Why Constantly Checking the Steem Price is Driving you Crazy

I recently discovered Coin Gecko. Coin Gecko is a great site. Quick accurate information, easy to use graphs over different time periods. Despite this, my days on Steemit were a little happier before I discovered the green lizard. In my first month on Steemit I would spend my time reading articles, leaving thoughtful comments, and doing research to write some articles myself. Now I spend a lot of my time obsessively checking the Steem price, and scrolling through Steem Now to scrutinise every up vote and piece of curation profit as it comes in.

To a completely rational mind, constantly checking the steam price should make me happy. In the last year the price of Steem has increased by 260%. Clearly it has gone up more than it has gone down. All those happy moments when I see a green upward arrow should outweigh the disappointments of the downward red arrow. That is not the case. When Steem goes on a sharp upwards trajectory, the dominant thought in my mind is worry about losing it again, mixed in with a small dose of satisfaction. A sharp decline brings disappointment and fear that my hard work on the platform has been wasted.

The chances are that your mind works in a similar fashion to mine. There are two reasons why. The first is a psychological principle known as loss avoidance, and the second has to do with the way randomness works over time. Today let's look at loss aversion.

Loss Aversion

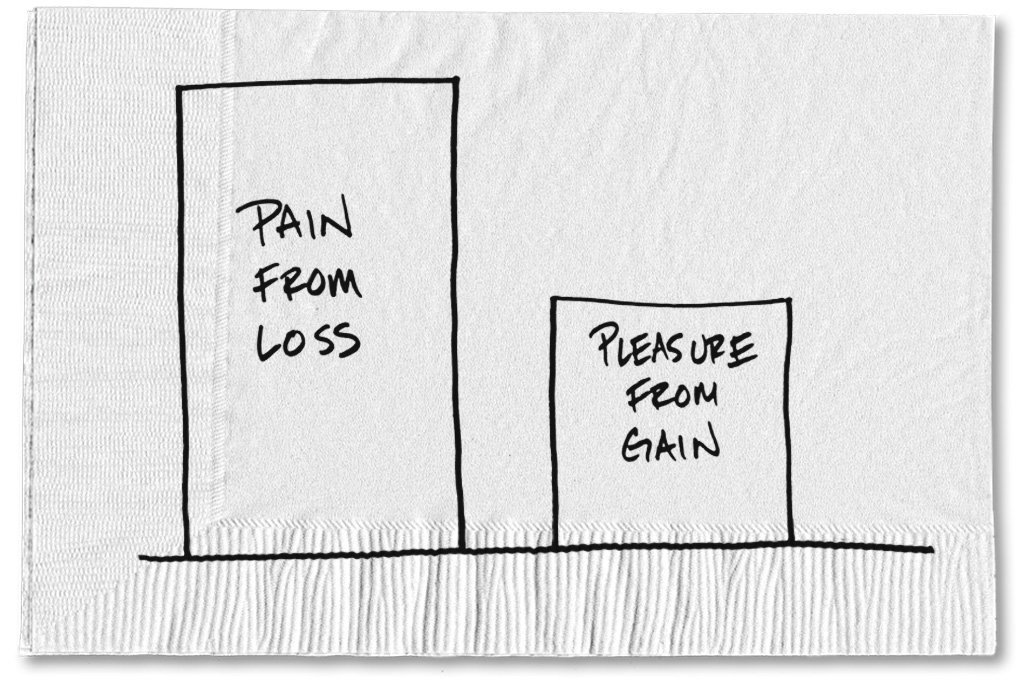

Loss aversion is the principal that we will feel more pain from a loss than the satisfaction we would receive from an equivalent gain. This picture explains it better than I can.

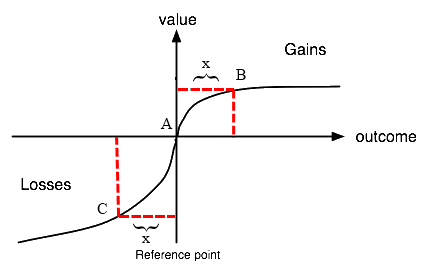

And here is the more scientific version

For most people the pain of a loss as roughly twice as strong as the pleasure from a gain.

The principle of loss aversion was first proposed by two psychologists by the name of Kahneman, D. & Tversky, in a 1984 study. Many experiments set up to test the effect have been performed. The consistent finding is that people much prefer to simply keep the money they already have, rather than risking it to gain an equivalent or slightly greater amount amount. People are aware, subconsciously or consciously, that the pain of the loss will outweigh the gain.

This might be rational under some circumstances of scarcity. For example, after receiving your pay check on Friday you run to the casino. Things don’t go as planned, and you find yourself sitting in a poker game down to your last $40. The cards come down, and you estimate if you put all your money in you have a 50-50 chance of doubling your money or losing it all. Here it makes sense to avoid the chance of the loss, as with no money for a taxi home you might be sleeping on the street.

This may be relevant to a dedicated gambler, but I’ve yet to met anyone on Steemit for whom the price of Steem moving up or down a dollar represents a threat to survival. Despite this, keeping a close eye on the daily or hourly price movements generally results in a net negative to our mental state.

Loss aversion it is perhaps explained by the concept of the endowment affect. This refers to the facts that people value items they own more highly than an identical item owned by someone else. I am definitely guilty of running through in my mind the ramifications of a recent Steem upswing, thereby taking mental possession of the increase in value.

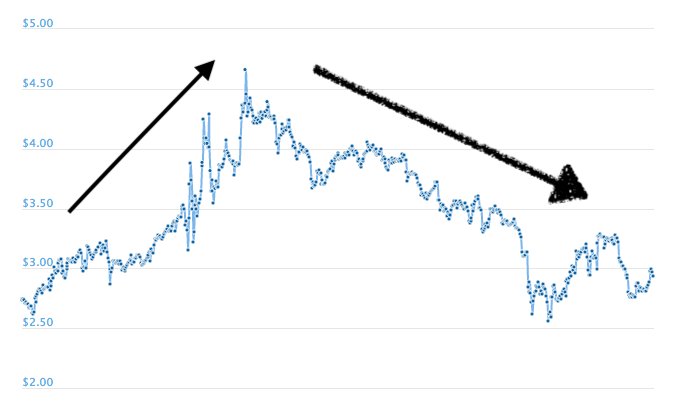

Let’s apply the principle of loss aversion to the Coin Gecko graph for Steem over the last 30 days (as of the 17th of May).

Solid Confident Upward Arrow: Hey not bad up a dollar. Looks like Steem has got some potential. Let’s go check out the value of my account in USD

Disintegrating Downward Arrow of Despair: It’s starting to go down, well gotta expect some volatility, …. hope it turns around soon…. really I’m gonna lose all the increases from the first week??

My final mental state is one of disappointment, despite the fact that the price actually increased over these 30 days.

In the next article we will look at why price changes in a cryptocurrency are especially likely to cause intense loss aversion.

You got a 20.00% Upvote and Resteem from @ebargains, as well as upvotes from our curation trail followers!

If you are looking to earn a passive no hassle return on your Steem Power, delegate your SP to @ebargains by clicking on one of the ready to delegate links:

50SP | 100SP | 250SP | 500SP | 1000SP | 5000SP | Custom Amount

You will earn 80% of the voting service's earnings based on your delegated SP's prorated share of the service's SP pool daily! That is up to 38.5% APR! You can also undelegate at anytime.

We are also a very profitable curation trail leader on https://steemauto.com/. Follow @ebargains today and earn more on curation rewards!

Well, I believe so long as if you have made a tiny profit, you should be happy enough. Besides, unless you eventually cash out into fiat, you shouldn't worry too much about the daily ups-and-downs.

I think if all people saw was a 2% profit at the end of the day they would be happy. But if they saw the price spike a lot higher earlier, they would finish the day disappointed. It is definitely healthier not to worry about the ups and downs

If you keep checking Steem price rapidly, it means that you have not accepted the risks that your coins are exposed to, or you have invested more than you can afford to lose, both situations are dire.

Yeah im trying to break the habit. I even sometimes cover up the part of the computer screen with the price on it so i cant see it:)

Try reading this book, it is called:

Trading in the Zone by Mark Doughlas

Thank me later...

will check it out

Thank you for the article! I understand your thoughts. As a woman I tend to focus a lot on what I find important (not saying men don't do it though) and I also feel huge disappointment when things don't go as I would like them to. I as well agree with the fact that the pain from a loss is bigger for me then the pleasure from a gain. But as this is volatile environment I try to be flexible and accept the situation as it is.

From a rational point of view you are right, Steem price is always going to be volatile. It’s hard to control our emotions though, I find the emotional reaction comes through before I realize it is ridiculous to feel bad about the price moving down

You are right @flyyingkiwi. I'm trying to control myself but as you say, the emotional reaction comes first and I'm not sure if we're able to train ourselves not to react. Anyway, let's stay positive and hope for green numbers :)

Lots of green numbers today. I’ve been checking

Congratulation flyyingkiwi! Your post has appeared on the hot page after 26min with 4 votes.

very good post, very useful. I like this.

You got a 90.91% upvote from @lrd courtesy of @flyyingkiwi!

We are offering 100% earnings for our delegators + 15% curation rewards for the largest delegator and 5% of curation rewards are burnt.

Delegate Now

Since I've never had a knack for accumulating wealth, I approach my adventure in cryptocurrency with a mixture of optimism and resignation. One of my more brilliant investments was in Icelandic currency, before the 2008 collapse.

My stake in Steemit is purely one of time and effort, not cash. No more speculation for me. Upturns in account value are met with a smile and downturns with a shrug. I guess I've buffered myself against loss aversion, in this one area.

@therealwolf 's created platform smartsteem scammed my post this morning (mothersday) that was supposed to be for an Abused Childrens Charity. Dude literally stole from abused children that don't have mothers ... on mothersday.

https://steemit.com/steemit/@prometheusrisen/beware-of-smartsteem-scam