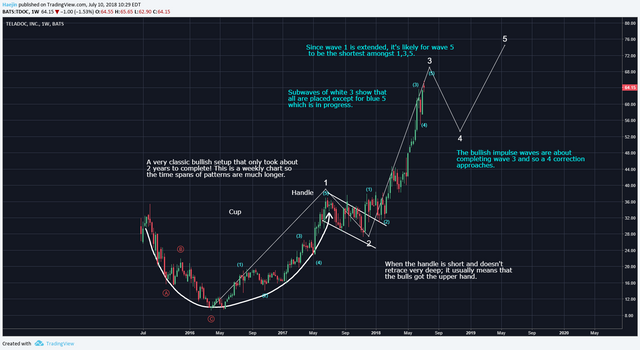

Teladoc (TDOC) Analysis

SUMMARY

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Nice cup and handle. Technicals are great, but could you comment on its fundamentals please?

I only use TA and don’t commingle fundamentals. Elliott Waves states that news and events will arrive to justify the forecast.

You gave yourself 700$ on this day, just on comments you made, not including your posts. Sheesh.

lol, no one cares about the fundamentals (we're in a 14 year bull market, if fundamentals had any weight this stock market run would've ended 2 years ago). The stock market: 90% hype, 10% fundamentals. If you wanna make money follow the trend

I agree with the last part, following the trend. The primary objective of a Technical analyst is to find the direction of the price eg the trend.

you misunderstand me. When I said fundamentals don't matter I was talking about p/e, earnings, debt, balance sheet, ect. Technical analysis does matter because it's based of the patters of human emotion. Price chart equals hype.

How did you know this waves does it have a specific calculation. Trying to catch the tips.

Posted using Partiko Android

It's good if you're a junior person. It shows that you're willing to work hard and compile information.

The conclusions seem weak to me though; I wouldn't give you my money to invest though if you were interviewing for a portfolio manager type position. If you were and I was a portfolio manager, I'd probably hire you (assuming none of the other interviewees were better) and retrain you if you demonstrated that were up for that.

Traditionally, hedge funds short stocks when they're able to long other stuff as well--if you pulled enough public similar healthcare growth companies and could long those, while proving that $TDOC is the worst of bunch, I'd consider trading on that idea. However, if you're pushing a only short idea, I need something more like a fraud (e.g. Enron) or a likely forever unprofitable business model issue (e.g. Twitter) to even consider short selling (I'm a retail investor so I have almost zero interest in ever short selling as I rationally value my money and therefore rarely am willing to take unlimited downside risk for limited gains). I doubt either exists here--it's just a company that's grown tremendously because the idea behind the business model has potential (lower costs through not-new/not-innovative but very cheap and widely available technology as to increase access to care in hopes it betters outcomes) and there may not be other public competitors or better investment opportunities at this time so that money would want to move there.