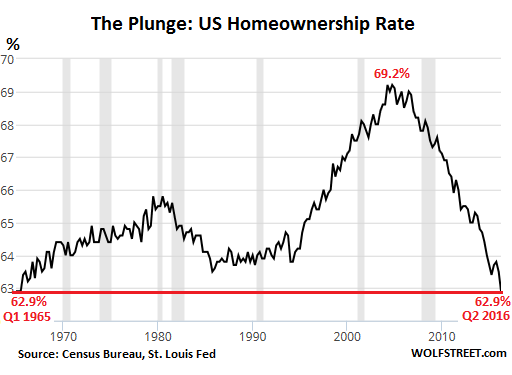

Home Ownership At Decades Low

Yesterday I touched a bit on how I think the housing market is going to be ravaged by student debt and other debts in general across the country. If you look at home ownership from the 1950s until now, you can see that we are at about the rates of the 1960s which is significantly smaller than the rate we have been in the last 5 or so decades. At the same time you can see rents are growing at a pace faster than income, so what is going on?

In simple terms, the housing market has been and continues to get consolidated by large corporations. In 2008 there was no sector hit harder than real estate, with mortgage lending grinding to almost a complete stop. Those who had physical cash or money during that time were able to basically get the deal of a lifetime. Giant developers and real estate companies that werent completely leveraged were able to buy up large chunks of property in various cities. New York, Boston, and LA all saw the consolidation of properties from many owners, to much fewer.

The reason consolidation is bad is primarily because it lowers the amount of competition for owners of properties and the prices of what you actually get are so ridiculous that the real estate companies are the only ones who can afford to buy them. They are willing to take a much longer return on investment if it means removing competitors. Rent is essentially being set at whatever people are willing to pay, which is a ton in places like Manhattan. This has pushed people into places like Harlem and Brooklyn, but now even those places are being actively purchased and developed.

Things are only going to get worse in my opinion, mostly because even at the ridiculously small interest rates we have now, people arent buying homes. What happens when interest rates go back up and there arent 4% mortgages available? People plain and simple arent going to be buying houses. The rent trap will continue and these mega real estate companies will just continuously consolidate. 2008 shook up a lot of markets but I believe these are the long term ripple effects happening before us.

The Federal Reserve keeps promising they will raise rates this year, but I doubt they can do it by much. There is a good chance the endless stream of cheap money is going to continue to flow into the economy because turning it off could be very dangerous. If you have the money and have been thinking about purchasing a home, it might be the time to do it, especially if you have a ton of job security. Mortgages are so low it also might just be a decent investment if you or a relative buy something to rent out. I tend to invest in REITs (Real Estate Investment Trusts) but if I had a more secure line of income I would probably buy something up.

-Calaber24p

no one can afford to buy a house

buy some bitcoin and you’ll get there ;)

Congratulations, you received a free 6% upvote from Sreeps Minnow Support.

If you would like your posts upvoted with a higher percentage or resteemed please visit my most recent blog for more details.

Very nice of you

This is really dependent on location. Here in CT, I couldn't imagine buying a home right now. They are overpriced for the average middle-class family. I'm holding out until either another crash and I can find some space cheaper, or I really build up my savings and I can put 40 or 50% down.

The thing is with cheap mortgages you end up paying about the same for rent and you actually own something. Its not always the case, but I dont know if I see the house values crashing any time soon.

Yep, rent is outrageous in most big cities when compared to a mortgage.

I'm thinking a housing bubble part two is being created, but it may be a while before it pops...

Probably a rent bubble happening, but the problem is in certain cities like NYC people own or rent apartments they dont even live in because its such an international city.

If you live in central London you will be crippled by the cost of rent. I don't know how people survive these days.

Your post is right on spot!

This will eventually have an impact. I live in NY and when I drive around Manhattan I see so many stores closed. I’m sure that main reason is the skyrocketing lease cost. It will eventually spread from commercial to residential, where people will not be able to cover their cost for rent. I think it’s already happening, people are moving more to the suburbs. We can say that something will eventually gives up.

I couldnt even imagine the price of retail. I actually hate NYC im across the river in NJ, but everyone in my family commutes or lives there. Everything is ridiculous even with the salary boost.

rent is outrageous mostly in big cities when compared to a mortgage.well there will be a time when the city we are in will also be developed and rent will begin to rise...I think it's a good idea to those wo have the cash at hand..nice

Mortgage is good and I will support it... Government have to regularize the cost of house rents because some landlords increase their house rents yearly and no maintenance is made on the house they let out

At these rates mortgages are good, hopefully the banks wont start charging ridiculous amounts if the fed raises rates.

Beautiful article. ❤

Upvoted by @lhecenam check my blog if you want

Invest in a house is good, the problem is the price on USA, usually we need to make an agreement with the bank to complete the payment of the house in maybe 10, 15, 20 years... a lot of things may happen in that period of time, i mean, for me 20 years is almost the half of your life paying for a house... we should invest on our knowledge to find easier way to get money and create our business, if your business is good developed, you will be able to purchase maybe 3 houses in that time that, so you will be able to receive incomes renting the place.

i think its reflect of trump policies nothing else