Dear friends and family. Please take a weekend and really investigate block chain investments. You're gonna miss the boat!

I know this post is going to lots of Steemians, but frankly I'm writing this specifically for my real life friends and family. I'll be sharing it in an email soon. You're welcome to read my letter to my family.

3 Sentence Summary

Consider making 10-20% of your investment portfolio cryptos and do it within the next few weeks. Start by putting a few hundred dollars in as a starting point as soon as possible as a way to get comfortable. I think tidal wave two is within the next month or two so you don't have infinite time to doddle.

A note

The point of this is that I think this may be one of the most unprecedented buying opportunities for an investment in my lifetime and I want my friends and family to consider taking a shot at it. There are incredible opportunities here, but it also isn't easy and there is risk. Depending on your risk profile and depending on your current life status this may or may not be a good fit for you.

To be extremely clear this may or may not be right for everyone or all walks of life. These are my perspectives for my family based on having been deeply involved for a year and I'm trying to share this industry as a passionate educator because that's just who I am and I'm proud to be that. This may not be a good fit for you and your family depending on your current financial situation. You need to take ownership of your own decisions. I'll try to talk about risks, challenges, and downside as well. I'm extremely bullish for this year, but it's not without risk!!!

Hey guys

I have been in crypto for a year and a half. I've only been a real investor in this space for a few months, but I've been active in a crypto community since August of 2016. So far I think I've had a pretty spectacular run. I've personally invested $5,000 into crypto and a few thousand into tech as a starting investment. The total value of my crypto portfolio is just shy of half a million dollars and I've pulled $20,000 out for expenses. I don't think everyone will be able to take the same pathway I did, but there are elements to this that I think are repeatable that will still have massive financial implications. Most of my returns have happened in the last 4 months.

So, my point today is to draw you into a conversation to give you a few charts and tell you a story. Armed with some stats and knowledge that I think the story point towards an unparalleled possibility for investors. I also think it has some real risks and isn't for everyone. This is meant to inform you and implore you to explore this area. I'm not telling you to buy because I don't know your circumstances well enough to make that call.

I'm not sure it's advice... I'm doing my best to share why I'm such a passionate advocate, why I have an extremely bullish outlook, and I've been in sales for years. It's hard for this not to sound like a pitch, but everyone has to make financial decisions for themselves. There are also risks. While some might think technology and fraud are the biggest I actually think the biggest risk is YOU the investor.

You're the biggest risk

Below I'll go into why I'm extremely bullish on crypto, but for just a second here's one of the biggest draw backs. This place is insanely volatile, but it didn't work the way I thought it did. The meteoric new highs are exuberantly fast, and the corrections are agonizingly slow. The dot com bubble took years. The correction took years. Here we call that February. I think the biggest risk is that as a new investor in the space you're captivated and sucked in by the highs and can't sell or worse buy more, and when the lows come you panic/freak out and sell low. It might be best if you buy some and set it aside for a few years, but if you can stomach looking at the charts there's absolute fortunes to be made in crypto.

Scaling is the next biggest risk

The speed with which people are entering the market is exploding the space. There are some options that can scale now that I'll talk about later, but some of the major coins are already at max technical capacity (for right this moment). I think there's a real chance some of the coins won't keep up with the growth. Mitigating that risk while the space grows is an absolute challenge. With that growth so comes new devs. I'm hopeful if we through enough code monkeys working on the the problems they'll get it right, but there's a risk that some coins and chains will outright fail under the weight of growth.

Fraud

Crypto is still the wild west. It's intentionally hard to regulate. You can't rely on a central authority to necessarily save you if you're cheated. I recently lost $2,000 on a coin that pulled the plug. That happens. I think standard discernment is important and you're gonna have to sniff out bullshit just like any other market where people to try to make a buck. That said the safety net isn't here to the same extent. So, you have to take full ownership of the choices you make.

Where you are in life

Markets can stay in downturns longer than you can stay afloat. I think we're going to see 10X returns this year on the major coins and 100X or more on many of the alt-coins. That said there's a good chance you're not going to time the market perfectly and that they'll go down before they go up. Stocks might dip 5%. Crypto calls that Tuesday morning. This correction is a 35% dip right now off of highs and probably has one more lower low to go before it springs back up.

We are at 12k btc today. I think it'll hit 15ish and then hit 8k before bouncing back up hard. If you don't ladder in at the right time you could see a drop before you see a rise. Don't invest any money that you might need to get back quickly because it could force you sell at a really shitty market time.

Those are real risks, here are the rewards

Here are thoughts on why I think crypto is an amazing opportunity for me and my family. I welcome and encourage you to wrap that up into a lot of other perspectives before you actually do anything. I do think we have a fairly narrow time to get into one of the biggest tidal waves of investment. You missed out on block chain tech reaching what I'll call level 1. We'll still be here for level 2 and 3. This is about how comfortable you are taking risks, which usually is how well you understand something. I'm here to educate you so you can make an educated chioce on what you want to do with your investment portfolio.

Again, take ownership of your own finances and see if this is a good fit. I'm not a registered financial guy. I don't know if this is a good fit for you and if the risk profile is going to be worth the upside potential. It's there for me, but you have to find out if it is for you.

Cryptocurrencies and block chain technology are going to explode

A year ago people would say $20,000 per bitcoin is unimaginable. A year from now we'll be dreaming of how inexpensive that looks. In my vision of the future every website has a checkout option of credit card, paypal, and crypto. You can't do this just yet, but it's not long into the future before I can pay my mortgage, utilities, and lunch with crypto currencies. I'll buy my next house with it. We're going to mainstream so hard it'll cause whiplash. In the process a tsunami of money is going to enter into the space and it'll make people who are early investors very wealthy.

I think the early investor bus is going to leave the station soon. There will continue to be great opportunities, but I think what we are going to see this year will be unprecedented... even for cryptos!

What is a cryptocurrency and what is block chain

These are two words that describe the same thing. These terms are describing public ledgers that record all the data and share it across a wide list of people. Aggroed sends 15 sbd to ausbitbank. Mary sends 10 steem to Jim. Those are transactions that are stored in a big file and that file keeps growing. Every chain is different but on steem we wait three seconds and take a snapshot of the new transactions and store that into a new chunk of data saved as a "block" and then those blocks are hooked into the chain ready for the next block.

One way to think of this is create an excel file. Rather than saving the whole file every 3 seconds simply save what changes were made over the last 3 seconds. Those changes files should then be small. If you play those files back in a row like a movie you can see how the excel file changed over time and get caught up. That's essentially what block chain tech is.

Cryptocurrency describes the same thing, but puts the emphasis on a different aspect of how it all works. At first I thought crypto was meaning something sinister when I first landed here, but it really just refers to the algorithm of how blocks are created and stored. What you want is trust that the data is true and no can modify them. If I can make a block or change a block to randomly say aggroed recieves 10,000,000 SBD then the whole thing will have a lot of problems. So, to fight that programmers included cryptography into the tools so that bad actors were thwarted.

People are flocking to blockchains!

When bitcoin hit $20,000 per bitcoin there were reports of crypto exchanges, places where you can exchange one crypto for another (like a stock exchange) and sometimes for fiat curencies, signing up 100,000 people per day! The next wave of investor, adopter, and developer is coming here right now in a tidal wave. JPM has it's own chain. The banks put together Ripple as a group chain. Institutional money is already entering the space, but it's not long before pension funds are taking a position as a standard operating procedure.

It's slowed down some since there has been a price correction, but the funny thing about corrections is that it gives people an opportunity to buy in and in many ways we're expanding our base through the correction. Let's talk about why that matters.

What gives currency value?

8 months ago I put out an economics post. That was at the very start of my witness campaign. Folks ended up electing me on the Steem blockchain to help build this blockchain, which I do through a server that I run! The main thrust of that paper and what I'm discussing today is that the value of a currency is the number of people using and accepting that currency. Here's how I get there. (For savvy readers there's some stuff about SBDs I've changed some of my views on since I first started this, but that's secondary to the info on big picture economics which haven't changed).

Value of the currency is proportional to all the goods and services this kind of thing is straight out of a textbook

Figuring out goods and services in an economy is really freaking hard. Figuring it out in a decentralized economy tied to other decentralized economies in a global manner is basically impossible.

A really good proxy for all that trade though is the number of people in the economy. People is much easier to calculate and estimate. I also trust it since it's people are doing the buying, selling, manufacturing, and services. Number of people are a really good approximation for amount of goods and services in an economy. Yes if I'm comparing a highly industrialized nation to an impoverished agricultural country it's not a perfect tool, but cryptos are a global phenomenon and thus that should mostly level out.

Value of the currency is proportional to the number of people in the economy

PEOPLE ARE THE VALUE!!!

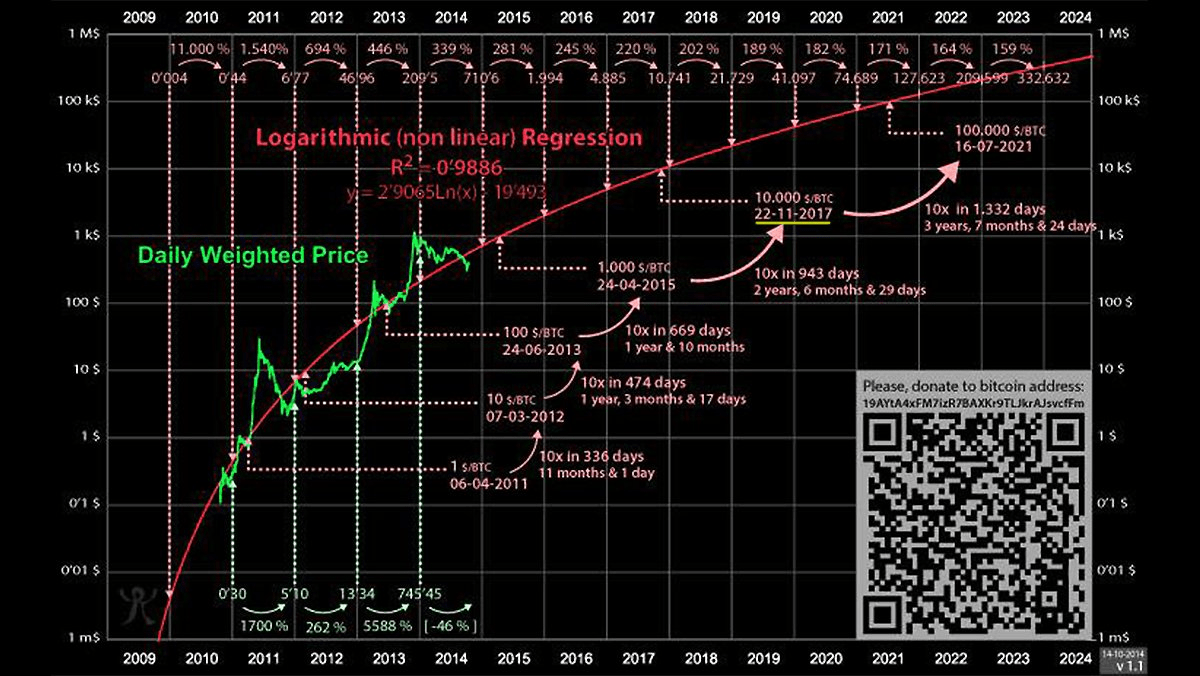

So, if people are the value and we're seeing them sign up in droves that gives me a lot of faith that we're going to sky rocket as an industry. There's an economics "law" that also indicates this. The law defines it more mathematically than I have. It's Metcalfe's law and has shown to work for fax machines, telephones, and facebook. It states the the value of a network is proportional to the square of the number of people in the network. Here's a chart of bitcoin moving along the anticipated pace dictated by Metcalfe's law. That little regression number up in the top left shows for the tracked portion of this graph that there is a 98%+ correlation to the value of bitcoin to Metcalfe's law. We're still right on track.

People are the value. PEOPLE ARE THE VALUE!!! People are coming in droves. The value is going to increase by a metric fuckton!!!!

Why do people want cryptocurrencies?

The trick is not to look at this in isolation, but looking at it from the perspective of what's the delta between the options?

If we're considering government issued currencies then cryptocurrencies have a huge number of advantages. For starters let's look at the Federal Reserve, which is a private bank whose leaders have gone on record before Congress stating they are above the law and who operate the current money system. They print $160MUSD a day right now. During the financial crisis in 2008 they printed $16T and handed it out to banks and actually mostly foreign banks. Since the central bank has started our nation's money has lost 99% of it's value. As a result of these economic conditions if you have $10,000 in a bank account today you will be able to purchase fewer goods and services with it next year because it will continue to decline in value. Cash since the inception of the Federal Reserve has been a horrible store of wealth.

Other options exist too. You can buy stocks, commodities, and real estate, but it's hard to find good deals. Much of these markets are extremely manipulated. The libor scandel showed basically trillions of dollars in loans were manipulated by all of the major banks acting in collusion. High Frequency Trading has showed that financial firms are manipulating prices before you're able to get them. Real estate is going ballistic, but a lot of it appears to be driven by overseas investors using the properties as a way to launder money out of the country and it's creating unrealistic prices for properties.

Essentially people buying cryptos are looking at other options and ultimately deciding that they aren't trustworthy investments and we'll see that they under perform cryptos on top of that.

So, what's good about a crypto?

Clear and transparent rules about how the blockchain operates. The software is opensource. That's one of the reasons so many people can create new chains (there are over 700 cryptocurrencies now), but it's also a major reason why people trust it. You can go onto a public code repository, download software, check out the software, possibly add changes to the public software if you're inclined, and then run the wallet, miner, or program and trust it's the same thing everyone else is using with the same rules as everyone else.

Devs from all over the world will look at the code and make sure it's doing what the various white papers, a document describing how they function, say it's going to do. The code for the currencies can be checked for truthfulness. The amount of fraud for the blockchain code itself is incredibly low because the code is publicly scrutinized and the algorithms are designed to stop any kind of theft or hijacking.

There's no central authority that can just print 16T more tokens on a day without an act of congress. The amount of coins in cirucation and the printing authority is distributed. The threat of individuals inflating the coin at the expense of everyone else outside of the pre-set rules of the game is practically non-existant.

Releasing new coins and rules of the game

Blockchains have a set schedules for how they release new coins and to whom. This is mostly commonly done by mining. People purchase equipment to solve a complicated math problem and if they are the ones to solve it coins are released to them. How many coins and the rate of inflation can be determined by the rules in the code for the blockchain. So everyone knows how much is coming and when.

The benefit to this system is that no central authority can up and decide to print 16T tokens cause (insert selfish rational here)!!!

You know the schedule, all the users agree on the schedule, no one has a right to print more (unless it's in the rules), and it's up to the rules of the blockchain to distribute them. The power of money creation is no longer isolated into the hands of greedy bankers, but now decentralized to everyone in the world that wants to run the programs!

The power of deflation

While many of the cryptocurrencies are technically inflationary the number of coins created is so small relative to what government fiat ("fiat" described below) currencies choose to mint that they are essentially deflationary. Most of the currency wars in government fiat are a race to who can print the most! Most of the currency wars in cryptoland are who has the least inflation!

Part of the reason the coins gain so much value is that deflationary currencies tend to go up in value. That's a self fulfilling prophecy too, but ultimately if you know you can buy more goods and services with a currency if you have it and sit on it for a year then you are inclined to own and keep it. It keeps supply lower, which increases price. Practically all the cryptocurrencies are deflationary compared to government money and so they are highly attractive when comparing basically any crypto to any government "fiat" currency.

(Fiat generally implies that it's backed by nothing. The USD was on the gold standard up until the 70s when Nixon Nixxed it. Until then you could take money to a bank and exchange it for gold. It was gold backed. Now you can't make that exchange. Since on paper it isn't backed by any asset anymore it's called fiat. What gives it value? The number of people in the world that accept it as a medium of exchange, and it's defacto backed by petroluem and the US military.)

Borders

Crypto is international in scope. People in every single country use it. I can choose to send currency to any single person on the planet. I click some buttons and boom. Value is sent. Some cryptos take a few hours to clear. Some take a few seconds. It's drastically faster than modern banking software, and many coins have eliminated fees and middlemen. I also don't have to check in with a central authority to do this. I'm not waiting for someone else to approve my transaction. If I want to trade I do it. Many people are attracted to how liberating that is.

Security

If you don't own the keys it isn't yours. With cryptos you get a set of keys. The world saw in cyprus how banks can give accounts a hair cut and do "bail ins" and set negative interest rates and a million other things to steal your money. If they don't have the keys they can't take what's yours! (You can lose keys and lose money. Exchanges also don't give you keys and may get hacked so there's risk there too.)

It's the delta!

USD- slow to move, highly inflationary, privately controlled, privately issued.

Crypto- instant to hours to move, deflationary, publicly controlled, opensource, publicly issued, decentralized

Why now?

Cryptocurrency trading is highly volatile and mounds of money are moving around. For a stock trader used to 10-15% as big changes in a year it's hard to comprehend the violent 80% swings that bitcoin has gone through or the 10-150X swings that the alt-coins have gone through (there are over 700 cryptocurrencies now. Bitcoin is the main one that still has 30% market share, but many other coins exist collectively known as alt-coins).

Bitcoin is currently correcting from the first major wave of unprecedented investment. When that correction completes I believe, but can't prove that we are likely on another metioric rise that puts the 20k btc to shame and leaves everyone shaking their head. Everyone shaking their heads except for the people who have been in crypto for a while and know it's coming.

Scope of the crypto market

Don't take it from me. Take it from Mike Novogratz a billionaire investor with 20% of his personal assets in cryptocurrencies.

Takeaway- Dot Com was 6-7T and only located in the USA. Blockchain is global and only 500B. We have room to grow.

Some thoughts on how to be a good investor in the space and what trading looks like.

A 40 min interview with a well informed skeptic.

Criteria for picking winners and a good portfolio

I'm not advocating that you take all your money and put it into crypto. That's actually pretty dangerous. I am suggesting that you have a balanced portfolio and consider crypto another asset class to put in it. Own cash, stock, real estate and crypto. I think crypto should be 10-20% of many people's savings and investments. This may be higher if you're young and have a safety net of some sort.

I don't think you can reallly go wrong picking bitcoin or ethereum. I think they are trusted and proven assets that large investors will purchase and hold. I think they make good investments, but I don't think they'll be the final winners, but as far as crypto goes they are probably the safest investments.

Scaling is the future

I think and it was nice to hear that billionaire reaffirm this thought that the biggest issue is going to be scaling. Lemme use some round numbers. I think within the next 9-15 months we're going to reach $100k btc. That puts bitcoin at a valuation worth 1/4 of the value of gold as a store of wealth. That doesn't seem unreal to me. In order to get there we have to go from bitcoin around $10k to bitcoin around $100k. That's a 10X change, and according to Metcalfe's law which I think there's evidence we're following that means we have to grow by 10^2 or 100x people in the network. What that means is that I need a chain that can scale and it has to be able to scale in 2018.

There are going to be more winners than what I'm going to put here, but I'm invested in and think highly of a class of coin's I like to call "Dan Coins." These are all coins built by a guy by the name of Dan Larimer who's a freaking programming genius and has a team of really freaking good devs (some of whom I've worked with personally).

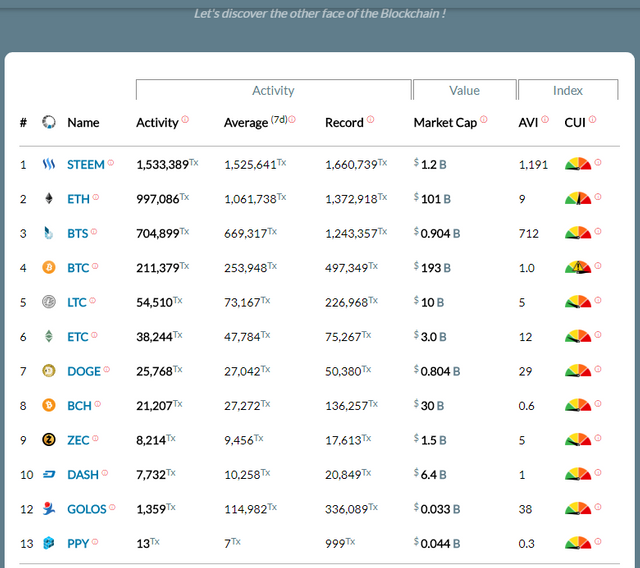

There's a website called blocktivity.info. It tracks the current value of a coin, which is generally thought of as the market cap and can be determined by looking at the total coins and multiplying by the value of each one. Then it looks at how much activity is on the block and how many transactions it can handle. Lasty it makes a ratio of block activity versus marketcap, normalizes it to a value of 1 for bitcoin and then starts comparing coins. High values are undervalued. Low numbers are overvalued.

All the coins that can scale are Dan coins. These are powered by a blockchain methodology call DPoS or Delegated Proof of Stake. They are lightening fast, scale exceptionally well, have zero or near zero fees, and use almost zero electricity (unlike Proof of Work, PoS, coins that use 20% of world electricity).

I think I'd include cardano in here too that is using a hybrid approach.

So I like Steem, BTS, EOS, and Cardano for 2018. There's others... but as a class I like DPoS coins.

It's all about people

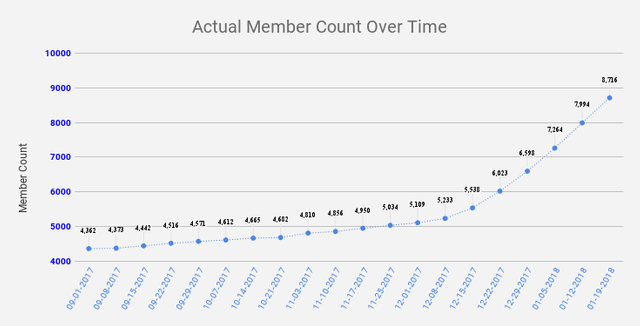

@penguinpablo tracks weekly users:

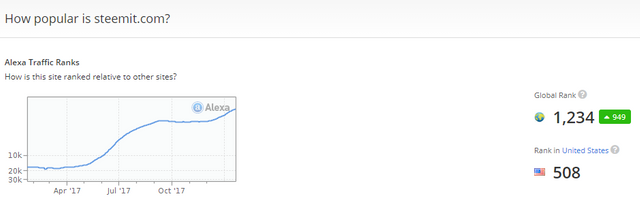

Alexa ranking show's steemit.com at position 504 in the United States (we broke 500 and then it backed off a bit as price went down. We'll be in the top 400 after the correction is over).

and lastly I run a group for new users on the platform. We started from scratch on June 1st 2017. We're at over 9000 people.

@discordiant keeps good stats on how we've been growing:

I think value is proportional to people, and I see herds of people joining. It's not just my group or steem. This is a global tide of people moving towards decentralized cryptocurrencies to solve whatever they can think to solve this way.

Conclusion

Crypto has amazing opportunities. You need to get informed and then consider it having a home in your portfolio. You probably can't go wrong with Ethereum and bitcoin, but I think the future is in DPoS coins and second generation technologies that can scale. There are more than I have mentioned, but those are ones I'm confidant in.

This space is risky and extremely volitile. It's not a good fit for everyone. I have money to invest and I'm comfortable in this space. I have more than 20% of my assets in here, and I'm not sure I can recommend that. However, crypto is an expanding space and an unparalled global tidal wave. Please consider what I've shared as you take ownership of your own investments and consider choosing on your own to make an investment into crypto.

Disclaimer: The point is to educate yourself, take a baby nibble to try it out, and then make up your own mind with your own due diligence to figure out what to do.

PS I'm gonna work on a post of how to logistically get a little money into the system in short order.

PPS Here's a CNBC analyst-

https://www.youtube.com/watch?time_continue=131&v=3J0Ng_g0q0Q

This post needs a highlight just by itself.

This is well versed.

Keep on steemin'

I respect your opinion, but the total amount of Tether, what it is used for, the wash-trading, the price floors they attempt to maintain with Tether, and the general fact that most exchanges only have Tether and not fiat as a trading pair, along with Tether being equivalent to 15-20% of the estimated net inflows into crypto have made me a predict that prices will implode and we will see a market cap smaller than when this bull run started, so around the 20-30 billion dollar range. I think most coins will lose nearly 100% of their value and BTC itself will overshoot down past 1000, low triple digits are a possibility.

It's like crypto is stored in the attic of a house, you let people in and they're unaware that they have to leave their money in the basement, and the walls are propped up with Tether, a highly flammable material with unknown properties used to inflate prices through the roof so to speak.

There are going to be many bag-holders, or holders of nothing at all if exchanges simply choose to shut their doors for good and take what crypto they have. Exchanges are not safe, they do not care about you, and they do not operate for the long haul. This is why they have been attempting to exclude US customers and customers from areas with stronger abilities to pursue money-printing activities.

I am optimistic in the ultra-long period for this technology and later iterations of its ability to change the world for the better, but perhaps we are rushing to conclusions if we assume that the Tether scandal and lack of true liquidity at exchanges can weather the flood of people trying to withdraw longer than the fiat system can keep itself propped up. And considering that central banks are just now starting to announce that they are unwinding their positions, this lessens the likelihood that the implosion of fiat will take place sooner than the implosion of crypto prices. Those smart enough to keep crypto close to their persons might have something of worth to hold on to, but it is not a guarantee that governments will not come after them hard if they maintain value against rapidly devaluing fiat currencies.

I can not in good conscious see you write such a letter to people you care about without stating that it is disingenuous if you do not include information on this current impending systemic risk looming over the crypto world while knowing that such a risk exists. If you were unaware of the risk then I hope that you are now aware of the dangers and take the time to read more about the matter. It would shatter their confidence in the crypto world if they were to see such an event play out before their eyes right as they dipped their toes in the water, and they would be hesitant to ever return, even if it ultimately turns out to be a good choice in the future once this event has passed.

Thanks for the comment. I think it's entirely possible that like every bank basically ever that tether took in an asset, gave out certificates for the asset, and then overprinted the certificates and will leave people holding the bag. I don't think that tether at 1.6B is going to be enough to squash crypto valued between 500-830B. besides more competition is coming so 1 failure isn't going to be enough to bring down the whole thing. Or maybe it is and I'm wrong... that's a risk.

I just believe that because so many of the huge volume exchanges, in fact almost all of the biggest, trade only USDT there will be enormous pressure and bottlenecking to fiat exit routes. This might ramp the price of certain pairs up, but drain others without those routes completely. And when people wake up to walls of 80%+ losses they're going to take notice and follow the herd, and all of that is dependent on IF the exchanges can "handle the volume" as they've always claimed. They might just press the big shut it down button like they've chosen to do in the past, after all. The tactics they're employing are certainly slowing the collapse, but I think every day more and more people are wising up and trying to lessen their exposure to the risk, and many are discovering the exchanges simply aren't letting them. Thanks for taking the time to comment on my comment and read it at all, I know wall exchanges aren't the most effective means of communication, but sometimes I feel they are necessary.

I'm always chilling in Discord. Come hang out with 9,000+ other Steemians in there.

@aggroed I read all your post and totally agree with BTS, Steem and EOS being the dreamteam of crypto with magical Dpos systems, created by the brilliant visionary @dan Larimer, and his brilliant devs!

Something I would add to @charitybot thoughts is that after a massive mainstream of crypto that I believe something huge may happen this year, many businesses and people , professionals and any person will start accepting crypto as a means of trusted value, and their will not be a need to change it to fiat. Sure, that many people will want to exchange some or all, but that will be according to it persons judgement.

Hope this thoughts add to this, and as always look forward to your ideas on this.

Regards, @gold84

What exchanges do only trade USDT? I know it can be bought on most exchanges, but from my experience, most trades are paid for with Euros, Bitcoin or Dollars. I'm not sure how the situation is outside Europe, but a lot of exchanges offer easy fiat exit routes for european customers, with minimal fees and decent transaction times.

Hey mate, Binance has USDT.

Sign up to Binance

that's a good disclaimer.

Tethers are to be used as a visual pricing tool when buying other crypto, and must maintain a $1 value to be useful for that purpose. No one should be hodling Tether. And Bitcoin will never fall back to $1000 from here.

You have to understand that there is less than 1% of the people on the planet in crypto right now and if you think of crypto in the early stages like the internet back in the mid 90's then you will understand that there will be hundreds if not thousands of coins or tokens that will come out that will fail. But there will be just as many coins and tokens that will make it in some form or another... Crypto is not going anywhere anytime soon.. it is here to stay and will change everyone's lives just like the internet did and mobile phones have done. If you want to invest in crypto and I recommend everyone to invest at least something, even if it is only $20, just make sure you do your research first and do not invest more then you can afford to lose.. the upsides outweigh the downsides this time. Do not be the person that looks back at this in 10 or 20 years and says only if I had invested something... Go without take away food or quit smoking or drinking or anything else that is a waste of money and use that money to invest in crypto.. even if crypto does not work out for you , your health will thank you in the end.

Yes, but buying into an overbought asset is still getting in at the wrong time. I do not disagree that the future potential is there, but I am not FOMO'ing at these prices, and hope not too many else who have few liquid assets are.

Hi @aggroed ! I am not sure if you had the chance to read any of my comments to previous posts you made, but I will make another attempt so as to get a reply from you.

I read all your post and many of the things that happened to you is what has happened to me with altcoins, and I also believe the cryptos of @dan BTS, Steem, EOS will skyrocket because of all they can do, which is far more that what bitcoin or ethereum are doing, and with the addition of lots of power and capability to do many more.

And SMTs will make Steem rock, and EOS will rock when more devs start coding with its blockchain and start ICOs and the way the guys that will create an Encyclopedia with the EOS platform and will airdrop their crypto to EOS holders, everything what is going on here, and with BTS what @stan is telling about its alliance and that it can handle so many products for finance.

I really enjoyed reading and wathching Novogratz videos and see his thoughts.

Now talking about a creation I have been working on which is an 11 chapter full steemit guide, I have mentioned you in several past Chapters with your tutorial in @utopian-io , and in the latest Chapter 8 I posted today I mentioned you with the panels you are helding and how important is that to learn the needs of the Steemit community and the Steem blockchain.

Here is Chapter 8 of 11: Learning about "How Making Connections & Relationships with Smart and Creative People helps make our way on steemit and make steemit a better place"

https://steemit.com/promo-steem/@gold84/chapter-8-of-11-learning-about-how-making-connections-and-relationships-with-smart-and-creative-people-helps-make-our-way-on

Looking forward to your feedback @aggroed on this new Chapter if you have the chance. Your comment and additions will enrich this post a lot!

Regards, @gold84

Awesome post and well timed, just made my own post about my first entry into crypto (bought STEEM of course)!

https://steemit.com/steem/@cygon/making-my-first-investment-in-crypto

Dude. You made so many great points that i dont know where to begin... you like overloaded my brain with the exact things that i believe. Almost exact anyways. But I’m going to start by asking, may i use that meme at the bottom for some of my future posts i like that one a lot lol.

But in short, BTC naysayers don’t understand how things work. It’s not a bubble because these things will always have value. Their value is not going away. This is only the beginning. Wider adoption still needs to take place, and that brings greater growth. So even if this was a bubble, we are not close to bursting yet.

Also, there are so many possibilities with Blockchain technology. Sure many coins are stupid. But the coins prove there is so much possibility with the use of blockchain. Steemit is a great example.

Those who believe a “bursting bitcoin bubble” (hows that for alliteration? Lol) will impact the world economy are wrong on so many levels. The world economy is so much bigger than the amount of money in crypto right now. And its spread through out the world. Sure some countries have a higher concentration than others, but the impact to the country would be minimal since the crypto is not tied to a government. But say Russia created a crypto and used it within its borders exclusively and it became the standard of money there. If that “bubble” bursts, Russia would see some affects.

But as it is right now the negative affects would diffuse to almost nothing and little would be felt in the world as a whole. The upside is so much greater than the risk, which is why i got in. The tech is great. The possibilities are endless. Everybody kicks themselves for missing out on the dot com scenario, but everybody is skeptical of these types of things. They hate to risk it, but hate missing out. With crypto you have a great opportunity to make great returns. You wouldn’t make the types of returns you see in crypto with the stock market. It would take years.

Sure it can be risky and everything. Which is why you should never invest more than you are comfortable losing.

I can address so much more, but then this comment would be a post lol. But great stuff. You wrote a lot of great things and i wish i could cover all of them.

I'm glad I'm not the only one that sees things this way.

You are the eye opener to much new people out here. PLEASE give some lectures about the posibillities :D

I think the mom and pop investors spent their money just into the peak. And sold at the bottom and are now burned as digital currency investors. Maybe until a good time to invest has come, at the next to next high...

thanks for sharing @aggroed - great content. From my own perspective, I'm starting to view crypto more and more as a portfolio diversification play. Just like they teach you in Finance 101, "Don't keep all your eggs in the same basket." For anyone, crypto is a great way to diversify away from traditional investments like stocks and bonds. At one time, it was considered "too risky" to invest in stuff like emerging market stocks. But, as it turns out, emerging market stocks were a great way for U.S. investors to tap into globalization, to get a piece of all the value and growth that was being created by the likes of China, India, Brazil, etc. And so I see crypto kinda headed in the same direction - there's a growing sense that enormous value is being created in the world by the blockchain, and people are looking for a way to "capture" a piece of it. I don't think people should risk everything they own on crypto, but I also don't think people should risk everything on the U.S. stock market... You want to diversify away as much of the risk as possible, while still being able to profit from price movements upward.

That's how I am starting to see it too. I think you make a really good point.

I heard one sentence in an EOS promo video that blew my mind, because it really is true.

It was something like, "If you are currently developing software using a traditional client/server database architecture instead of developing an application based on the blockchain, the odds are that you are already working on an outdated application."

It's true. The extraordinary benefits and properties of blockchains (security, decentralization, direct incentivization, immutability, etc etc etc) are so overwhelming that eventually they are going to propel the technology to be an integral backbone of software much as traditional dbs are today.

Dear @aggroed! I'm new to the world of crypto! I'm on Steemit because I genuinely love the idea that for creative and valuable content you get paid. It hooked me, i invested all to power up! (Today i understood why my curation is so tiny - I was simply voting far too quickly, haha! so much to learn!) I'm spending a lot of time reading about the platform, its rules, how does it all work and so on. and i still feel lost. But i know that i am responsible for my own choices. Therefore i really need to be able to make independent decisions. My next challenge will be to understand the market of cryptocurrency and hopefully invest a litte bit, who knows. Thanks to articles like yours today my schooling;) is a little bit easier. Thank you!:)

Come join us in Discord. We got 9,000 people in there to help. All Steemians.

I will, thank you! But unfortunately the link to discord is not working:/ Could you resend it to me? Is there a particular chat/subject i should be looking for? thanks! :)

Excellent post. Unfortunately, most of the smart and brave people are broke and guys with money don't have balls. But that's good for us. Resteemed, of course.

Thank you sir. Well, broke people I'm trying to fix with Minnow Support. People with no balls really just don't understand it and can't assess risk. I'm fixing that with this post, and probably me talking through this post or a PPT on dtube.

I admire your work here. Very positive.But there are many ways to help. I personally support people I trust. Family and friends. But I trust them they'll spread positive vibes and upvotes to people in need as good as me. I know that some call this a circle jerk, but I don't care. They just don't understand how the system works. Thanks again for your effort.

I think there's a fine line between supporting a community and a circle jerk. I think if no matter what you do you find your post in trending and no matter what a handful of people write they get full votes and it's impacting trending and making a measurable move on the reward pool that's circle jerk. If you're doing roughly the same thing, but helping people at a much smaller scale that's building community. You're not on my list of mega circle jerkers on the platform, but I do think you've done a great job helping to build up the asian community on Steem. So, thank you for that!

I'm not even sure what I'm doing. It's just too complex to figure it out. And when you just think that you know, they bring in some changes. And you need to start all over again. The only thing I'm sure about is that I spend too much time on steemit. Way, way too much. Thanks for your time.

I really appreciate your opinion and this amazing post.

I and my husband are investing into cryptocurrency but with not much knowledge. We are learning daily and trying to study it to understand it more, so I really appreciate posts like this where I can get a better understanding of it.

I'm trying to learn and grow in steemit which I love doing it, but still lots to learn, but as long as we have our seeds planted and take it day by day, I believe this could be amazing.

Trying to talk to family and friends about it and introduce them to it, but not many of them are listening, so there is no support around us until we start making the big bucks then maybe they will be interested in it, but like you said, they might miss the boat.

Binance is the best exchange for trading cryptos in my opininion. You can sign up by clicking the link bellow:

Sign up to Binance

Thanks a lot @zemiatin. I really appreciate it and will try it out.