TIB: Today I Bought (and Sold) - An Investors Journal #276 - Australian Bonds, Philippines, French Electricity, Oil Services, Europe Supermarkets, US Interest Rates

Interest rates are on my mind. Markets focus on earnings. Profit taking in oil services, supermarkets, interest rates and electricity. A contrarian bottom fishing trade in Emerging Markets. Bitcoin and Ethereum prices tumble with SEC postponing the Van Eck Solid X Bitcoin ETF decision.

Portfolio News

Market Jitters - Tariff Tantrum Markets are focused on US earnings which showed a post GFC high for the number of beats of estimates. Higher oil prices helped too.

This despite the news of an increase in the tariff rate from 10 to 25% on a range of Chinese goods to be implemented on August 23. Pressure is building across smaller businesses with rising input costs which they may not be able to pass on to customers. We can only guess how Donald Trump, who follows public opinion closely, will react.

The PBOC did ask Chinese Banks to exercise caution in trading the Chinese currency - that worked to bring the USDCNY down a bit (700 pips).

Interest Rates The debate on interest rates is beginning to heat up.

Today we have Jamie Dimon, head of JP Morgan, saying that 10 year rates should be at 4% (vs 3% now) and markets should prepare for 5% as the US deficit has to be financed and yields on offer will need to rise to attract investors. I am going to guess that JP Morgan is already positioned to be well short

Meanwhile in Japan and Europe there is something of the order of $9 trillion of negative yielding bonds in issue. This is a massive divergence in interest rates which as to unwind somehow. The table shows 10 year government bond yields across the world

https://tradingeconomics.com/bonds

The challenge is in the timing with the European Central Bank committed, subject to data, to reducing their bonds purchases in 2018 and to raising rates through the summer of 2019. And the Bank of Japan remains committed to zero yield on the 10 year JGB's, though they have intimated some flexibility.

I was watching interest rate markets overnight - they all took a nudge up again together. Note: these are price charts - price down = yield up. US: that last red bar grew bigger as I was watching and I had to cut and paste twice to get this one.

Europe nudges lower

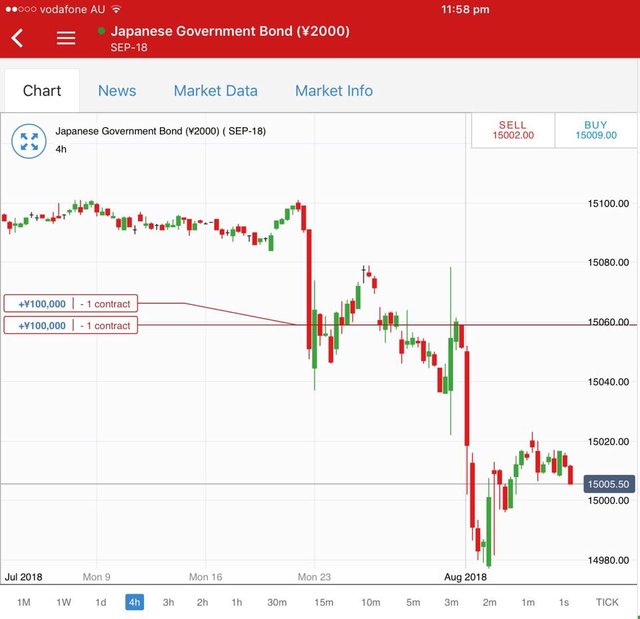

Japan too

I watched a Real Vision video of a trade idea to short international bonds to trade this divergence, as something of a hedging trade. The idea was to sell short a German or French or Japanese Bond (say the 10 year in each case) or to short an international Bond ETF (Vanguard's BNDX was a suggestion). The view was the carry cost would be low [Means: Paying the interest to the person you borrowed the bonds from] and the forex risk was low when it came time to buy the bonds back (because they expect the rates differential to keep the US Dollar stronger than the Euro or the Yen). One way to fund the carry cost is to buy a fixed interest bond or bond fund in your own country and use the coupons received. Ideally one would look for a bond or fund that has low capital risk (hard when rates are rising). There is an options market for the BNDX ETF which only goes out to March 2019. With a closing price of $54.63 a strike 54 put option would cost $85 per contract (1.6% of strike). The problem is March 2019 is before the projected rate rise date set by the ECB.

I have toyed with doing this but have chosen to stick with being short the European futures markets on 3 month interest rates (Euribor) with December 2020 expiries and shorting Japan 10 year Government bonds using CFD's. This way I do not have to fund coupon costs though margin requirements are higher. Currently I am exposed to ¥2 million short JGB's and €4.75 million in Euribor futures.

An alternate way to run this trade is to be long European or Japanese banks. This trade has the bonus of including a dividend yield though it does require more capital.

Bought

iShares MSCI Philippines ETF (EPHE): Philippines Index. I was watching one of the talking heads on Bloomberg TV (Komal Sri-Kumar) talking about the trade war and the implications on the Chinese currency. He was projecting the currency to drop below 7.00 - I agree. Longer term (5 to 10 years) he remains very bullish in investing in China and in certain emerging markets. He set out his criteria: modest current account deficits and foreign investment encouragement. He also talked about labour rates and availability. He mentioned Vietnam and Philippines specifically.

I have been invested in a range of SE Asian markets based on GDP growth and unemployment as a proxy for labour availability. Here is the latest table I use which shows how my investments pretty well cover the top 15.

Philippines has disappoointed despite the high growth and plentiful labour supply. Markets do not like President Duterte and the high inflation. I added to my Philippines holding to average down my entry price in one portfolio. I will continue to hold onto my current exposures in other emerging markets.

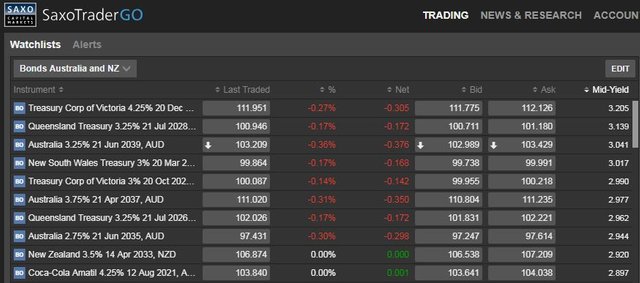

Treasury Victoria 4.25% December 2032 Bonds AUD Fixed Interest. I reinvested the proceeds of the maturity of Asian Development Bonds in these State bonds. The talking heads are all saying that the smart bonds strategy for maturing bonds is to buy short duration bonds in the event that yields rise and bond prices fall. If this is true, why then did I buy bonds maturing 14 years away from now? My view was the yield to maturity (3.19%) was higher than current Australian inflation and 14 years is long enough for Australia to go through another full cycle of raising rates and lowering rates. If I am right, I will be able to exit at about the same level I went in at. On the same day, the Reserve Bank of Australia kept interest rates at their lowest level for 21st month in succession. We are well into the bottom of the cycle - time enough to rise and fall again.

A quick step back to explain yield to maturity. The bonds are paying a 4.25% coupon and they mature in December 2032 = 14.25 years away. I paid 112.257 for a bond with a face value of 100 and I will get 100 back on maturity. Yield to maturity calculates the effective yield I will get if I hold the bond to maturity. The calculator adds up all the coupon payments I will receive plus the maturity amount and subtracts the amount I paid and annualises the result.

How did I choose? I looked for coupons that were higher than inflation and ran a calculator to get a sense of the numbers. I looked at Commonewealth government bonds, State bonds and some corporate bonds. Then I discovered that my broker allows one to sort the bonds they support in yield order (last column). I picked the highest one.

Credit risk is an important factor - I am happy with the credit risk of State government debt. Standard and Poors rate it as AAA.

https://www.dtf.vic.gov.au/economic-and-financial-updates/state-credit-rating

The list of the top 10 is interesting as there is only one corporate bond in it (Coca Cola Amatil) which was offering a lower yield to maturity than government debt with higher credit risk. I have read that a number of foreign (including US) corporations have been using the Australian debt markets to raise capital basically on a view on the Australian Dollar - called Kangaroo Bonds. My broker was not offering any of these. The bond that matured was a Kangaroo Bond.

https://www.reuters.com/article/australia-debt-bonds/kangaroo-bonds-make-duration-jump-idUSL4N1Q213K

Here is a link to a yield to maturity calculator. I did use it to understand the data my broker was presenting

https://www.investinganswers.com/calculators/yield/yield-maturity-ytm-calculator-2081

Sold

Beach Petroleum (BPT.AX): Australian Oil Producer. Research house had sent out a signal to close this trade ahead of earnings season before I went away. I kept the trade on but with a lower take profit target. That profit was hit for a 9% profit since June 2018.

Koninklijke Ahold Delhaize N.V. (AD.AS): Dutch Supermarkets. Stock has been languishing for some time and then recovered to pass the strike price. Closed December 2020 strike 20.03 call options for 40% profit since March 2015. Overall profit since purchase of options in May 2014 is 157%. The chart shows the value of long term options with the blue ray showing the bought call bought pretty well at the top of the 2015 run up.

Price traded in the RIGHT zone for some time and then fell over in 2015 by 25% before starting a recovery. The chart really tells a story of an impatient investor saying "at last I can get out". The next chart shows the next level of patience needed. It adds in the French Supermarket, Carrefour (orange line) which I have invested in (stock and options). I could do with a similar recovery story.

In my pension portfolio, I was looking to increase cash holdings. I closed out a few profitable trades to raise cash (the next 3 listed below). These sales do not reflect my fundamental views on the positions held.

Fluor Corp (FLR): Oil Services. Closed part holding for 7% profit since April 2016. Fluor price action is a good example of how markets tend to overreact to news and earnings. The chart shows the drop on prior earnings which was mostly dragged back by subsequent earnings.

I retain part of my holding in stock and am also invested in January 2020 call options (shown). I am strongly invested in oil services on the back of rising oil prices. I did look at buying on the past drop but chose not to as I was already well invested in Fluor and other oil services stocks including the Van Eck Oil Services ETF (OIH).

Electricité de France S.A (EDF.PA): French Electricity. Price has been holding comfortably above 13 for some time. As I am holding strike 12 and 14 call options I closed December 2019 strike 12 call options for 53% profit since March 2018.

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): Closed out a 98.5 strike June 2020 Put option for 177% profit since October 2016.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $484 (6.7% of the high). The SEC postponed the decision on the 2nd Bitcoin ETF application, this one made by Van Eck Solid X, and price made another dive towards the bottom of "no mans land" and is currently holding around the $6600 level. The bar formed a bearish engulfing bar which added to the news flow feels very bearish [Means: price moved up to take out prior day high and then dropped to pass below the prior day's low]

Ethereum (ETHUSD): Price range for the day was $43 (10.5% of the high). ETH price reacted more strongly to the ETF news and dropped 10% to break through what had been an important support level, directly to the one below (lower pink line). News that both Robinhood and Coinbase would be adding Ethereum Classic seemed to add to the bad news for Ethereum.

Price action on ETC suggests that a lot of ETH holders switched to ETC. Sadly the swing up in ETC was not enough to get a profit on one of my bot positions.

CryptoBots

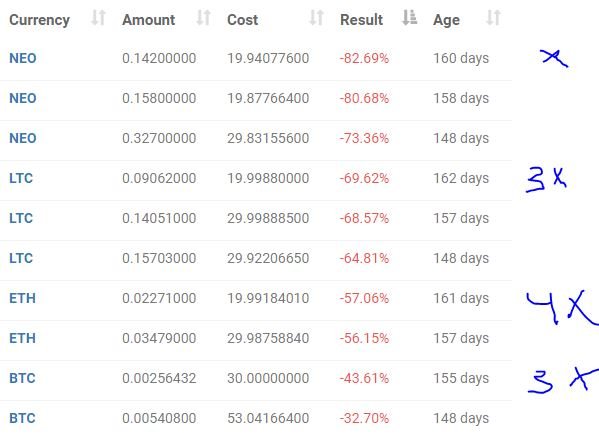

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-44%), ZEC (-51%), DASH (-63%), LTC, BTS, ICX (-73%), ADA (-54%), PPT (-74%), DGD (-66%), GAS (-78%), SNT (-46%), STRAT (-68%), NEO (-72%), ETC, QTUM (-65%), BTG (-69%), XMR (-41%), OMG (-53%).

On a day when BTC dropped 7% and ETH dropped 10% altcoins did a little better mostly only dropping a point or two. GAS (-78%) remains the worst performer.

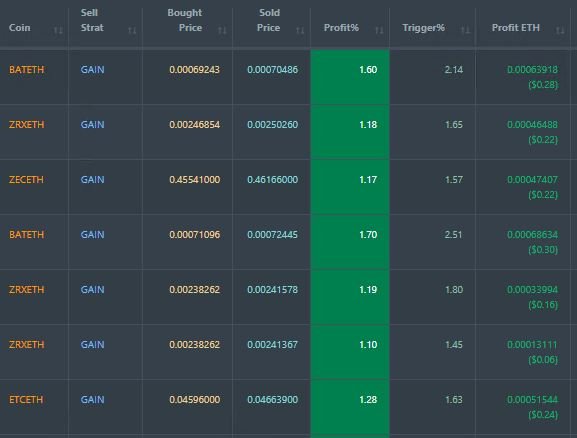

Profit Trailer Bot Thirteen closed trades (1.38% profit) bringing the position on the account to 1.03% profit (was 0.86%) (not accounting for open trades). These trades fully recovered the stop losses made while I was travelling.

One of the trades produced a small profit of only $0.06 - I increased trade size from 0.95% to 1.15% which means that I am running just under 5% capital at risk (before DCA)

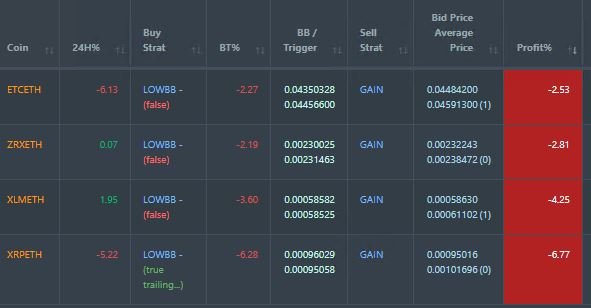

Dollar Cost Average (DCA) list is fully loaded with ETC dropping off and closing for profit and coming back on. If I have time today, I will begin testing PT Defender to manage the XRP position though it has not yet completed its first level of DCA.

Pending list remains at 10 coins with 3 coins improving, 4 coins trading flat and 3 worse. With the big drop in BTC and ETH, falls here were modest.

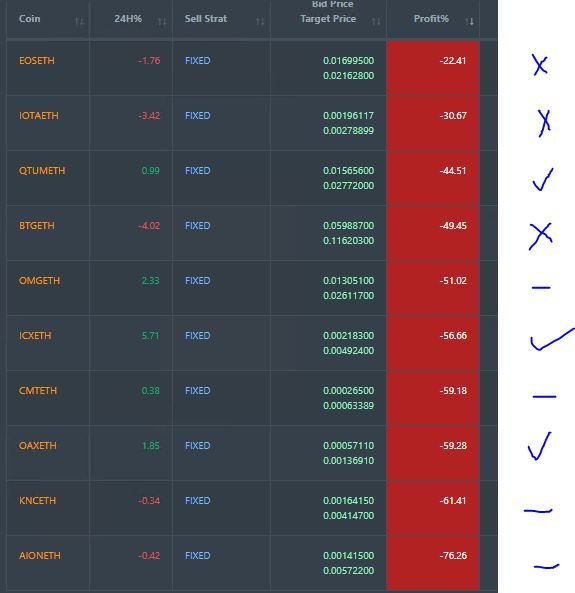

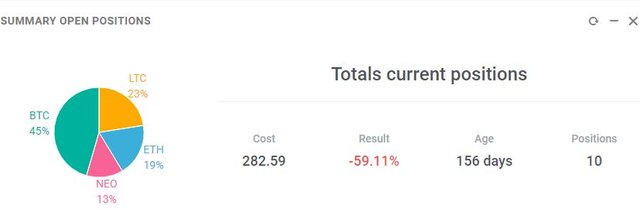

New Trading Bot Positions dropped 3 points to -59.1% (was -56.3%)

All coins traded lower with ETH the worst dropping 4 points. 80% down for NEO is ugly. The market wants to see a solid application emerging.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 5.2% (lower than prior day's 6.7%).

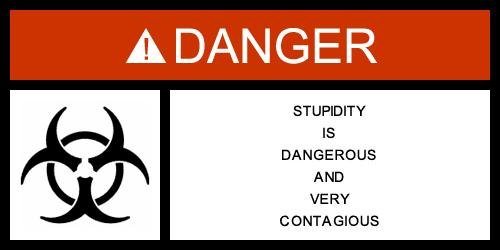

Rant Ahead: European Securities and Markets Authority (ESMA) has officially announced on Friday 1st June 2018 leverage cuts on CFD products that will come into effect on 1st August 2018. The net effect on this account is that margin requirements have gone up by 17 times. There is scope for retail investors who meet certain qualifications to be classified as professional investors. As it happens , my broker can also switch regulation of the products from Europe to Australia though this does require a new account to be opened. Either way a sophisticated investor has to do work to protect himself from an over zealous regulator trying to regulate for stupid. The tough part is "stupid will always do what stupid does" no matter the protections built in by faceless wonder regulators. Maybe this is what they are worried about?

Betacommand at en.wikipedia [CC BY 3.0 (https://creativecommons.org/licenses/by/3.0)], via Wikimedia Commons

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. Economy images come from TradingEconomics.com. Stupid image is credited below it. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

August 7, 2018

I guess an indirect impact of the interest rate volatility will ultimately lead to forex as well... I wonder if it will ultimately impact some cryptocurrencies at least indirectly. I guess we are in for a ride!

As I see it, interest rate differentials are the greatest driver of the big moves in forex followed by investment market shifts followed by trade. Speculation today that Donald Trump is going to try to weaken the US Dollar - he clearly does not understand interest rate differentials (and risk). Money is going to come flowing for those high US yields as soon as dividend yields drop in world equity markets. He will be sitting there like King Canute.

Thus far, what has got me interested in crypto is it is uncorrelated with these markets. That will change as the community of holders overlaps more with other participants.

Edits: Corrected ETF application from Global X to Van Eck Solid X

Solid post, do you trade forex at all?

I have had a go at it. I am not very good - so I tend to stay away now and rather do it via long dated options.

Re-steemed

Continuously succeed for you, I support you and your activities on this platform.