TIB: Today I Bought (and Sold) - An Investors Journal #360 - Australian Dollar

Market nerves are growing. Bitcoin bounces. I am staying on the sidelines apart from fixing my short Aussie Dollar trade.

Portfolio News

Market Jitters Return

US markets had a rocky day on Friday but did manage to close a little higher.

The China situation is certainly bothering sentiment. Monday news is a little more cheery as the Chinese New Year holiday is now over and the US trade delegation will have somebody to talk to in the coming days. These long holidays are never good for markets as they lose direction without data.

Interest rates did not like the uncertainty either and yields slipped also.

Uranium

Quietly moving ahead in my portfolios (from their depressed state) were a few uranium stocks - Centrus Energy (LEU) for example.

It is hard to pin down specifically what is driving the move up. There was a presentation at the annual Mining Indaba conference running at the moment in Cape Town pointing to a steady rise in prices on the back of improving demand and supply cuts which have created a supply deficit. Nuclear production is now back at pre-Fukushima levels. Supply contract deficits are being met from the spot market.

Part of the supply deficit has been a cessation of US supply from their denuclearisation process. I would suggest that US withdrawal from the US-Russia INF treaty has a part to play in changing sentiment. Centrus Energy is the business that manages the disposal of denuclearisation uranium. I did update the chart by adding in the new downtrend line which has been broken.

Currency Trades

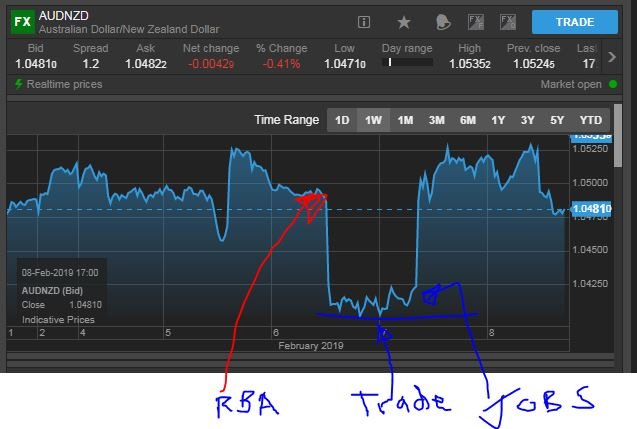

Australian Dollar (AUDNZD): I wrote in TIB359 that I felt my short AUDNZD trade was a dumb trade made worse by the poor New Zealand jobs report. I was encouraged when I watched the CNBC Options Action program talking about a few trades they made that were made to look dumb by earnings surprises (CMG and EXPE).

They said there are a few things one can do

- Review your assumptions to see if they are still valid

- Check the timing for expiry to see if there is time to recover

- Change some of the parameters and modify the trade.

I had done exactly that (before I saw the show). My key premise for the short AUDNZD trade was to be short the Australian Dollar following the surprise from the RBA that they felt the next rate change could be a cut. The next chart shows the impact of the two items of news flow. That chart told me my assumptions were fine.

AUD went back to where it came from before the RBA said anything = assumptions about AUD are unchanged by what happens in New Zealand. First thing I did was to add the other half of the trade buying a 1.0485 put option with the same expiry (before the February RBA meeting in 2020). The next chart shows that trade as pink rays. The breakeven (dotted pink ray) does not come up as much as the rise in strike becasue the option was more expensive.

The next thing I did was to sell a 1.0000 strike put option for the same expiry to span both contracts. That strike is just below where the 45% profit line is (i.e., matching the 2015 lows). That changes the profit profile to a maximum profit of 82% for the 1.0400 strike contract and 195% for the 1.0485 contract.

Outsourced MAM account Actions to Wealth closed out 3 trades for 0.32% losses for the day - they lost in that dip in the AUD.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $374 (11% of the low).

Just when I write

There is just nothing that looks like it will break the downtrend feel about the chart

price decides to make a break for it. You might wonder what happened. The clue lies in a 4 hour chart with volume attached. I am going to guess a steady build of volume from China at the end of the Chinese New Year Holiday.

Ethereum (ETHUSD): Price range for the weekend was $23 (23% of the low). Price followed Bitcoin in the first spurt, consolidated for a day and then made another higher high.

CryptoBots

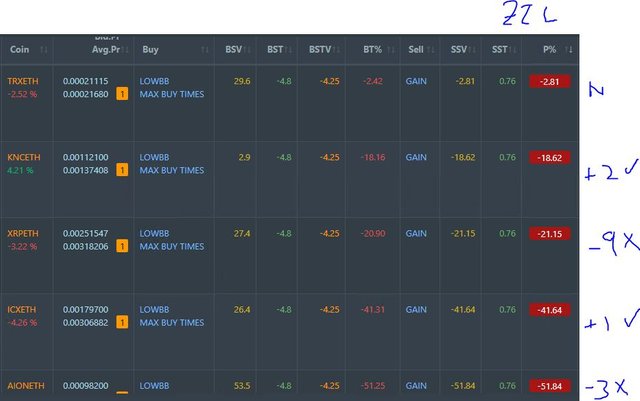

Outsourced Bot Not renewing.

Profit Trailer Bot No closed trades.

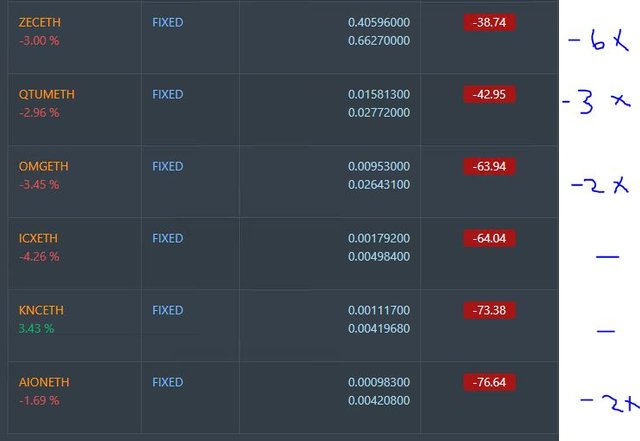

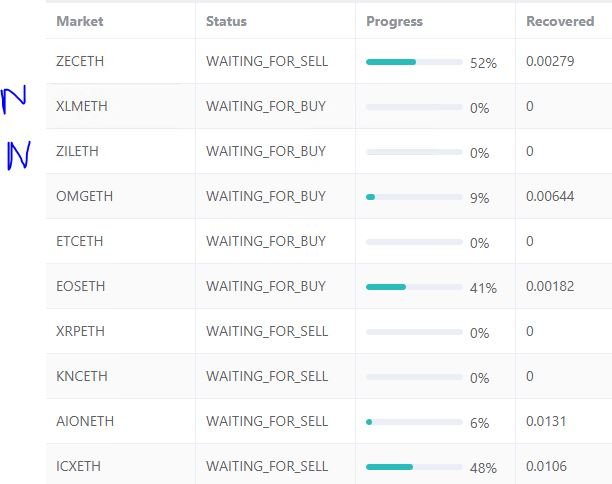

Dollar Cost Average (DCA) list remains at 5 coins with some changes. I started PT Defender defence on ZIL which I had missed noticing creep on the list. ZIL came off the list and was replaced with a new trade on TRX

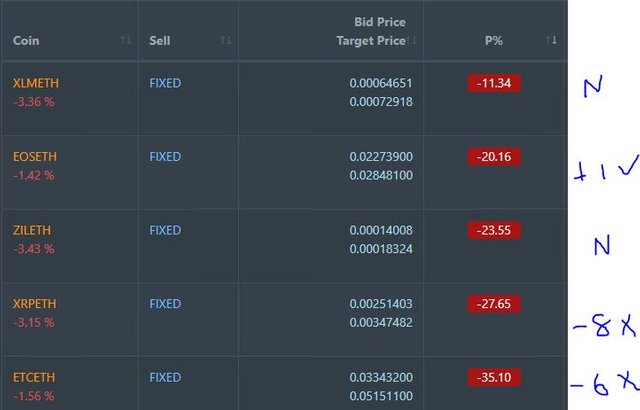

Pending list increases to 11 coins with two new coins (XLM, ZIL) added to PT Defender duties. Of the remainder, 1 coin improving, 2 coins trading flat and 6 worse. I had planned to close down the blacklist trades and focus on whitelist trading only. A big surge day for Bitcoin and Ethereum is not the time to make such a change - if the sentiment has turned more positive it will work its way through to the other coins in due course.

PT Defender increased to defending 10 coins with the addition of ZIL and XLM.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

February 8, 2019

I recall the Aussie Dollar being strongly correlates with metals. Is that still the case despite the recent declines in metal prices? I would suspect that correlation could grow if the commodity cycle returns.

Posted using Partiko iOS

It sure is - Gold, Copper and Iron Ore. BUT it moves also with Oil Prices.

Interest rate correlations are currently low as short term rates are lower than US rates and bond yields are about the same as US.