Reality Check !

How money do you think you're going to make trading ?

I know I've been writing a lot of 'downer' posts lately, and this one is going to seem like one also. But it's not, it actually might make you realise you're more successful than what you think.

Everyone is full of stories about how great they are at trading. Everyone throwing around comments about Lambos and moonshots, but is anyone actually making any money ? and if so, how much ? Probably a lot less than what you think.

Sure, there might be exceptions that prove the rule and people sometimes do get lucky, but for most people trading is a long hard grind. It's boring. It's like milking a cow, just slowly and surely sucking that teat, day in day out. If you're not bored out of your mind trading, then you're doing it wrong !

So what is a realistic yearly target ? 1000% increase of your capital ? 250% increase ? Nope, try 10%.

Everyone know what a hedge fund is ? I won't go into details because you can read about their structure and purpose from other sources. In brief though, a hedge fund is a company that'll take your money (along with other investors) and pool it together, and invest that money for you with the intention of making a profit. The fund takes it's cut of the profits and then pays the rest out to the investors.

Hedge funds are quite lightly regulated in comparison to something like mutual funds, so they have almost unlimited ways to invest your money. Some specialise in metals, others in currencies, some in commodites such as orange, oil, coffee. But pretty much they'd invest in how many times a horse poops in an hour if it'll make them money. They're considered the 'top dogs' when it comes to investing.

They deal with an incredible amount of money and they really know how to trade. When a bank wants to raise capital, they go to a hedge fund to invest it. Because of the lax regulations, hedge funds aren't even an option for the likes of us proletariat. Most have minimum deposits in the 'millions' range before you can even use them.

The point I'm trying to make is hedge funds are the top of the trading pyramid when it comes to success. So how much money do they make every year ? Not that much...

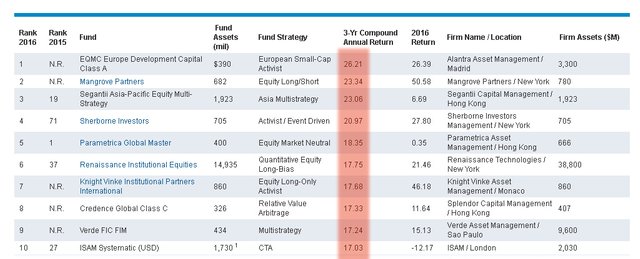

Here's a list from the last 3 years showing what the top, most successful hedge funds made. It's averaged over 3 years but it's less than 30% return on average. Doesn't seem so much, does it ? And that's the very highest performing funds, most do nothing like that.

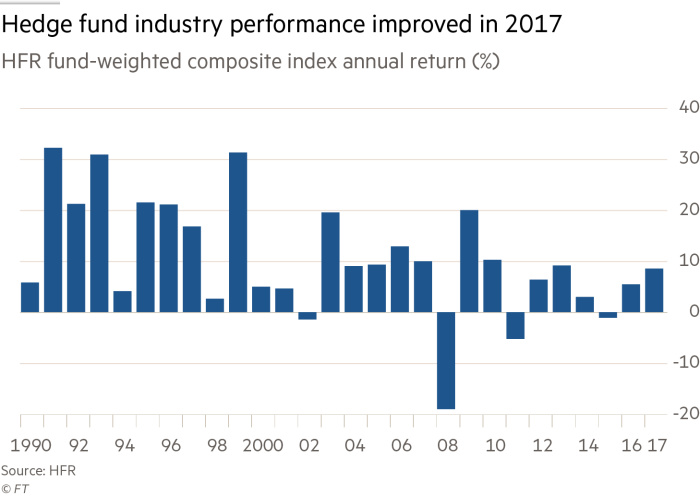

Hedge funds don't even make money every year, some years they bomb completely depending on the world political and financial economy. Look at this chart below which shows the average hedge fund profit for the last 15 or so years. In 2017 for example, hedge funds only made a 9% annual return.

Also look at 2008, when the last financial crisis was in full swing, on average the funds lost 20% !

So how much do you make a year ? How does it compare ? You often read stories (never with any proof) of people making it rich trading, but it's just not true. If the best traders in the world are only making an annual return of 10%, does it sound reasonable when some clown on the internet boasts about making 10,000% returns ? C'mon, seriously. If that were true, that person could compound every year for a few years and literally own all the money in the frikken world, it's all fantasy.

I'm not saying you can't better a hedge fund. Bear in mind they're investing other peoples money so they need to have good risk management in place. You might be able to make a 'double or nothing' trade with your own money, but they have to be more conservative. But you still have to be realistic.

If you have a $1000 account, it's very very unlikely you'll be able to turn that into a $10,000 account within a year. That would mean you could turn it into $100,000 the year after, and $1,000,000 the year after. It just doesn't happen in the real world.

So this is the reality check part. If you can outperform a hedge fund, you are doing really well ! If you start now with $1000 and make $250 over the year, that's a pretty damn good return !

Now I know someone somewhere is going to claim 'huh, I made a single trade that doubled my account !'. Perhaps. But that was a single trade. See how your account looks after 100 trades, or 10,000 trades. It's easy to turn $100 into $200, but although it sounds ridiculous, that's not the same as turning $100,000 into $200,000. There are huge psychological barriers to overcome for a start, because you would probably have to be risking upwards of $50,000 a trade...

So have a think about how much you actually make a year from trading. Your probably fed up, depressed, sick of not making it rich yet. But take heart, all these assholes on the internet boasting about their Lambo sized accounts are just that, assholes. None of it is real. You're probably a lot more successful trader than what you realise.

Header image credit : barrons.com found via google image search, no affiliation

In the real world we all mostly hear about the happy stories and how people get rich stories. It is very difficult to find the ones where people struggle and never succeed. To be honest who wants to hear about the sad stories anyways? No one wants to be losing their money and learn from others who also does the same. So its an easy sale for the people who make promises of winning big.

10% annual return is definitely a good number. By the time people who start working and reach retirement age that would be like 40+ years of savings or 400% of gains not including compounding.

Thanks for putting thing back to reality. Where it belongs.

Compounding is the key, just become successful and make a profit, no matter what the amount, and the magic of compounding will do the rest !

It is the same with sports betting. Most professional sports bettors aim on a ROI between 2 to 5%. While this doesn't look at lot, but they do wager lot, which makes it worth wile.

Also in this scene you only read about ROI of above 50%, which is just not true. We have to take in mind that 95% of the sports bettor are loosing money!

Great article. Keep them coming @tradergurl. I will upvote the post later this week. I am doing some kind of experiment for which I do need my voting power!

Edit: it is good to see that SBI upvotes are putting your post above the dust threshold limit!

As I said in the article, it's just simple maths. I even baulk when people give advice of "risk 2-5% of your capital on each trade". If you even had a 1:1 risk reward and were making 2% of your capital on each trade, maybe 20 - 30 trades a day, you could probably retire in a few months...

I'd need to work it out, but I only risk around 0.25% of my capital per day, total. And that could be spread over 10 trades. 5% per trade ? hmmmm.....

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto

Nice reality check.