Apple, Microsoft, Nike, CitiCorp, Cisco Systems, Dell Computer, DHL, ..... all around 300 really big firms, doing business. For decades. And China took a lot of ideas and made their own software, their own cars, their own computers....and so on. Why wouldn't they prosper. But you can do that only for short time.

Thx for your comment @worldfinances

would you consider using enter sometimes to separate blocks of text? it would make reading much easier :)

yours

Piotr

That would be no problem. I just have to get used to that ;)

Dear @worldfinances

Thank you for your previous comment. And Im also sorry for such a late reply. I wonder if you even will read my comment ...

ps.

I NEED YOUR HELP :) Nothing serious really. But I still hope you can spare few minutes of your time :)

I found out about great contest where winning community can receive a year's delegation worth of 20k SP!

I realized that receiving such a delegation could help greatly to grow our community. After all I'm upvoting each valuable comment. On top of that, I'm doing my best to promote quality content published by other authors and again: I like to reward those who engage with those authors.

I know that it's probably a long shot and most likely our community won't stand a chance in this contest. But I love being the underdog! Let's give them a fair fight :)

Which brings me to my next question, I was wondering if I could count on your support? At this stage I would only need to ask you to comment this post and suggest myself for the contest. Perhaps you could also make another suggestion: @ help.venezuela (this is run by my dear friend @ achim03).

https://steemit.com/dpoll/@theycallmedan/20k-steem-delegation-poll

This is just a first round attempt. I hope we can make it to second round hahha :) Naturally I would appreciate if you could ask your friends to help with our little "quest" :)

Let me know what you think? Perhaps you can also share some advises and hopefully we can "do little bit of brainstorming". Would be awesome to win :)

Yours

Piotr