Congratulations! You are about to survive the longest bear market in Bitcoin's history!

Get ready to pat yourself on the back!

In roughly one week (or 2.5 weeks depending on how you calculate), you will have survived the longest bear market in the history of bitcoin.

Bear markets are defined as dropping 20% or more from their all time highs.

Since January 2018, bitcoin has officially been in a bear market, unable to recover above key resistance levels and experiencing more than a 12 month sell-off.

If the price of bitcoin remains below $16,000 for the next week (February 2nd), then it will have experienced its longest bear market ever.

Previous bear market record.

Back in 2013-2015, bitcoin experienced the longest bear market on record.

From November of 2013 to January of 2015, bitcoin satisfied the bear market conditions of being 20% or more off its all time high.

That would mean the bear market officially lasted 410 days, or 420 days depending on who you ask.

Currently we are 403 days into the great bear market starting in 2018.

Once February 2nd rolls around, you will be able to say that you have officially survived the longest bear market ever.

If not then, wait a few weeks and you will be able to make the same claim!

More about these bear markets can be found here:

https://news.bitcoin.com/current-crypto-bear-market-set-to-become-the-longest-ever/

Hopefully this means we are getting close to the end!

Stay informed my friends.

Image Source:

https://news.bitcoin.com/current-crypto-bear-market-set-to-become-the-longest-ever/

Follow me: @jrcornel

until there's no major improvement in btc LN or major adoption in large scale. there's no main catalsyt to spark a next bull market, maybe other major news will come up to spark a catalsyt for bull market in the future.. who knows...

even if bear market is over i expect there's gonna long time in accumulation phase which take months or years...

I could see that as well. Prices no longer going down would be bullish in its own right.

2020 btc halving could be the next catalyst to start the bull market. 2019 long sideways action in my opinion.

Posted using Partiko iOS

I could see that as well. Though, historically prices have tended to start moving up roughly 1 year prior to the halving. Which would be May of 2019.

That would be nice May 19, after waiting this long I think we can wait little longer. Im definitely going to take profits this time around, but a mistake is the biggest lesson you could have and after a bunch of mistakes from being a new trader with no prior experience or knowledge of the market I fell I've come a long way and boy am I ready for the next bull run. Im in crypto for long term believe this is the future. I want to set aside some btc for my young kids for when they turn 18.

The thing is, if bitcoin recovers again and makes another run at those highs. It probably goes a lot higher this time around. So, selling at $20k may leave you shaking your head shortly after... it's tough to time tops and bottoms.

I expect next bull to go higher than 20k for btc probably near 100k my opinion. I will definitely not sell at 20,000k I might take 5% profits as it goes up after huge rallies and buy back in on dips. Its nearly impossible to sell ath but I had plenty of chances to sell pretty high from my initial investment and I held all the way down. Once I see a full market reversal back to bear ill sell 80% of my bag and try to buy back in once I feel its right time.

Thats my game plan but when that greed hits you make some questionable calls. I over 10x my investment last bull now im down 80% on my initial investment. I did great trades as we moved up bought all the right dips. My problem was I thought it was going to continue to 100x having no knowledge of markets at the time and based on past performances. I understand the market cycles allot more know. But I definitely agree with everything you said it’s extremely tuff to time tops and bottoms.

Posted using Partiko iOS

Sure hope you are right 🧐

About which part?

Now just for a different viewpoint - I did very well on Bitcoin in 2017, but now regard it as all over.

Maybe this is not a bear market, but an all over market. Japan's housing market has been a "bear" market for 19 years - will it ever go back up? - with a declining population, probably not!

I think we got apples and oranges here... bitcoin is very different than Japan's declining housing market.

Well they are both fruits and will go off if left in a bowl for a while!

Oh let him be. . .

Your Teddy Bear!

I'm not going anywhere!! Now's the time to accumulate for the next bull cycle

That's what I am thinking as well.

Crazy when you consider that we are still above beginning of 2017 numbers by 3-4x!

Posted using Partiko iOS

True, though that is 2 years in the rear now.

I need to buy more Bitcoin!

Posted using Partiko Android

No time like the present!

interesting thought been so many ups and downs in this market, made it an interesting journey for sure. hope rest of this year is better.

Bear markets can't last forever, or can they...

@jrcornel, in my view, last time BTC was in a downtrend (Bear Market) for over 17-18 months: from the end of 2013 till the middle of 2015. Actually, last time the bear market ended in the beginning of 2016.

Yes I believe for this metric, they take the high and then the low to define how long it lasted. There was roughly 9 months of sideways trading after the bear market hit the lows though.

@jrcornel, most of the people who write articles for the mass media are not traders/ financial analyst. So, they don't understand very well what a Bear market means. I have worked in this area (financial sector) for the last 13 years (mainly as a financial analyst). So, I have work with the mass media as well. So, I am a bit familiar about it and how it works ...

Posted using Partiko Android

Good to know. Lets see if your projections line up with mine...

Based on what happened in 2014-2015, we could expect to see bitcoin start going up again around August of 2019, if the time frames work out to be roughly the same.

What do you see?

@jrcornel, thank you for asking me about my point of view... You know... I can talk for hours.

Let me try to explain you briefly my point of view on the current situation. The price decrease in 2013/2014 and the subsequent bear market was due to the Mt.Gox case, etc. It was not a problem of the Bitcoin itself. It was due to lack of infrastructure to buy and sell/ and to keep your crypto. I think you understand what I mean. Now, we have thousands of crypto exchanges, different kind of wallets, hardware wallets, etc. So, the infrastructure for trading crypto and for storing crypto is well developed. But, the problem now is the Bitcoin itself. Namely, the scalability issue. The next bull run will start when it is clear that the scalability issue of Bitcoin is going to be solved. At the moment it is not clear, when the scalability issue will be solved. It could be that the Lightning Network would be able to solve this technical problem of Bitcoin. But, the LN is still in its early phase of development... We will see. Still there is no solution to the scalability issue of Bitcoin on the table. So, I think this time we will have to wait much longer...much longer. We will see. Of course it would be nice if all of sudden some brilliant minds solved the scalability issue of bitcoin ...Then the price would skyrocket.

Btw, I stared making videos for DTube on a daily basis. I am doing daily Cryptocurrency Market overview. Tomorrow I will discuss this topic, thank you for giving me the idea :). Actually I have talked about it last year in the spring, in the summer, in the fall (I talked about the scalability issue), but because DTube videos are being deleted in 2 months, it would be nice if I mention it again tomorrow.

If you have questions, just ask me.

Interesting thoughts, though I don't fully agree. I think bitcoin can go up WITHOUT ever being a viable global currency. Gold is an $8 trillion dollar market. In my opinion, bitcoin does everything gold can do, only better. If bitcoin takes just 10% of gold's market, we are looking at $800 billion market, or roughly 12X where it is currently. If bitcoin takes 50% of the market, which I think is possible, that would be roughly 70X the current price. I think bitcoin can go way up just by being a better store of value.

The Bitcoin lightning network works, I have used it and anyone can. But its not widely adopted because of the bear market. The exchanges and many websites are not accepting the lightning network since it involves a significant upgrade that needs a lot of effort with little rewards. The rewards of the upgrade are small because the transaction fees have dropped significantly because of the bear market. I think the lightning network will be widely adopted when its needed and that's when the network has heavy traffic and high fees. So you can consider the scalability issue solved.

Btw, you can even run your own lightning node for like $300. Easy peasy. But you can't profit off it because there is not much traffic on Bitcoin lightning network.

@waleedtee, have you used the Wallet of Satoshi for the LN?

Posted using Partiko Android

No, but it looks like a great initiative ! I've been using "Electrum wallet" for LN

According to our calculations, the market will move up in March / individual races of some altcoins already show themselves. Soon everything will start ......!

I could see that as well. I am cautiously optimistic that the next bullish phase starts in the Spring of this year, or roughly August.

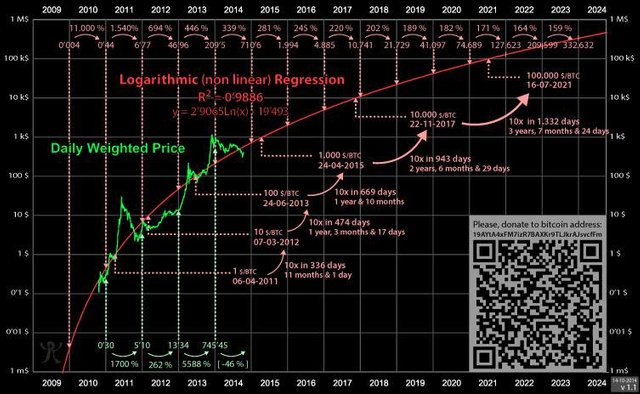

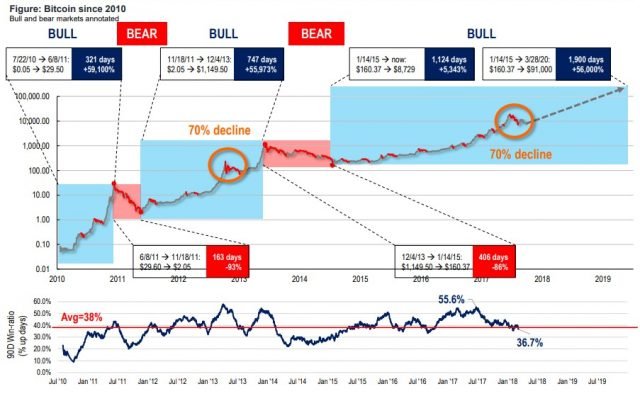

I looked at the bear market of 2014/5 and compared toady's bear phase and it looks like we have a little while longer to go. However, I have seen graphs and stats that say for each new cycle it takes proportionally longer for bitcoin to complete a cycle. So the next coming bull run may not match the past cycle but may take longer than ever before, based purely on the nature of bitcoin and not on any fundamentals or news or events. I'm no expert, these are just graphs I've seen by others.

Is that completely true? Each cycle has taken longer? Looking at the charts with a quick glance it doesn't appear that is the case... at least not going back to the very first bull/bear markets.

Hi there, @jrcornel, I respect your experience in the market and am keen to learn from your experience. I found these charts referring to bitcoin's price cycles. Can you perhaps give an opinion on them?

![Bitcoin price prediction log graph til 2024.jpg] )

)

(

![Crypto bull bear phases graph.jpg] )

)

(

They are really old charts, no?

Good point, they are quite old, though the second one shows price up to Q2 2018, and shows how each cycle in bitcoin gets longer and longer.

I guess it all depends on what you define a "cycle" as. In this case it looks as though there has only been 3 cycles in Bitcoin's history according to the charts. I see about 6 or so, but that is just me. :)

Do you think so?