A Followup To The "Top 8" Crypto Strategy (I'm up over 85%!)

A little over two weeks ago, I wrote an article about the cryptocurrency strategy that I felt was the smartest. You can read the original article here: https://steemit.com/cryptocurrency/@mattw/an-easy-way-to-ride-the-cryptocurrency-wave. It includes my breakdown of the strategy and looks at some historical data, had you followed that strategy.

To be honest, I wasn't invested in that strategy at the time of writing it. I wrote it as a way to do research on the strategy. By the time I finished doing my research and writing that article, I was convinced that it was the way to go for my hard earned money.

On November 30th, I took my own advice and invested across the top 8 currencies by market cap. I had roughly $340 sitting in just Ethereum at the time and I decided to take that $340 (in USD value) and spread it across the top 8.

As I write this, it's now December 14th. It's been 14 days since plopping my money into this strategy and here are the results...

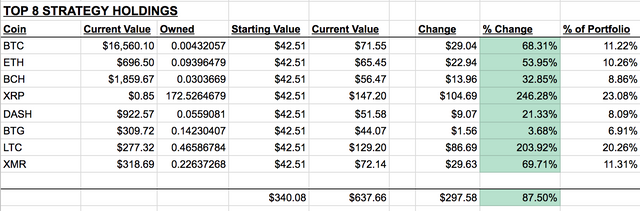

The Spreadsheet:

This is my real money as of writing this. It's not example data of what "could have" happened. This is where my personal investment stands today.

I had $340.08 worth of money to spread across 8 coins (roughly $42.51 per coin). Each coin represented 12.5% of my portfolio on day 1.

I invested in:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash (DASH)

- Bitcoin Gold (BTG)

- Litecoin (LTC)

- Monero (XMR)

The spreadsheet shows how many coins (or fractions of coins) I was able to purchase of each.

As of today, every single coin is up, with Litecoin and Ripple being my big winners (Ripple literally jumped overnight since yesterday).

My initial $340.08 investment is now worth $637.66... That's an 87.5% return on investment. No too bad for exactly 2 weeks.

Obviously, this is not investment advice and there's no guarantees that it will continue to move like this. However, I personally feel pretty strongly that it's the smartest way to invest in cryptos. When some coins go up, others go down. Since starting, I've not had a single day where all coins went down or even had a day where my current value was less than my starting value.

What's Next?

My next step is that I'm considering rebalancing already. My plan was to let this ride for a minimum of a month and more likely a total of 3 months before considering a rebalance. However. I don't like the fact that any one coin accounts for over 20% of my portfolio. Between Litecoin and Ripple, that's almost half my coin portfolio at the moment. A rebalance seems in order.

To rebalance, I'm going to, once again, look at the top 8. I'm going to move my coins around until all 8 of the coins I'm invested in equal roughly 12.5% of my portfolio.

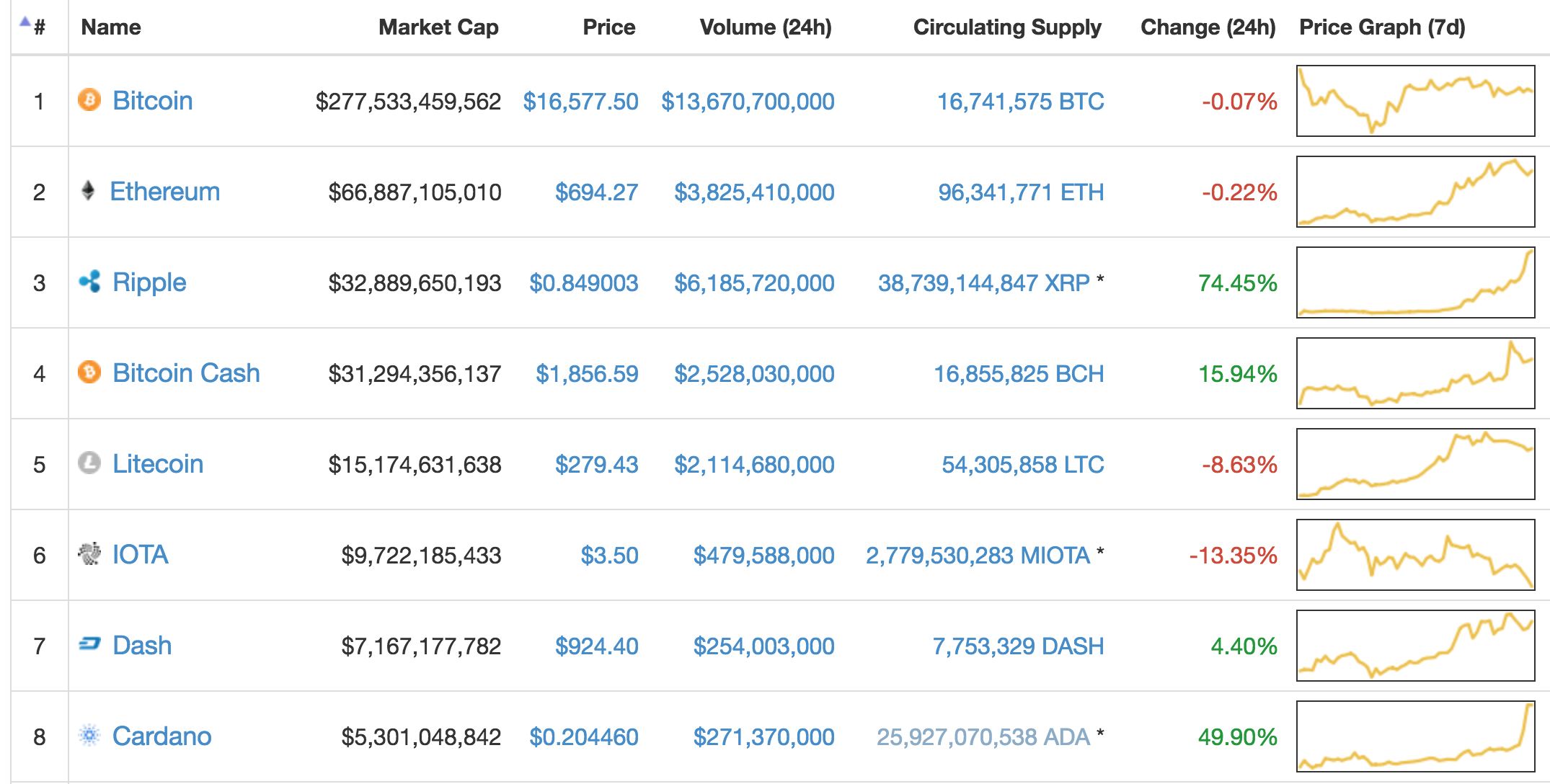

Here are the top 8 as of this writing, with "Cardano" being the only one that I don't know a ton about.

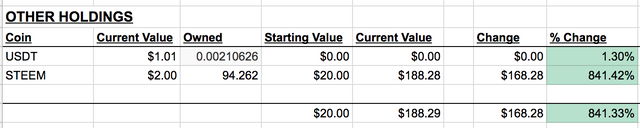

On another note, I do hold one more coin, outside of the "top 8" strategy...

Steem has been doing great lately!

(Ignore the Tether row - I was using Tether to trade as close to the dollar as possible but I own less than $0.01 worth)

I invested a total of $20 into Steem and then I created (what I think is) great content. Between my initial investment and the sweat equity that I've simply put into writing posts like this, the value of my Steem is worth over $188. It pays to create content that people enjoy.

As far as my next steps with Steem... I'm gonna let it ride and continue to write content that I think will be beneficial to others.

If you enjoyed what you read here, don't just 'retweet' it, don't just 'like it' elsewhere. Make sure you sign up and UPVOTE it, here on Steemit and share in the rewards! Also, if you enjoy what I put out, be sure to follow me here on SteemIt as well.

A simple idea for seeking out winners. I like it. I have been investing actively in Bitcoin and Ethereum and by default Bitcoin Cash for the last two years. I have started mining a few others along they way BUT have not really done any research.

Your idea allows the market to do the research. I am going to run a variation on this. Rather than pick from the top 10, I am going to pick 8 from positions 8 onwards - i.e., to get to position 15.

That's a great way to look at it. I didn't think about it as "letting the market do the research for me" but that's essentially what's happening.

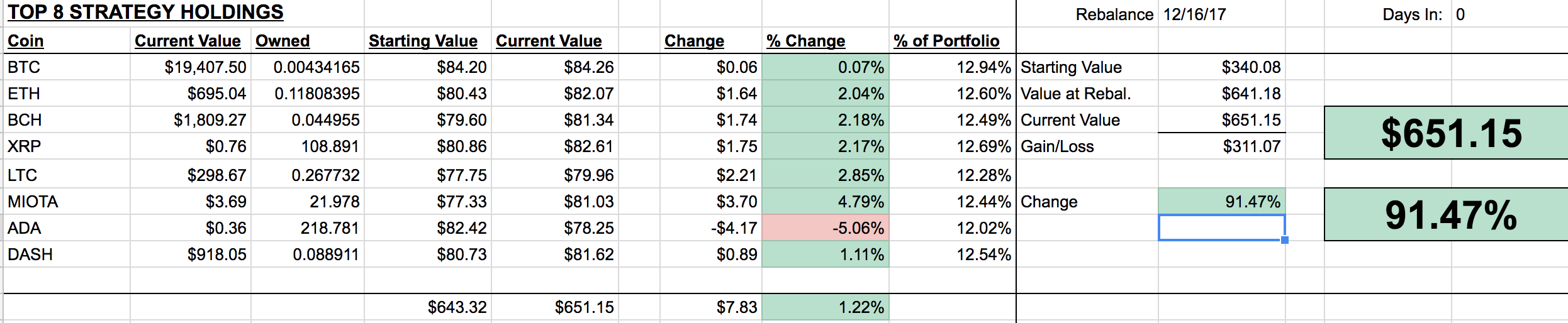

I just did a rebalance today to the current top 8. Here's what it looks like about an hour later:

(Right-click and open the image in a new tab/window to get a better view)

My spreadsheets are getting more and more complicated. Ha, kinda. :/ I've at least spread evenly among the (almost) top 8 - a couple I can't buy on Bittrex. Did put some in Hashflare yesterday right before the price increase today! Whew.... just hope I can reinvest and that they're not capped on hardware.

Yea. Keeping the spreadsheet neat through rebalances is tough. I've basically just cloned the tab in Google Sheets, typed all the numbers in the original tabs to lock in the values, and started over with the new number as my starting number... (Not sure I'm even making sense. LOL)

Its a good concept, but it has been a great week in crypto's too. Im not sure if it proves the theory..but thanks

I can only assume by your comment that you didn't actually read the article that this was a followup to... https://steemit.com/cryptocurrency/@mattw/an-easy-way-to-ride-the-cryptocurrency-wave

I actually did quite a bit of historical research over multiple time frames, with multiple coin types, and multiple investment amounts. The strategy proved to be strong over the past year, no matter when you go into the market.

This post, that you (might have) just read is just my results from implementing the strategy with my own money. Yes crypto has been doing great this week... But it's been doing great for the past 100+ weeks as well so I'm not totally sure I get your point about pointing that out...

Best,

Matt

Matt, I did something like this a few months ago. I had $1000 to put into cryptos and I split it across the top 7 or 8. That $1K is now worth $2500. My problem is that I had it in Bitfinex which is cutting ties with US investors. So I moved it all to Coinbase for now after getting it all back into BTC, so I was looking for a way to spread it out some. After reading this, I'll probably do something very similar. I might actually leave $1K in Coinbase with BTC and take the other $1500 and use that to diversify. There's something about not having all of my crypto cash in one exchange that makes me sleep better.

Btw, so which exchange are you using? I have accounts at several but I think the safest is offline wallets of course.

One last thing - thanks for the spreadsheet screenshot. I'm an all-in data guy and use spreadsheets for EVERYTHING, but I've just not been able to find the right way to track my crypto, or at least a way that gives me the right data at a glance. I like how you set yours up so I'll be changing mine to mimic. Thanks!

I found a simple addon called CryptoFinance that works on Googe Sheets. Simple but effective http://mymark.mx/AltCoin to see it in action on my version of Matt's idea

Yea. The CryptoFinance Add-on for Google Sheets is the backbone to my spreadsheets. It's a huge time saver. :)

Most of my coins are purchased in Bittrex or Binance... Both are US friendly. I have a Nano Ledger S hardware wallet that I store most of them in after purchase.

I've been planning on making a version of this spreadsheet available for free. I'll see if I can make that available this week. :)

I have to wait until Tuesday to get authorized in Bittrex. I had everything in Bitfinex but they're stopping their association with US investors. I've looked at a Trezor for offline storage.

p.s. I'd LOVE to see a copy of your spreadsheet. I've recreated what I saw you post, but it's the rebalancing part of it I get screwed up on. Would appreciate to see/use your version!