Educating Family About Money : Part 1 – Gold and Silver

Most people think money is that paper fiat currency you’re carrying around in your wallet. It is what we have grown accustomed to and it is a commonly accepted societal norm that we rely on this paper because our government says it’s ok.

Source

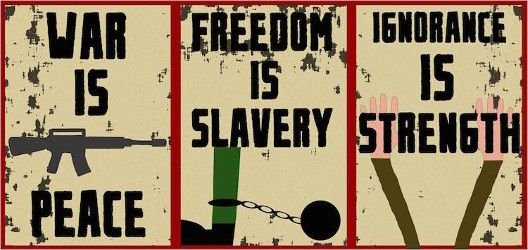

As you go down the rabbit hole and investigate the history of money it becomes pretty clear that this paper stuff isn’t really worth holding. The smart and rich people put their wealth into assets and they only use currency for transactions and cash flow. But the majority of people are clueless about the way the financial system and central banks are working and in many cases they don’t want to know. For the Sheeple “Ignorance is Bliss” and many people of my generation are just too busy with their heads-down-bums-up just trying to make ends meet so they can make their mortgage payments. They don’t have time to look into this stuff themselves. They just want to trust that the governments and banks will do the right thing….and we know where that leaves us…..

Source

So when I figured some of this money stuff out, the first thing I wanted to do was share some of the knowledge I had gained. At first I was just blurting and ranting about things and my arguments might have seemed barely coherent as it can be such a complex subject. Trying to explain it and doing a bad job usually just results in the “Thousand yard stare” and you can see your audiences eye’s glaze over – you’ve lost them.

Source

I’ve come to appreciate that getting past the mainstream brainwashing about money is actually a bit of an art form. Now I am no expert as I’m still struggling to convince even my own parents about this subject. They want to just trust their mainstream financial adviser, who has them chasing yield in the typical crowded trades that will continue to pay them 5-6% a year until we hit the next financial crisis and it takes a big dump. They already lost something like 50% of their retirement savings in the last GFC and they still haven’t got it back. But that’s the thing with old people – they have a bad short term memory.

Source

So I’ve come around to thinking that the best way to teach family about money is to actually get someone else to do it. You can focus on facts as there are a lot of good documentaries about the history of money, which was in fact Gold and Silver for centuries. Since I’ve changed tact I am very close to making a breakthrough. I actually got my father to watch this recent video “Bitcoin : Beyond the Bubble” which runs for only 35 mins but it has an excellent opening 10 minutes or so where it summarises the history of money. My dad actually shared the video with his Probus group, and believe me – That is a big deal!

Source

Mike Maloney appears in that video and while I have followed him for a couple of years now it’s only recently that I have come to appreciate that he is very focused on Investor Education. He speaks very well and explains complicated subjects in easy to understand language. He has also done an excellent series called “Hidden Secrets of Money” and I am confident that if I can get my parents to sit through that then I’ll be half way there.

Source

My realisation is that it is quite difficult to explain the Cryptocurrency phenomenon without a basic understanding of money and currency because it is important to understand what problem Cryptocurrency is actually trying to solve. I think it is wise to start by looking back through history and understanding the important role Gold and Silver has played (and still plays) in our financial systems before looking forward to Cryptos. In Part 2 I will talk about that next step.

http://educateinspirechange.org

http://themillenniumreport.com

https://www.pixoto.com

https://au.finance.yahoo.com

https://vimeo.com

https://goldsilver.com

checking some of your posts and ya got my full vote, interesting post. I would say gold and real estate are the best things to hold to create some wealth.

Thanks. I broaden that a bit and put both gold and real estate into a category of "tangible assets", but I can't bring myself to buy real estate at these lofty valuations, so it's gold for me right now :)

Yaa I guess gold is easier to sell. I heard silver is going to be a hot commodity in the near future because is going to be used for many things involving tech. gadgets

The "system" is purposely obfuscated to ensure a level of confusion and complexity to the common person. That's why not many people understand it and many many people are bored by it.

I agree. It's a shame as it doesn't need to be so complicated a subject.

Trying to explain it and doing a bad job usually just results in the “Thousand yard stare” and you can see your audience's eyes glaze over – you’ve lost them.

I don't understand your comment. You have just copy-pasted my own words and then self-voted yourself. You haven't even upvoted the original post.

So I’ve come around to thinking that the best way to teach family about money is to actually get someone else to do it

I don't really get when you said those words, does it mean that the family couldn't have an expert who could educate his family on the issue of money.

I feel like it's meant that because @buggedout is a close family member they are more likely to dismiss what he is saying as unofficial biased information rather than that of a 'trained' professional or documentarian.

Thanks. You've pretty much nailed it there @bogglemcgee

I seem unable to convince them, whether it's because I am a family member who they discount, or it's because my presentation skills aren't good enough. I have come around to thinking I need to find good professional material from other sources to help make my case.

Gold and Silver cryptos are already here.

Check out Unity Ingot (UNY) and the whitepapers on Cryptobontix.com.

Unity Ingot currently has the highest 7 day return on Coinmarketcap.

Thanks for post.

Thank you, @buggedout for the nice article.

I have a similar problem with my family. Especially smart and successful people are difficult to convince that they've been fooled.

I have found a good way, though. I ask them about fiat currencies. Questions like those:

I totally agree. The problem is that we all take the meaning of money for granted. No one teaches us about it.

I have found Andreas Antonopoulos's speeches very enlightening.

Do you have a link to any particular speech that interests you?

Check this one:

https://steemit.com/bitcoin/@alketcecaj/andreas-antonopoulos-in-an-old-but-good-introduction-to-bitcoin

Links to specific speeches would be good!

Thanks. I haven't seen much of Andreas speeches. Thought he was more of a blockchain guy, but I might have to study him up a bit more before I write part 2 :)

I totally kno the feeling...ive been trying to tell people about our financial system for years now! the federal reserve is nothing part of our government and the fed got started in 1913 and was talked bout how to come about there ponzi scheme and rob the amerikan people. they print money out of thin air and charge interest on it and we tax payers have to pic up the bill! our money has no value and backed by debt not gold juss debt and is juss a fiat currency no worth shit. fractional reserve banking is where they can lend 10 times the amount they have in there banks! they been printing for over 100 years now and it will collapes and it will make the great depresstion and the 2007 2008 crash look like a disneyland trip!

ALL THEIR PLANS ARE ON THE US CURRENCY

That is interesting. I'm tempted to go and get some US notes now to try that out! :)

I've tried to explain to people how our money isn't actually money but I too sound like a nut job. It's really an uphill battle against indoctrination. One paradigm shift that may help with helping your close friends and family to understand is by having them make the paradigm shift to understand that goods aren't getting more expensive, but their money is getting more worthless. Great post!

That's an interesting way of looking at it. Reverse the inflation paradigm. I might try that one too :)

Great post, I’ve just found you one here and will be following you. I’m looking forward to the next part. It’s so hard to discuss matters like this with family and especially older family members.

Thanks. I'm still working on Part 2. Hopefully I can do the topic justice :)

The colonies had no problem issuing their own FIAT money and then the king said "how dare you prosper" and mandated that they use only gold and silver, which being a commodity could never take the place of money, or an abstract unit of measure, which the colonial script was almost money, except that unit creation was still controlled by the government, and you cannot have a system of measure where units cannot be freely created for the function of representing value, or miles, or anything. Ultimately cryptocurrencies run into exactly the same performative impossibility: unit creation, unit creation which comes standard with any standard of measure, we had a war for independence thus because money supply with gold and silver was not capable to represent the value the people created. Equally intellectual property alone will overtake the supply of whatever precious or other vested value there is behind a currency.

www.bibocurrency.com Money indeed can be a hard thing to explain, especially considering that money for most of it's history wasn't really money but value in it of itself.