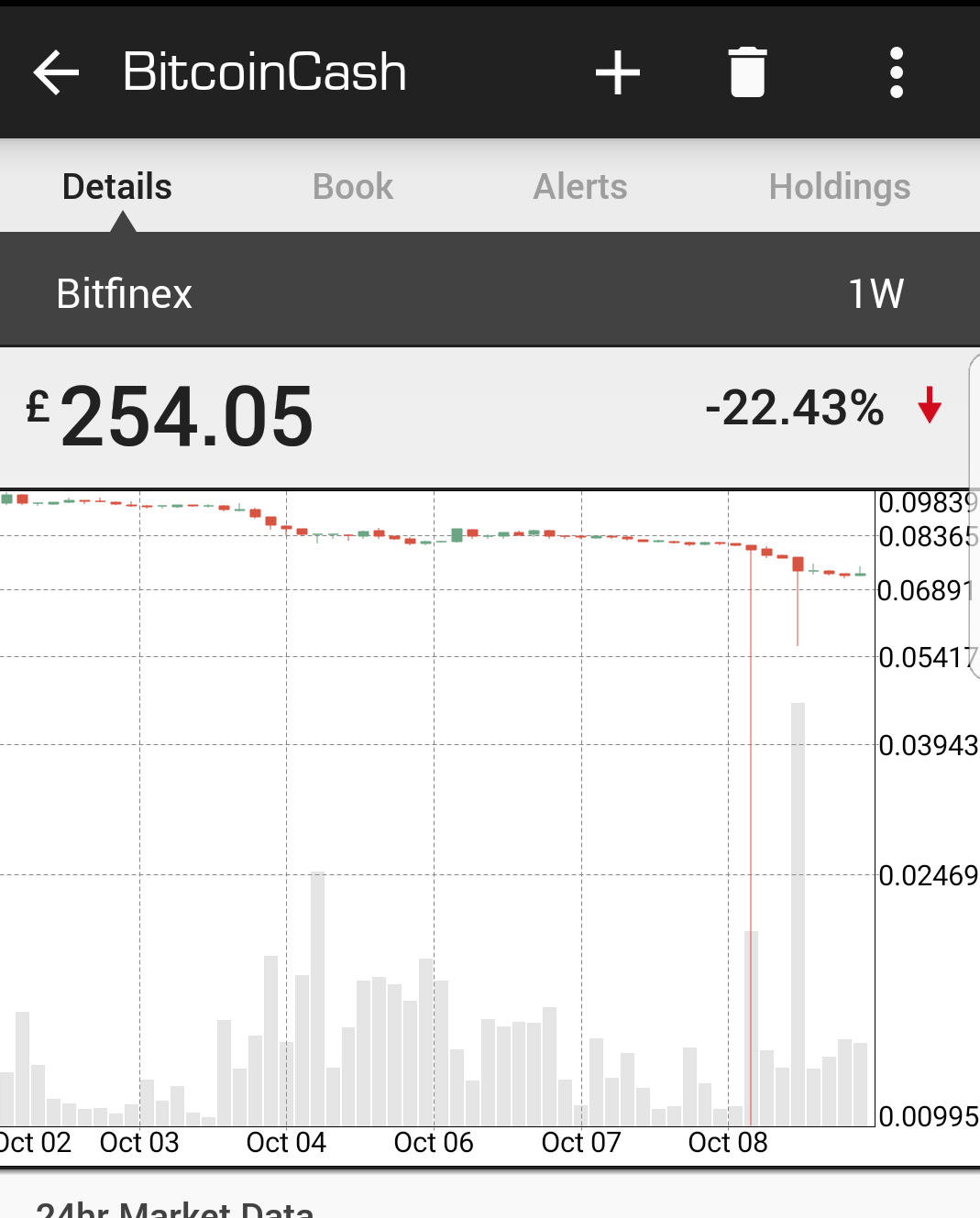

Anyone else notice the Bitcoin Cash 'flash crash' on Bitfinex? Regulators will.

Blink and you may have missed it

So I was minding my one business, fumbling through my phone.

An aside:

Who would have thought that mobile phones would play such a major role in our day to day lives? It seems like yesterday when I had to walk to a phone box to call someone (at another phonebox). Do you remember those big red contraptions? And having to to pull the numbers in a circular motion to dial?

Instead of fumbling through apps, I use to fumble through my pockets for ten pence pieces. The noise the phone made when I was running out of credit. Those were the days... the days when I used a phone to actually phone people. Nowadays to actually call someone from your phone is anathema. What is the etiquette? Am I supposed to text before calling? Heaven forbid, I actually turn up at someone's house unannounced?

Anyway I digress

I think my phone has a mind of it's own because I didn't mean to open the Blockfolio app and I certainly didn't mean to open the charts for Bitcoin Cash.

Another aside

I hate cryptocurrency charts. I think they'll be a time when history will look back at all the so-called technical analysis and laugh. It will either say;

- all those people wasting their time studying charts, when it was 'obvious all along' that all they needed to do was hold on tight to destination moon!

Or

- all those people wasting their time with cryptocurrency, when it was 'obvious all along' that it was going to collapse into a pit of worthlessness!

Either way, looking for rational patterns in a sea of irrationality is futile. All I ever see/ hear when I read/ listen to technical analysis in crypto is hindsight bias, confirmation bias and survival bias.

Damn... I'm digressing a lot in this post, I'll get to the point eventually...

So I looked at the chart and for some reason it jumped out at me:

The long thin red wick...

Bitcoin Cash had crash from over $250 down to $34 and back up again.

While it's nice to have a free market, these centralised exchanges are just asking to be regulated unless they put safeguards in place to combat flash crashes. Particularly those that allow heavily leveraged margin trading.

Coinbase is already under investigation for the GDAX Ethereum-USD crash. Other exchanges could find themselves in a similar pickle!

What's the downside of having the flash crash? As far as I can tell, it only hurts people who use trading bots and set them up a certain way. Seems like just a natural consequence of using bots and nothing that really needs to be or even could be corrected, other than just people changing the way their bots trade.

Maybe the worry is that the exchange can manipulate the crash (and then buy themselves at the cheap price), but I don't really see how 'regulation' would fix this. It would just mean people with the government's permission can now manipulate the crash.

Seems like using bots in a way that doesn't leave you vulnerable to such things is the only solution.

A lot of people that trade manually (not with bots) put in stop losses,. They do this to protect themselves should the price fall below a certain threshold. These seem to get automatically triggered when these flash crash occur on crypto exchanges.

Worse still if you say you put in a stop loss $300. During ordinary trading you can expect, should it get triggered to execute a trade in the $295 - $300 range (depending on the liquidity and size of the order).

However during a flash crash, by the time your order gets executed you could end up selling your coins at $50 (or in the case of the GDAX incident 50 cents). Which would not be your intention. Particularly if the price goes back up to normal range say $350 minutes later. People lose a lot of money on an isolated occurrence that happens on a single exchange that is out-of-step with the rest of the exchanges.

Someone with leveraged cash and visibility of stop losses could use that money and information to crash the market and pick up cheap coins as the stop losses are executed, if the exchanges do not have the necessary safeguards in place.

Add to that, that the exchange has visibility of everybody's stop losses and it is largely unregulated space.... it's an open invitation for consumer protection regulators to stick their noses in.

A very informed answer!

From a purely technical background, that 'flash crashes' can happen makes sense. The trading engine has no concept of particular tokens, what their intrinsic value is, what their prices on other exchanges are or whatever, it can only look at the available orders in the orderbook and if there isn't enough liquidity then a flash crash may happen.

Sure we can argue there should be protections to stop liquidating people if the market drops by a certain percentage in a single second or whatever, but that's where we get to choose arbitrary numbers - always difficult. Adding delays could also be risky: let's imagine the market doesn't pick back up and drops even more, now margin traders can't pay back their loans anymore.

Something I've been wondering is, should the engine draw on liquidity from other base pairs? For example, if ETH/BTC is catastrophically crashing, should margin positions be liquidated by drawing from orders on ETH/USD pair then selling the USD for BTC? This has both an upside and downside - it might make crashes less frequent (more liquidity to draw from), but could also cause a 'cascade' of crashes across multiple currency pairs (ouch!).

Whole topic is difficult, every exchange will need to find their own answer. But as more liquidity enters the markets, flash crashes will become less frequent.

Sorry for the rant, I should probably have posted this as a new blog post haha.

From what I've been told, Poloniex's margin trading engine has a 'protection' like that in place. A while ago we saw ETH/BTC on Polo crash by 20% in an instant but then trading froze for several minutes as (presumably) an engineer there was fixing things and trying to prevent it from crashing further... pretty intriguing haha :)

This guy is the best.

Nanzo for Un-President.

Not the UN President either lol!

Awesome post. Well written :)

I didn't see this flash crash but I do remember it happened to Bitcoin a good year or so ago when it was around $300 and it crashed down to almost nothing.

Its somthing to be aware of if trading these coins, making sure right stop losses are in place to overcome this occurrence.

Have a wonderful day. :)

Sometimes stop losses are the issue. Without the right mechanisms in place on the Exchange, the stop loss you thought would protect you, screws you. See my previous comment in response to full-measure.

Stop-loss orders without a limit price are seen by many as very dangerous (more like a loss order ;) ). If the stop loss feature doesnt allow you to set a limit price, don't use it, it will do more harm than good.

Margin trading is a whole another beast. Pretty much guaranteed your position will be forcefully sold for practically nothing if a flash crash happens. Worse, if you are in multiple margin positions then your other positions may also be sold to make up for losses from the first position, effectively emptying your whole account.

This is exactly why there are so many disclaimers and terms you have to accept before margin trading. Just don't do it.

I figure after a day it is safe now if this has died down a bit, but what a great post that was and some of the comments (and yours there also too) -- are GOLD as always.

I wanted to let you know one of the official DASH videos has just come out by email blast a few mins ago and I saw you in the front row at the ~40 second mark here Nanzo.

I am just about to blog on this now actually in a few mins. It is like 1 am your time now.

Thanks man.

That wasn't me but I can see the resemblance... lol. I was lurking in the back somewhere.

You can catch me on the thumbnail image of this vid (and at around the 5'30" mark),

I'll look out for your post. Thanks for stopping by!

Oh I watched that a week ago!!!!!

The worst part about watching Boxmining video was listening to him talking about "I need to eat... where can I eat" for like 30 mins ---- I am still LOL'g at your non official lunch review man.

Frankly -- the money that cost all you guys, for it to be such a crap lunch when that always speaks to the quality of an event to some extent --- is still bugging me.

I know we do not talk much man but you are one of my fav. people to read or watch.

You are keeping it real and you are so well spoken and thought out with your words.

And funny and balanced. +1

If only I had an order at $34 dollars...

I'm very upset about this . I've bought it at a high price literally around almost 700$ and now it's less than have the price . I'm trying to keep hope that it will recover but watching it fall everyday is not helping . Do you think it will rise again?

The short answer, I'm not sure.

It could have a pump at some point (like most coins). I think the issue is that now that there are a couple more bitcoin forks on the horizon (B2X and Bitcoin Gold), Bitcoin Cash could end up being seen as just another altcoin.

Most crypto are currently being dumped for bitcoin because everyone wants that "free" B2X.

On the flip side, Bitcoin Cash does seem to have plenty of big hitters behind it, and the ultimate aim is to try to be 'the' bitcoin.... However I'm not sure what gives Bitcoin Cash the edge over B2X.

Ultimately though, I try not to predict the price of any coin, I just try to position myself well for most eventualities.

I think that Bitcoin Cash has some very major edges over both version of Bitcoin Segwit coins (BS1 & BS2 i call them derogatorily lol just as they call Bitcoin Cash Bcash). The main thing besides being the only actual Bitcoin left standing that has all the transactions on the blockchain instead of using Segwit is my gut says is hackable, what people forget is that it has difficulty adjustment which will really shine when there are 3 version of Bitcoin competing over mining power as Bitcoin Cash will always remain more fluid and competitive for miners than the other two. If one of them gets low in price it will drop off the map as the miners will focus on the other two, one of which will certainly be Bitcoin Cash. So not sure whether BS1 or BS2 will win, but Bitcoin Cash is definitely going to go up in value after the fork.

Thank you for the information, I think BcC is being added to some other places next year which might give it a rise , until then, I will rise the rollercoaster

HODL! 10k Bitcoin Cash in 3 years, 5 k 2 years, 1k in 6 months, hopefully back over 700 in December or January are my predictions.

Sorry, that was my fault. I misclicked and sold 1.5 gazillion BCH.

That's pretty crazy, Wonder what really happened and if someone profited huge. Hmmm.

His name is Roger Ver and victims are people who fall for his 4th scam attempt.

I like Roger, you are just jealous of his success. I don't think increasing the block size was a scam, but I do think that Segwit coins are. Time will show that Roger was right you will see. In the meantime if want to use a Segwit coin I'll use Litecoin. Notice LTC is only $50 which means BTC is $4850 overvalued based on speculation alone since LTC is a more usable coin.

Wow that's crazy, thanks for sharing this, super interesting. I got in around 600 but holding and being patient. By the sound of it by November (Bitcoin hard fork) Coinbase for one will be adding BCH when it includes Bitcoin Gold. I think that'll generate long gains in the long-run. Best to hold IMO, even if it could sink lower still...

Yeah I know what you mean. Those exchange markets are pretty much used only to make a quick profit. They don't represent enough what crypto's and especially the blockchain itself is capable of... BTS to the moon! ^.^

I can't believe that!

You will at the time when an btc will be 4$