Stock & Bond Markets No Longer Believe

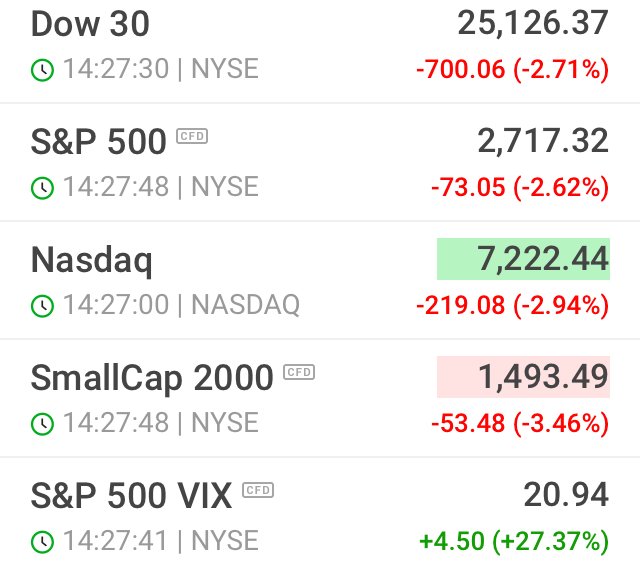

Last week was a green week for the markets thanks to the Powell put on Wednesday & tariff propaganda being gamed over the weekend & into Monday.

Let’s think about Powell first, the fed chairman’s public perception turned dovish after his statement last week. He basically said we are closer to a neutral rate than previously thought & that policy decisions would be data dependent. The market interpreted this as bullish news, perhaps thinking the Goldilocks market can continue forever with the perfect rate manipulation strategy.

The reality is, there has never been perfect interest rate manipulation in history & crash history suggests the Fed raising interest rates starts the end of a growth cycle & when something finally breaks (rising rates = unmanageable debt) they stop raising rates & lower them again to try & lessen the blow of the crash. By that time everyone from the upper middle class down has lost a huge chunk of equity in there home & any stocks or bonds they had the misfortune of holding.

The market knows these cycles well, yet Powell’s statement was interpreted as bullish because of the backwards thinking bad news is good news feedback loop the Fed has created via stimulus & cheap debt. Eventually that cycle breaks & leaves many greedy or perhaps just ignorant bag holders.

When I hear the Fed say we may have to slow the hikes combined with interest rate trajectory over the past cycles I see a giant contraction ahead. Deflationary crash style at first (debt cancellation is deflationary) & then hyper hyper inflative stimulus if we even get there before some type of reset. Guess that is why I’m not a short term trader.

The Trump & Xi meeting was also pretty meaningless news to me. They just agreed to kick the can slightly down the road & the media tried to make it out to be a really great success for the market. That rally faded pretty quickly yesterday & I was not the least bit surprised. Wouldn’t have been too surprised to see it shoot higher either, though, “buy the fucking dip” has trained many buyers over the past few years. I’m still waiting patiently on reality in the markets

Today looks more real, almost giving back all the Powell & tariff gains in an instant.

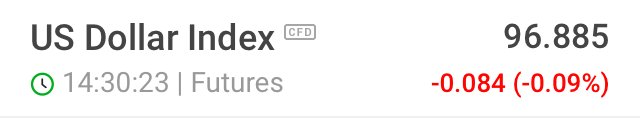

The dollar is pretty flat

Commodities doing pretty well today. Gold has crawled above 1230 resistance for the first time in awhile. If gold ever gets the momentum to truly break 1350 in usd, there will be a historic gold rush. Silver is historically cheap right now.

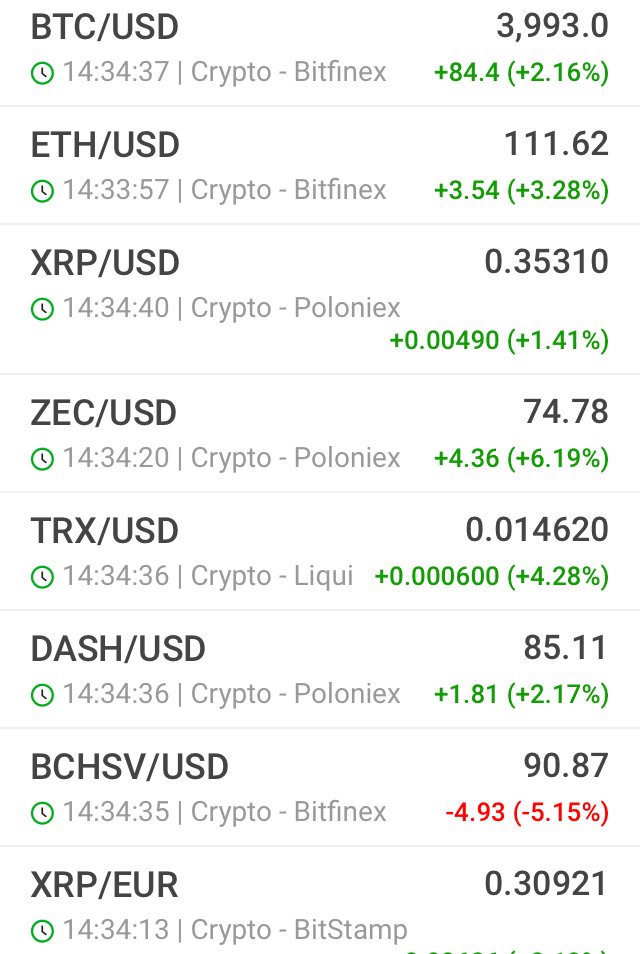

Crypto’s have been bouncing around this morning & prett volatile lately since the renewed sell off. I expect them to get beat up with the big markets for awhile if there is pain. Perception management is most important to the big banks.

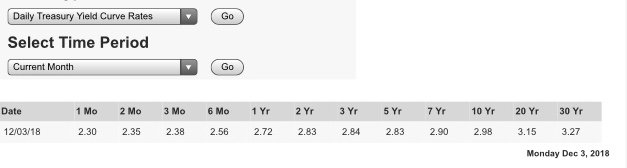

The bond markets are screaming right now: YIELD CURVE INVERSION!!!!!!! 😱

Straight off the treasury’s site👇 The 3year is officially yielding more than the 5year.....

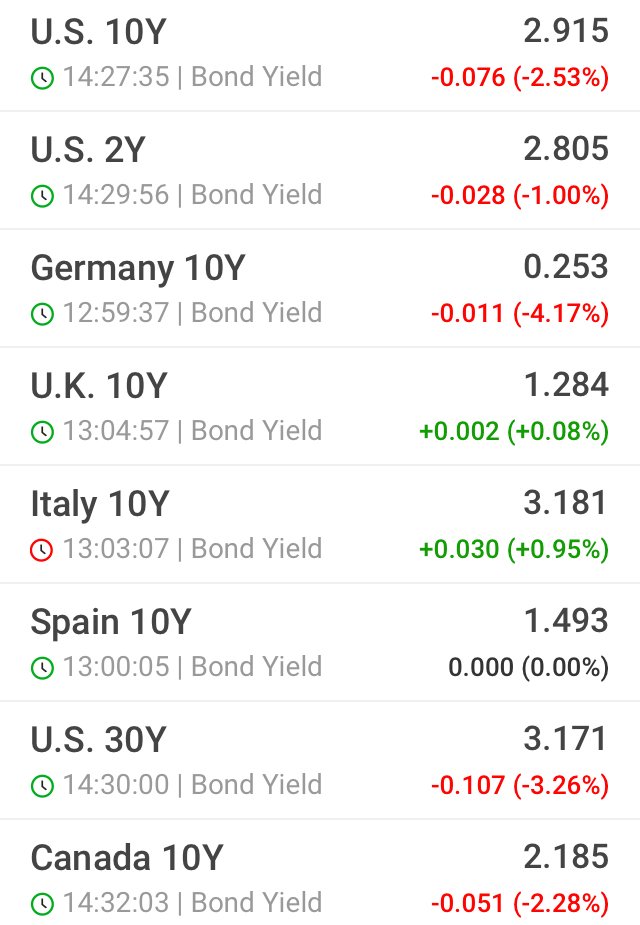

Look at the difference in movements today among the US 2, 10 & 30, not normal, not healthy.

Or how about that German 10y, one of the strongest economies in the world yielding .25% over 10 years 😂😂😂😂😂😂😂😂😂😂😂😂 Who in their right mind would buy that & why? Oh right, central banks do to manipulate currency & our lives. I almost forgot ....

The system is broken & needs redesign. There will be a lot of tough times ahead, but if people come together & put their resources in decentralized places we may have some hope of ending the artificially induced economic terrorism & tax slavery that is our economic system.

Do you care more about getting rich quick or changing things for the better long term?

I care about the long term and then the short term, usually in that order. Neither can be ignored though.

I agree with your post. Lots of knowledge dropped.

Perception management, yes. But are you implying the banksters control the crypto market?

Thanks, I love thinking about where it’s all headed & how we got to where we are.

I think big banks have the most ammunition to use & most to lose if decentralized crypto takes off. If I (evil me) were them I’d be trying to control the crypto market right now for sure. Top Priority

I think it's likely they want to control cryptos. But does that mean they're trying? Doing so would be detected, before long if not immediately. Even if we believe they ARE trying, are you implying they're succeeding?

If yes to all that, then why are we even trying to get free using cryptos if they're already under bank control?

I appreciate the depth of thought, helps me articulate my perspective

There have been some big money large anon wallets that have been popping up in the bear market from what I’ve seen. Could also be many smaller anon wallets, but maybe it would be detected either way. Maybe it already has been detected by someone, but what could they do?

Personally, I think crypto’s/blockchain are where things are headed either way.

The stock, bond & metals markets have proven to be rigged in all sorts of creative ways. Given that, I base a lot of my logic on how would bankers use their ammunition to influence behavior & perception into acquiring as many of the peoples assets as possible, especially during downcycles.

Can you imagine if crypto were allowed to run, like it did in 2017 (pre futures trade manipulation), in a 2008 style risk off environment? Fiats might die right then & there. So I think the game is to pop all the bubbles first, acquire as many real assets as possible & then start to move public perception to crypto. If possible. Things may break too badly before all that can happen this time

I could obviously be completely wrong, but is my honest opinion of where things are currently headed.

Congratulations @ceattlestretch! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Hello @ceattlestretch! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko