NVIDIA Is On Sale

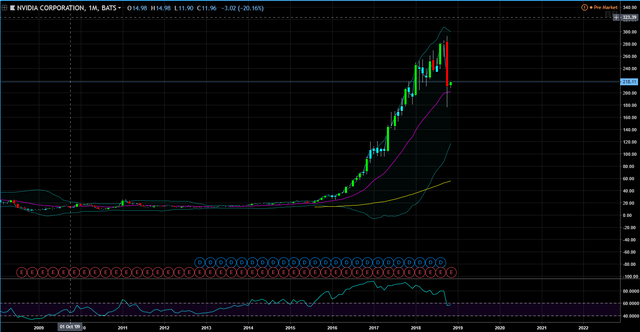

NVidia was once up over 300% in the last two years. However, NVidia too wasn’t invincible to the selloff in the Markets over the last several weeks. NVidia’s price is down almost 25% from its all-time high of $289.39 per share, set on Oct. 1.

Nevertheless, Smart Money buys at wholesale prices, while retail investors buy at retail prices. Which might be why JPMorgan upgraded NVidia to overweight from neutral with a price target of $255 earlier this week.

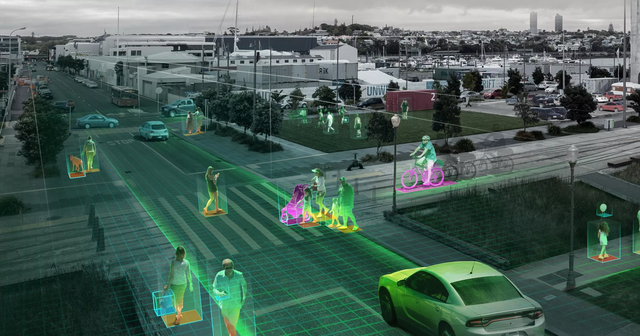

JPMorgan cites short term challenges in the gaming business due to excess inventory for their GPUs, but remains bullish longer term. Not only is Nvidia the leader in gaming, but also the leader in supplying chips needed for artificial intelligence and high performance computing the data center arena and driverless vehicle market.

Nvidia is scheduled to report its fiscal third-quarter 2019 results on Thursday, Nov. 15, after the market close. Nvidia has a history of beating Wall Street estimates.

So if you think the Markets have bottomed for now and think NVIDIA is on sale, buying NVIDIA through by way of call options might be a great short term trade:

If buying a call option, consider time decay and implied volatility. Rule of thumb is 90 days because most of the time decay is lost in the last 30 days of the option. Implied volatility is one of the deciding factors in the pricing of options and it’s important to compare implied volatility to historical volatility. If implied volatility is higher than the historical volatility, the option isn’t on sale and in order to make money the direction move in the stock price must compensate for the higher implied volatility.

Pending volatility is high, another way to play NVIDIA is through bull put spread.

A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset. This strategy is constructed by purchasing one put option while simultaneously writing another put option with a higher strike price. The combination results in the trader receiving a credit or income from the premium received.

The goal of this strategy is realized when the price of the underlying moves or stays above the higher strike price. This causes the written option to expire worthless, resulting in the trader keeping the premium. The risk of the strategy is limited by the bought put option.

Whatever, one decides the chart suggests NVIDIA has room to move to the upside

at least to the daily supply at $267.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

It's safe to buy puts or calls if expiration is equal or above 60 days, according to your strategy.

Advantage of lower time until expiration: you pay less and the break-even price is lower if you buy calls and higher of you buy puts.

Disadvantage of lower time until expiration: you have less time until expiration and the trade has less time to develop itself.

You can also do other strategies but you must be a net seller in this case because of high IV rank. So u should receive a credit.

Awsome post. Keep doing the great work.

Nice summary of some of the pros and cons of debit and credit options.

I don't trade options, but I pretend to trade them and I've seen some videos to learn more about them for my subject of corporate finance at university.

I've been watching this youtube channel and this guy has great content related to options. His main focus is making trades that start with an expected value equal to zero. And by cutting losses and cut profits at 50% or 25%, he increases his expected value to a positive number. By doing so, it will give him profits in the long-run. He also focus on high probability trading (which means that his win rate is always higher than 70%) and whether the IV rank is high or low (so he can decide to use a net seller strategy or net buyer strategy).

Now about me: ;-)

I'm new here and I'm going to make posts of market analysis and stock analysis, if you like this type of content feel free to follow me and reesteem my posts. I'm still new to swing trading and I'm using a demo account, but I want to register all my thought proccess here on steemit to learn from mistakes and become more consistent.

Read my Disclosure

I hope this helps! :-)

Cheers.

Have this and Netflix on my watch list! While I am not bullish on the overall market, these are great long term plays in my opinion and are approaching attractive levels...

Agree, they both will need help from the Markets. I think the wild card right now is a trade war agreement.

Rolland, I enjoy all of your posts. If you want to take your writing and investment talent to a significantly compensated position, consider applying for Stansberry Research's current opening. They have 500K subscribers and the top financial newsletter and top value. I have access to all of their newsletters through my lifetime subscription.

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.