TIB: Today I Bought (and Sold) - An Investors Journal #246 - Japan Govt Bonds

Markets are quiet despite the North Korea news. Central Banks hold central stage with key meetings this week. Quiet day for trading with only JGB's rolling over in the week of a Bank of Japan meeting. US Courts open up the vertical doors.

Portfolio News

Europe Muddles Europe does what Europe does best - it muddles. The headlines are clear.

They got bullied by Donald Trump with the tariffs and in the lead up to the G7 meeting and at the meeting. Maybe the time has come for Europe to follow Politico's advice - plan C = fight back. The article is a good read.

https://www.politico.eu/article/europe-nato-time-to-stand-up-to-donald-trump/

The migrant issue has been another example - muddle along, try to accommodate the refugee flows, try to spread the pain around a bit, bully the countries like Macedonia that close their borders, etc. Then it becomes too much and the time to play hard has gone.

Quite frankly as I read the European Central Bank headlines it feels the same.

Like the Federal Reserve, they said they would be data driven. The growth data is clear. Inflation data is not clear yet. The US direction is clear on growth and interest rates. And the easing has not begun - muddles again - "close call" indeed. I will not be surprised to see the ECB still needing to raise rates when the US starts to lower rates as the next recession rides into their end of town.

No surprise in my portfolios to see Europe down on a day when markets should have been celebrating the next key step in normalising the situation on the Korean peninsula.

US Markets US markets did not respond to the Korea story either. They seemed to be more focused on the Federal Reserve meeting which began during the day.

There is a part of the headline that interested me - fund managers are overweight US stocks for the first time in 15 months based on a survey of global fund managers

The increased U.S. weighting came at the expense of emerging-market and, in particular, eurozone exposure, the survey found

I have noticed this in my portfolios with a strong bounce in US Retail performance - up 24% since July 2017. So much for the demise of retailing. The talking heads were not talking about US markets this morning. They were focused on the Federal Court decision that approved the AT&T bid for Time Warner.

This decision has wide reaching ramifications for markets and industry structures. The Department of Justice had overruled the acquisition because they said it amounted to a vertical consolidation in an industry and was potentially anti-competitive and thence bad for consumers. The court disagreed.

Why is this important? It opens up the potential for other mergers in the media industry with broadcasters/network owners able to acquire content providers. This level of merger activity changes potential valuations in the media and broadcast/network industries (especially increasing the value of commodity network providers). More than that it changes to prospects in other industries where vertical integration has been blocked - e.g., in health care.

Shorts

Japanese 10 year Government Bonds (JGB): June futures expiry date arrived. Automatic rollover of futures to September futures closed out 3 contracts at 15085 for 0.09% loss. The worst part of the rollover process is the September futures were listed at 15059 - a 26 basis points difference trading from one day to the next. This tells me clearly that expectations are for at least one rate hike in the next 3 months.

For the 3 month life of the June 2018 futures, overall trading profit was 4 basis points = ¥265 => not enough to buy a cup of coffee but a step in the right direction on this trade. I am reminded of the conundrum my coach used to present

- Stop doing what is not working

- Keep doing what is working

- Let options/futures run to expiry

- The minute you stop a programme is when it starts to go right.

This is one of those.

Expiring Options

Qualcom (QCOM): My short term Qualcom trade is due to expire this week. Price is hovering above and below the sold call strike (60 - the red line). It looks like a late night on Friday deciding what to do. The bought call was at $55 which looks safe now. If price finishes above $60 the settlement will be to take delivery of stock at $55 and assign at $60 and bank $5 per contract profit. If price finishes below $60 but above $55, I have to take delivery of the stock at $55 and I get to keep the premium on the sold call.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $419 (6.1% of the high). Price drifted away from the recovery level and then collapsed to test the lower support level. Momentum indicators are strongly oversold though that means nothing when sentiment goes sour.

Ethereum (ETHUSD): Ether price action looks somewhat like Bitcoin price action in that it has broken below the previous support level (the dotted green line). There is a support and resistance area that was respected in April as a support level and in December as a resistance level (the dotted red line). If price breaks below that it will be something of a free fall down towards the next level (the blue line)

CryptoBots

Outsourced Bot No closed trades on this account (212 closed trades). Problem children was unchanged (>10% down) - (17 coins) - ETH, ZEC (-44%), DASH (-47%), BTS, ICX, ADA, PPT (-55%), DGD (-48%), GAS (-55%), SNT, STRAT (-42%), NEO (-53%), ETC, QTUM, BTG (-54%), XMR, OMG.

ETC did improve after Coinbase announced they would add it to their exchange moving from -47% to -38%. PPT is now the worst at -55% and has GAS, NEO and BTG for company in the -50% group.

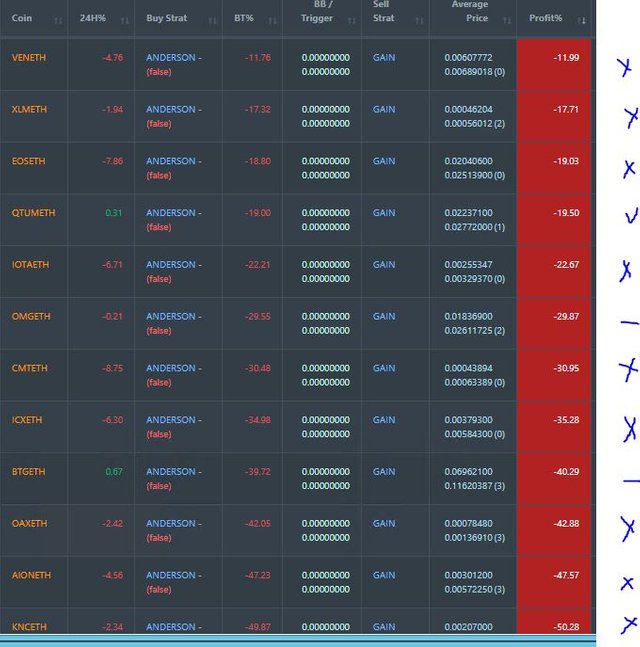

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 1 coins (QTUM) improving, 2 coin trading flat and 9 worse.

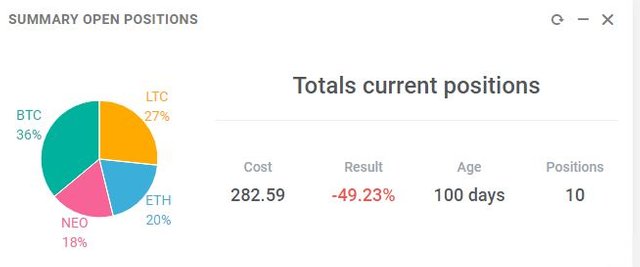

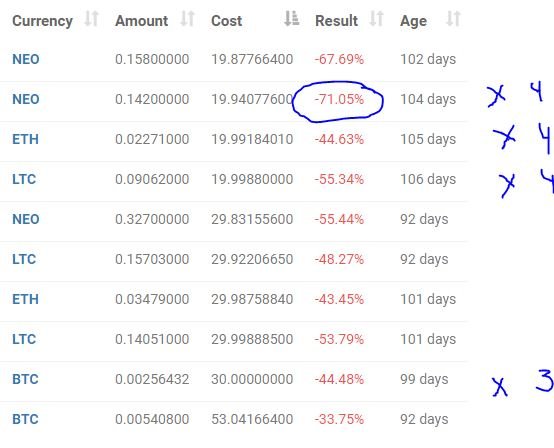

New Trading Bot Positions dropped another 4 points to -49.2% (was -45.4%).

All coins traded 3 to 4 points worse with NEO dropping below -70%. This is a long waiting game now over 100 days.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 0.56% (lower than prior day's 0.58%). Forex markets are quiet ahead of the central bank meetings this week in US, Japan and Europe

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Politico. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 12, 2018

Upvoted ($0.14) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

It's crazy how retail came back, I remember shorting Macy's last year from $34 to $18. The only thing that matters is sector rotation and where the Smart Money is rotating their money into what sector.

I did see the signs and wrote them up in TIB113 and TIB149. A quick chart update on the buy:sell chart I used then - SPY vs XRT. I was early in July and I got the turnover perfectly in January.

The pattern is clear now. The economy will keep that running for a while. The tricky (smart) part is going to be timing the exit before the whole shebang goes pear shaped.

Very nice. During the last Macy's earning call before I got out, there was news that call options shot up, I did't understand until after the earnings when price shot up...that was the Smart Money getting in, so they timed it perfectly as well.

Incredible @carrinm, a useful post, I really support this program.

Thanks

hopefully you can also do it in Indonesia. @carrinm

When all the interest rates stuff settles down I will be investing back in Indonesia. Maybe it will be better to invest directly on the Jakarta exchange rather than via US-based ETF's

I also think so, I will invest directly through Jakarta stock exchange. Thank you, good luck always on your side. :)